There's an Elephant in the Boardroom at Kinesis

Gold and silver audit issues aside, Kinesis operates a Cayman Islands based crypto and security token exchange that appears to be even less transparent than FTX

Disclaimer: Crypto Informer makes no guarantees, expressed or implied, that the data, the analysis, or the conclusions reached below are complete or accurate. We made our best attempt to accurately interpret all available data. We encourage Bureau Veritas and Kinesis to reach out to us on Twitter if any of our analysis is demonstrably incorrect.

It turns out that all the issues with Kinesis’ gold and silver audits may be just the tip of the iceberg with regards to the Kinesis Monetary System. In previous articles, we covered in detail that the audits are irregular, and, at least once, clearly incomplete as well as full of errors and inconsistencies. Still, there does seem to be some gold and silver held by Allocated Bullion Exchange (ABX) in several vaults around the world. This gold and silver may or may not belong exclusively to Kinesis Cayman, the issuer of KAG, KAU and KVT, and may or may not fully back the total issuance of KAU and KAG tokens, which itself is not clear.

We also subsequently discovered that the stated weighment procedure in the audit reports, was only satisfied by approximately one quarter of total audits performed to date.

In fact, not one of the January 2023 audits demonstrates that the auditors weighed a 2.5% random sample of total holdings. Bureau Veritas did not respond to numerous requests for comment on the authenticity of these audits despite having a page on their website specifically dedicated to audit verification.

But enough about gold and silver audits; let’s move on to the elephant in the room. Kinesis also operates a Cayman Islands based crypto and security token exchange. The exchange takes custody of numerous fiat and cryptocurrencies on behalf of its clients. Surely, in the current environment we find ourselves in, any legitimate cryptocurrency exchange would have audits, attestations, or proofs of reserve of some kind, right? In the case of Kinesis’ KMS exchange, it does not seem so. We couldn’t find any. We also couldn’t find any details regarding licensing and regulation allowing Kinesis to sell cryptocurrencies and security tokens to US, EU, and Canadian citizens, among others.

Kinesis support was unable to provide any answers to these very basic questions.

What if somebody asks in the Kinesis Community Forum? The topic will be locked before any answers are provided.

A search of Kinesis’ website only revealed references to the user’s licence agreement to use the platform and related APIs.

How easy is it to find that information regarding licensing for other exchanges? Very. Coinbase, Kraken, and Gemini all have pages dedicated to licensing which are easily found at the top of the first page of search results.

Where can one find similar information for Kinesis Cayman?

Allocated Bullion Exchange (ABX) has a similar page on their website, but it doesn’t acknowledge ABX’s role as a payment processor1 for Kinesis Cayman.

What about audits, attestations, or proofs of reserve? They’re similarly easy to find for Coinbase and Kraken. Many exchanges now provide proofs of reserves. Even Nexo, Crypto.com, Tether, and FTX have attempted to provide some type of audit, attestation, proof of reserve, or other transparency data.

What about Kinesis? So far, it appears that users get absolutely nothing with regards to transparency data for the long list2 of cryptocurrencies, security tokens, and fiat currencies Kinesis takes custody of on their behalf. This would appear to make Kinesis one of the least transparent centralized crypto exchanges in the world.

Given the state of current affairs, it seems more than appropriate to also ask, “What banks does Kiensis Cayman use?” This isn’t clear either. Kinesis used to have a US bank account with TD Bank, but that account was closed last month.

We know that Alloated Bullion Exchange (ABX), which Kinesis Cayman no longer claims as its parent entity, uses National Australia Bank to receive USD deposits on behalf of Kinesis Cayman.

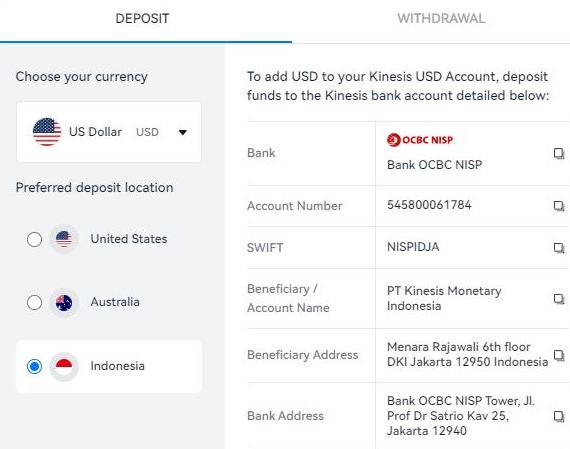

We also know that they accept deposits through PT Kinesis Monetary Indonesia at OCBC NISP.

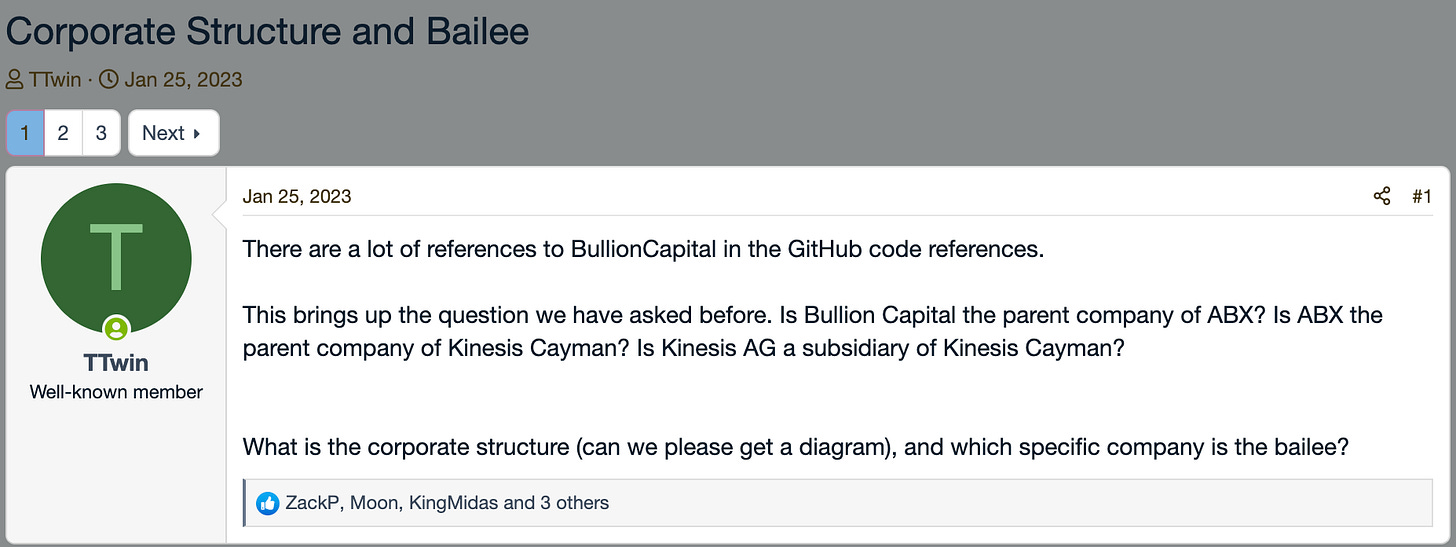

We don’t know if PT Kinesis Monetary Indonesia is a subsidiary of Kinesis Cayman because Kinesis has remained tight-lipped about the exact corporate structure of the “Kinesis Monetary System.” Investors have asked many times but have either been ignored or told that this information is “commercial in confidence” and would “prejudice the interests of Kinesis should they be disclosed.”

In short, we don’t know what bank Kinesis Cayman uses or if it has a bank account at all. We only know that Kinesis Cayman accepts deposits through PT Kinesis Monetary Indonesia, which may or may not be a subsidiary of Kinesis Cayman and Allocated Bullion Exchange (ABX) Australia. Kinesis users have similar questions, but at the time of publishing, no answers have been provided.

Can a Cayman Islands based crypto and security token exchange serve US, Canadian, EU, and other customers with an opaque corporate structure, unknown banks, and unclear licensing legally? We don’t know, but we feel these questions are more important than ever in the current market environment. It is imperative for Kinesis users and investors to understand that regardless of what they think about Kinesis’ gold and silver audits, there doesn’t seem to be any audits, attestations, proof of reserve, or transparency data at all with regards to Kinesis’ fiat, crypto, and security token liabilities. Nor does there appear to be any information with regards to how these assets are stored and safeguarded.

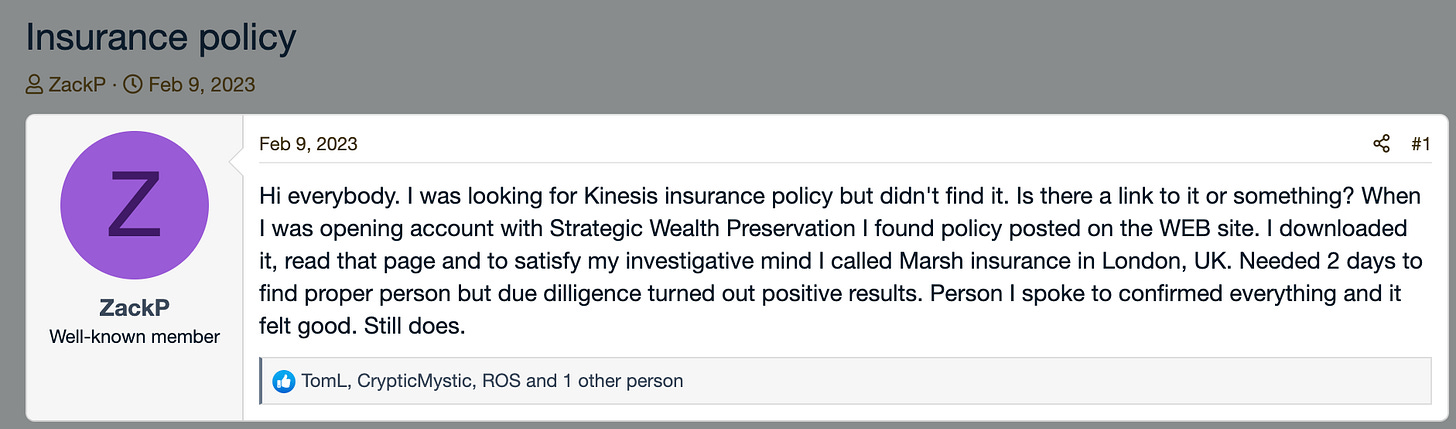

Insurance is another issue Kinesis users have been unable to get clarity on. It isn’t difficult to find proof of insurance from other companies.

What really secures and insures an investment in Kinesis, the tokens they issue or deposits to their Cayman Islands crypto and security token exchange? It doesn’t appear that anyone outside the company knows.

We know Allocated Bullion Exchange (ABX) takes custody of gold and silver for Kinesis Cayman. It’s unclear what happens to the fiat deposits ABX receives on behalf of Kinesis Cayman.

Kinesis Cayman accepts deposits of the following crypto, security token and fiat currencies: KAU, KAG, KVT, BTC, ETH, USDT, BCH, LTC, DASH, XRP, XLM, XDC, USDC, USD, EUR, GBP, AUD, CAD, SGD, CHF, AED

... in the meantime the fiat game continues as small banks all over the world are having liquidity issues and are either let down or gobbled up by big banks, who in turn plan to introduce CBDCs in the near future. This is the 1930ies game, played 21st century style all over. But hey, it was JP Morgan himself who said, Gold is money - the rest is credit. Now, what do you think CBDCs will be backed by ? Not gold.