Bureau Veritas and the Curious Case of the Time Traveling Auditor

Kinesis' independent, third-party audits contain a few details that are sure to raise some eyebrows

Disclaimer: Crypto Informer makes no guarantees, expressed or implied, that the data, the analysis, or the conclusions reached below are complete or accurate. We made our best attempt to accurately interpret all available data. We encourage Bureau Vertias and Kinesis to reach out to us on Twitter if any of our analysis is demonstrably incorrect. Unless otherwise noted, this article refers to the January 2023 audit.

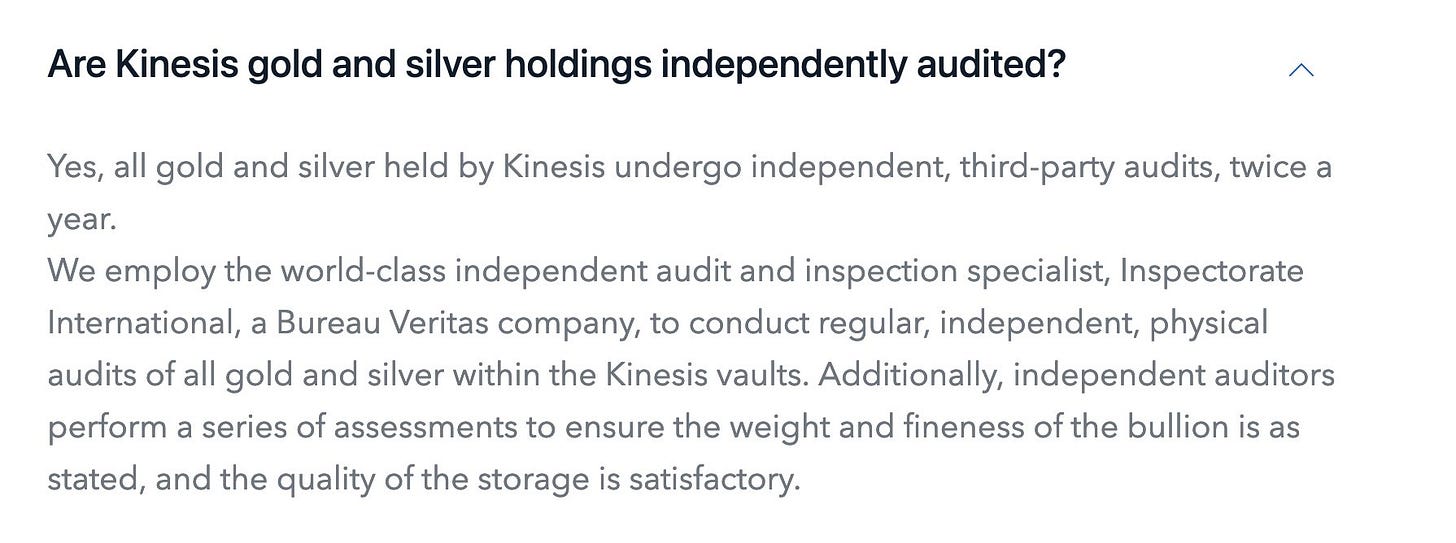

During the course of our investigation into the Kinesis Monetary System, we spent a lot of time analyzing the audits put forth as proof that KAG and KAU tokens are 100% backed by gold and silver at all times. In closely examining the audits, we discovered a number of anomalies, inconsistencies, and errors. We also noticed that Kinesis seems to be misrepresenting the scope of the audits as well as the content of the audits in the summary letters they provided with each set of audits.

This led us to ask the following questions of Bureau Veritas:

If a company publicly releases Bureau Veritas audits, how can an interested party verify that the audits are authentic, unmodified, and presented in their entirety?

Do you have any official policy or position on the practice of a company representing your audits as verifying or certifying facts and figures that were clearly not within the scope of your audits?

How do you handle obvious errors that appear in one of your audits?

Is there any way to verify the agreed upon procedure (AUP) that was used to conduct a particular audit?

We reached out to Bureau Veritas by e-mail on February 22, 2023, and followed up several times since to seek answers to these questions. We also reached out on Twitter. To date, they have not responded except to acknowledge receipt of some of our emails.

If there is no clear way to confirm that a third-party, indepdent audit is authentic, unmodified, and presented in its entirety, this leaves us questioning how much value that audit actually has.

Let’s go through some of the anomalies, inconsistencies, and errors that led us to ask these questions in the first place.

There are several problems with the summary letters.

The dates do not match up. How can auditors confirm the quantities of metal held one or more days before they began an audit?

The audits do not seem to confirm the fine equivalents stated in the letters because they do not contain sufficient detail to calculate these figures. It isn’t clear what source data was used calculate these figures, but it does not seem to be from the audits.

The audits do not appear to cover token circulation at all.

Furthermore, the audits do not appear to conform to the audit procedure as described on Kinesis’ website.

Additionally, independent auditors perform a series of assessments to ensure the weight and fineness of the bullion is as stated, and the quality of the storage is satisfactory.

In a recent Twitter Space, Kinesis CEO Thomas Coughlin claimed that KAU and KAG tokens are normally over-reserved. This is a rather peculiar claim to make since none of the audit summary letters, which are all signed by Coughlin himself, indicate anything more than miniscule rounding errors in terms of any over-reserve.

The Bureau Veritas audit reports also contain inconsistencies, anomalies, and errors. Let’s go through them.

The audits do not seem to contain any assessment of the fineness of the bullion other than visual inspection. However, if we examine Bureau Veritas audits for other clients, we find that this is a service that they offer.

How reliably can fineness be assessed merely by visual inspection?

During the last audit, no bars were weighed at two of the thirteen vaults due to inaccurate scales. During the previous audit in June 2022, again, two vaults lacked accurate scales. The November 2020 audit used an uncalibrated “ordinary kitchen scale” at one of the vaults.

Compare this with what should be expected in an audit report with a defined scope to verify the weight of the stored bullion, or a statistically significant sample of it.

How can an audit with the stated purpose of ensuring the weight and fineness of bullion be considered complete without weighing any of the bullion or testing its fineness?

Why does the auditor provide weighment data for small bars with little to no expected difference but not for the good delivery bars, which have a large expected difference?

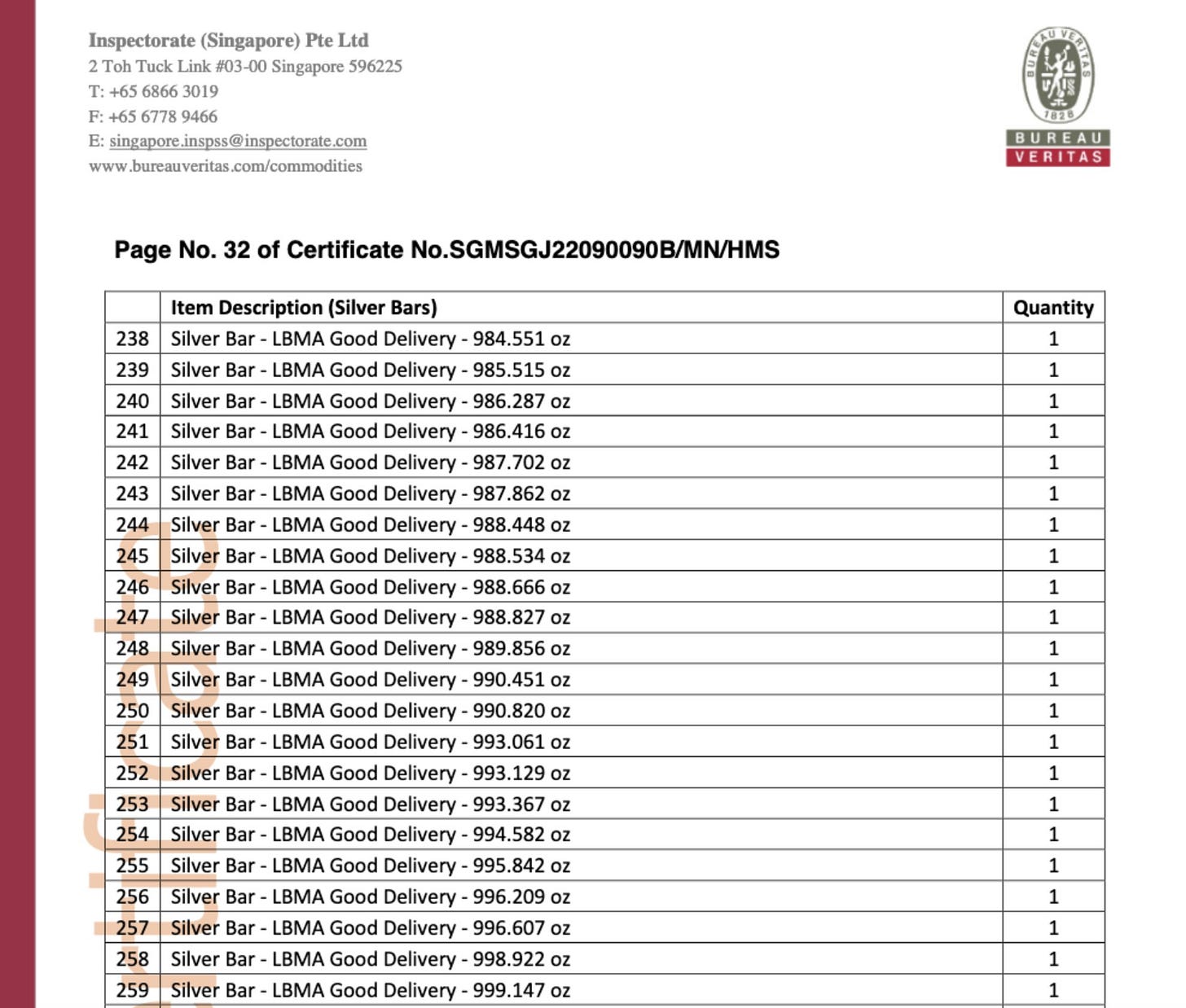

One of the thirteen vaults held 974 1,000 ounce silver bars, but this vault’s audit provided no weighment data at all, nor was there any inventory list provided with previous weight and fineness data for these bars. The potential variance on these bars equates to millions of dollars.

If, for some reason, it is not standard practice to weigh the good delivery bars, wouldn’t an inventory list specifying their weights and fineness be required in order to calculate the fine equivalent provided on the first page of the audit report?

Again, this data is provided in audit reports for other clients of Bureau Veritas.

It seems as though this type of data would be required in order to calculate a fine weight equivalent, especially to 3 decimals.

This brings us to another issue; Kinesis’ Bureau Veritas Singapore audits look different than those of other clients.

Bullion Star’s Bureau Veritas Singapore audit is on different paper and letterhead than Kinesis’ audit. Bullion Star’s audit is stamped and signed on every page. Every page is numbered. On the last page, the report is signed on behalf of Inspectorate (Singapore) Pte Ltd.

Kinesis’ Bureau Veritas Singapore audits use the same signature and Inspectorate (Singapore) Pte Ltd stamp but are instead signed on behalf of Bureau Veritas Commodities UK Ltd. There are no page numbers. The paper is different. Isn’t it a bit strange to use the signature and stamp of a Singapore entity to sign on behalf of a UK entity?

We found another audit performed by Bureau Veritas Italy but signed on behalf of Bureau Veritas Commodities UK Ltd with a Bureau Veritas Commidites UK Ltd stamp and signature.

Is this standard practice? We don’t know but it seems a bit strange.

A duplicate serial number1 was found in the audit. Is it possible for a Metalor 1kg bar to have the same serial number as a Valcambi 100g bar? We don't know. We have not been able to confirm whether or not this is possible. A representative of Valcambi did respond to a request for comment but could only confirm serial numbers for Valcambi bars:

Unfortunately we know only the serial number of our bars thus I’m not able to give you an answer [regarding the possibility of a duplicate serial number].

I can confirm Valcambi produced a piece of 100 gr bars 999.9 with the serial number AA 144782 in 2018.

To date, Metalor has not responded.

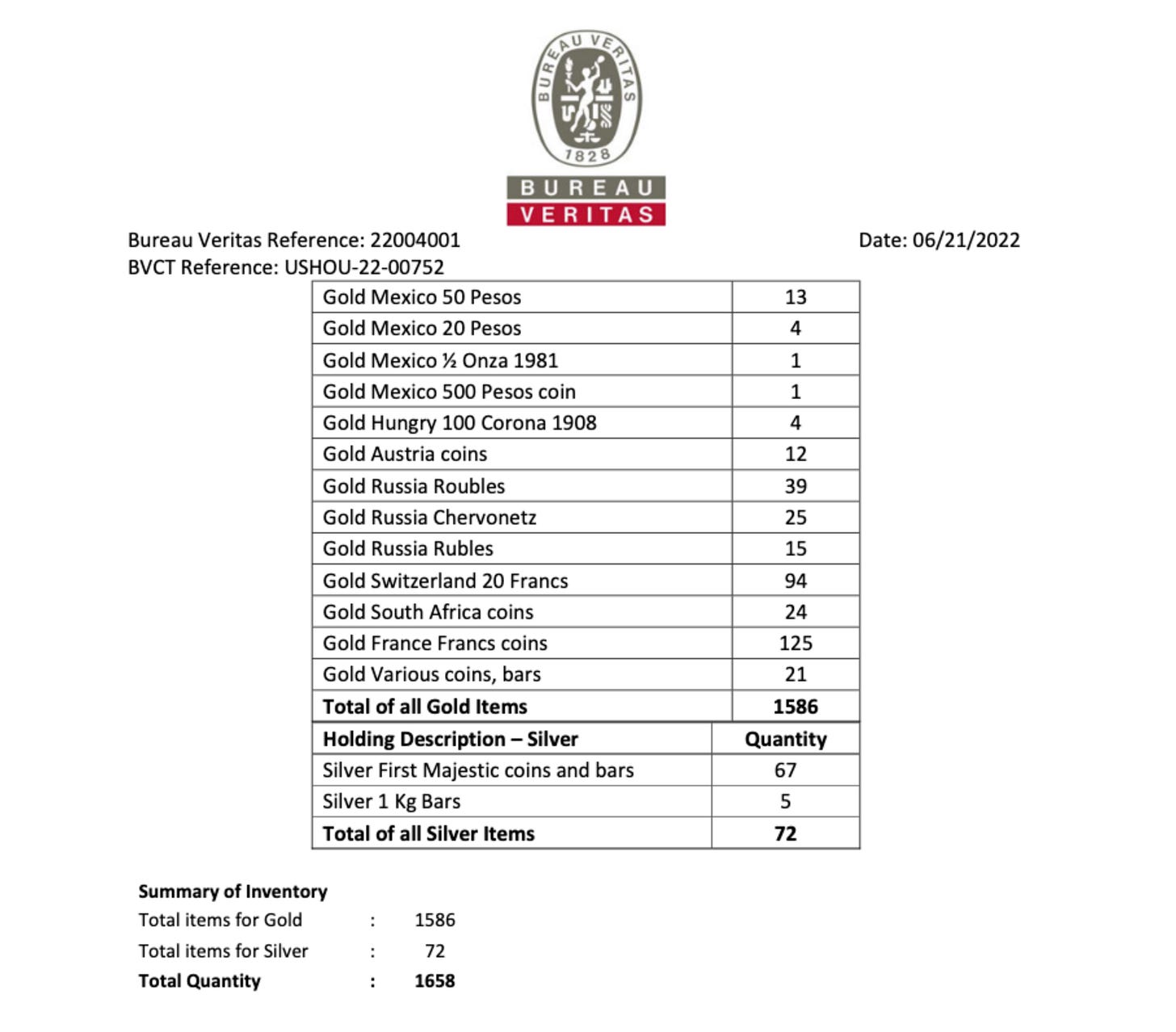

Is it standard practice to refer to audited inventory on official audit reports simply as “Gold Coins,” “Gold Various coins, bars,” and “Silver First Majestic coins and bars”?

How could a fine weight equivalent be calculated or verified with audit data such as this?

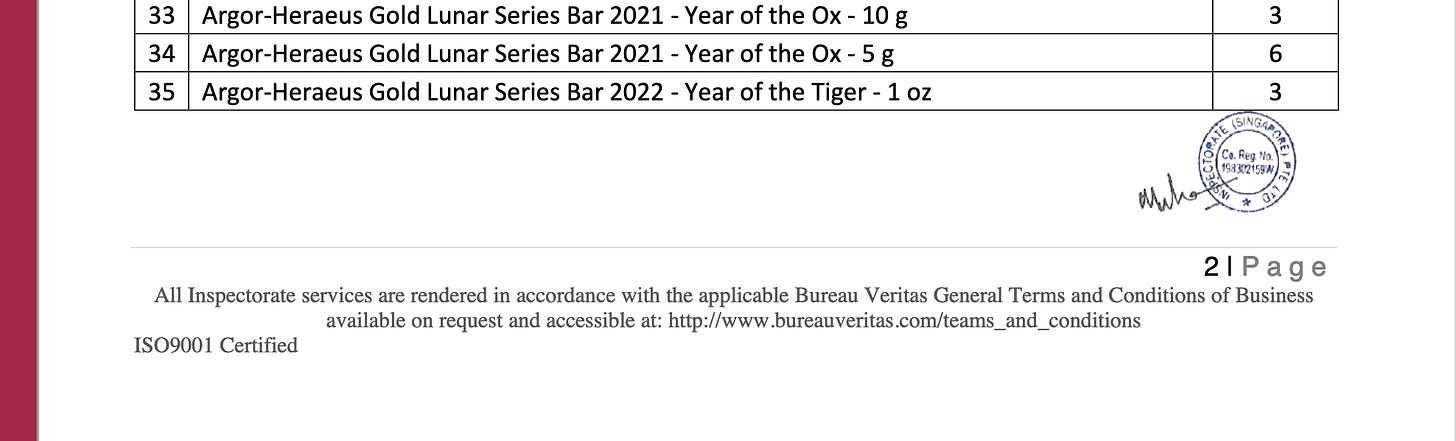

This list of items adds to 1,584, not 1,586.

Is this the same list of items that became simply “Gold Coins 1,586” in the January 2023 audit? If so, how did “various coins and bars” become all coins?

Saving the best for last, we finally come to curious case of the time traveling auditor.

On page 13 of the January 2023 audit, we found an audit report dated January 18, 2023, that makes reference to an audit taking place more than two weeks in the future on February 3, 2023. Great Scott! Has Bureau Veritas invented time travel?

This leads us to question who at Kinesis is in charge of reviewing and signing off on these audits. Given four to six weeks to review these audits (the gap between the report dates and when they were released to the public), shouldn’t many of these issues have been spotted and resolved? Should Bureau Veritas’ own quality control procedures have identified and resolved some of the issues before these audits were released to the client?

Many of these issues beg the question, “What value do third-party audits have if there is no reasonably easy and straight-forward method to verify that the audits are authentic, unmodified, and presented in their entirety?”

It’s not a question for Bureau Veritas, but it is directly related to the audits: how exactly is Kinesis launching a “parallel monetary system” for 280 million Indonesians without storing any metals in Indonesia?

Full credit to @RasooliSheida for spotting this.

Another anomaly: the Inspectorate (Singapore) Pte Ltd report dated 31 January 2023, and the Bureau Veritas Italy report dated 23 January 2023, have conclusions that are letter-for-letter identical except for the auditor's identification and date.

This seems strange for reports prepared by different entities in different countries.

It is not a case of having a single report template, because the report for Bullion Star dated 29 September 2022 is different.

[Edit: it is particularly noticeable due to the grammatical error "our finding does in no way relief" which I point out not to criticize it as such, but rather that it is unexpected that the same error would occur in unrelated reports.]

Looks like some hard work you put in there. Why did you not warn before FTX happened ?