A Conspiracy Theory on Allocated Bullion Exchange (ABX)

In this article, we engage in some wild speculation as to why ABX has not been able to produce their 2022 audit

News about the Kinesis Monetary System and Allocated Bullion Exchange is coming fast and furious. Last week, we learned in a Twitter Space that the assets of other entities, unrelated to the backing of KAG and KAU, may have been included in Kinesis’ last two audits.

Yesterday, we learned that Kinesis will lose access to their US bank account at TD Bank on February 28, 2023.

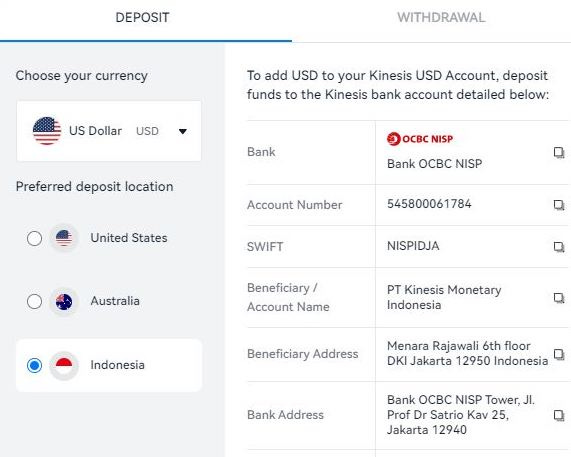

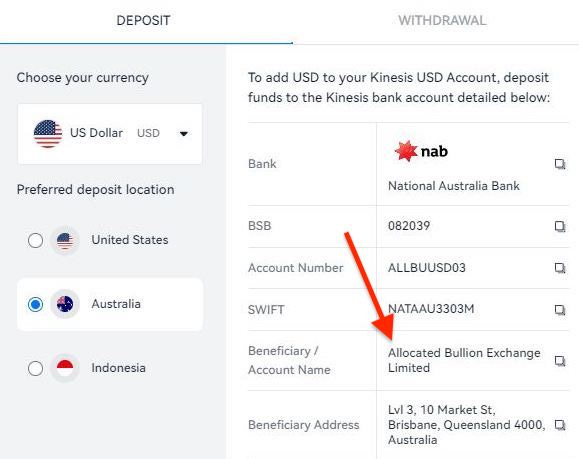

Today, we received tips from several Kinesis users regarding the remaining USD deposit options for Kinesis’ Cayman Islands based crypto exchange.

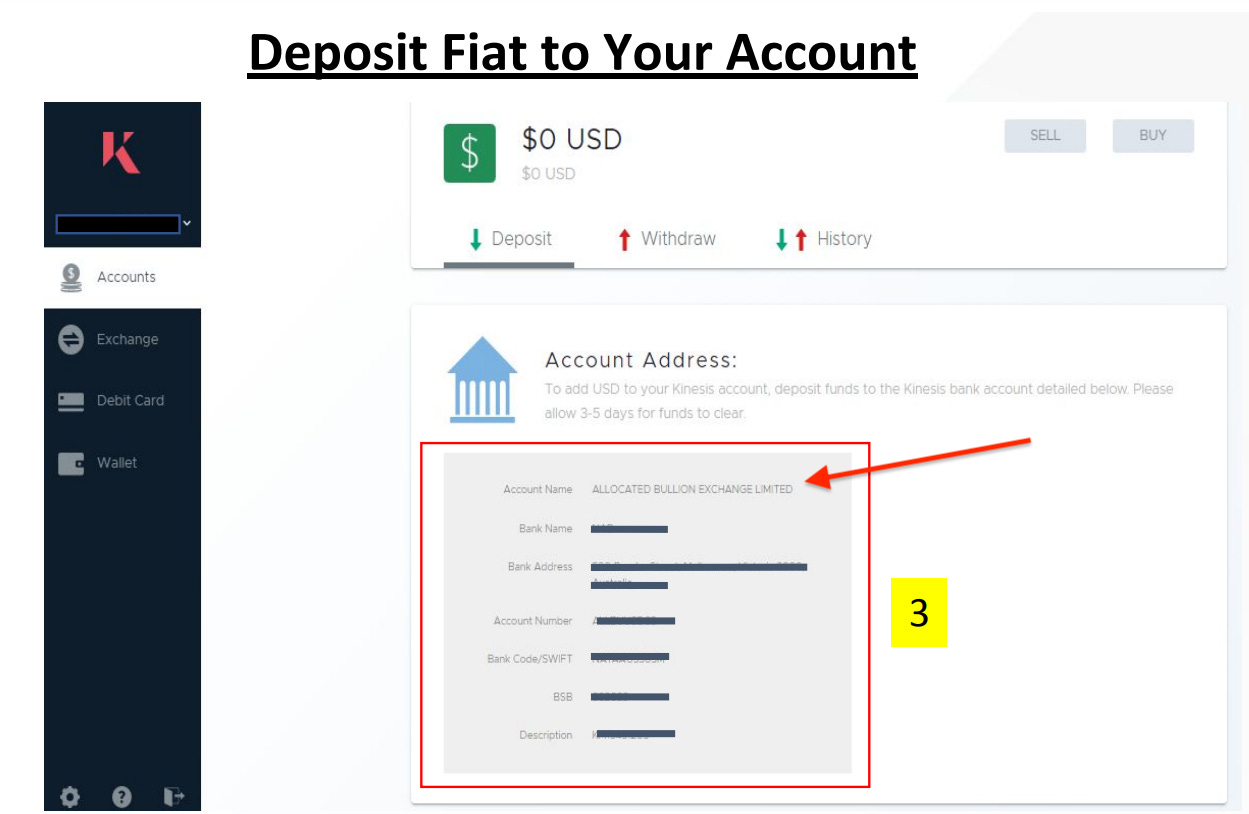

Further confirmation of this has been right under our noses the whole time in the Kinesis Money User Guide.

Do you see a problem? We do. It’s a big no-no to ask crypto exchange users to send their deposits to a different entity’s bank account. This exact activity was one of the many transgressions FTX aand many other offshore crypto exchanges, engaged in.

Why do they do this? The most common reason is likely that offshore crypto exchanges are unable to obtain and keep open their own bank accounts. You don’t have to take our word for it; listen to SBF explain it.

Having trouble with bank accounts for your Cayman Islands based crypto exchange? No problem; surely a boring and pedestrian “institutional precious metals exchange” is still a bank-friendly business.

If ABX were the parent company of Kinesis, maybe there might be a way to try to justify this, but since ABX is just a “strategic partner”, that’s going to be a very tough sale.

How about some wild speculation and conspiracy theories? Kinesis used to have a bank account to serve the Australian market, but some time during the great crypto meltdown of 2022, they lost it. Out of desperation, Kinesis began processing deposits through ABX. This is the reason ABX cannot produce an audit for 2022. Auditors really don’t like these types of activities. This is almost certainly one of the primary reasons Tether has never been able to obtain an audit.

Might this also be the reason that ABX holds all the vault accounts for the gold and silver backing KAU and KAG? Could it be possible that companies like Brink’s, Loomis, and Malca-Amit don’t want to provide vault accounts for a Cayman Islands based crypto exchange? We don’t know, but it seems like a plausible theory and we think Jerry would approve.

You need to explain this better so everybody can understand it, not just those who have a background. Most people do not even understand what fiat is ...