Did Kinesis Admit to Publishing a Fraudulent Audit in August 2022?

During a Twitter space on February 22, 2023, Kinesis made a number of alarming statements and admissions.

For the most important admission, skip ahead to 51:55; at this point in the conversation, Jim Forsythe states that the June 2022 audit contained assets that are not part of the Kinesis Monetary System and therefore not part of the backing for KAU and KAG. Continue reading below for some the other highlights from last night’s Twitter space.

16:43: Coughlin “In 2018 we opened our ITO and sold approximately 197,000 tokens with a par value of $197 million making it the tenth largest ICO in history at the time.”

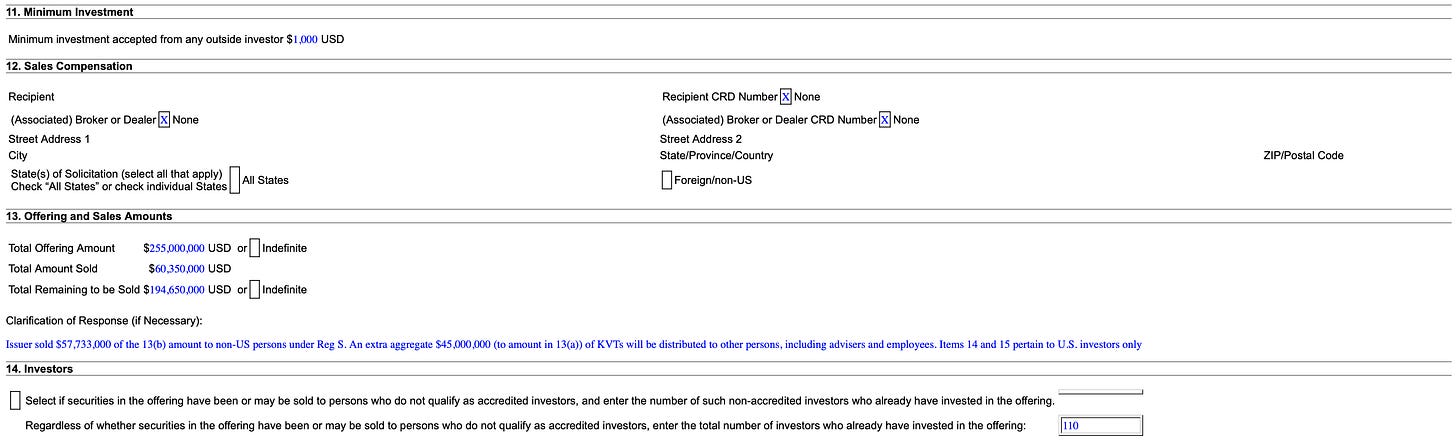

Does anyone believe this? It directly contradicts Kinesis’ SEC filings, which indicate they raised $60,350,000. Even that seems like quite a lot for a 2018 ICO.

17:11: Coughlin “In April 2021, the monthly transaction fees had exploded to over 108 kilos of gold and 4,700 ounces of silver worth US $6.29 million dollars.”

This was almost entirely due to Kinesis’ mint cycle scheme. Fees subsequently collapsed.

17:36: Coughlin “Then in June 2021, without notice our debit card programs were withdrawn by the bank. This was a major setback and monthly volume decreased from this point.”

It wasn’t the debit cards making the money; it was mostly mint cycling, and Coughlin knows this and he acknowledged it in a Kinesis forum post.

17:53: Coughlin “With all revenue lines taken in consideration, Kinesis Money has earned over $50 million dollars in revenues with transaction fee revenues being shared with our users through a non debt-based revenue sharing yield system.”

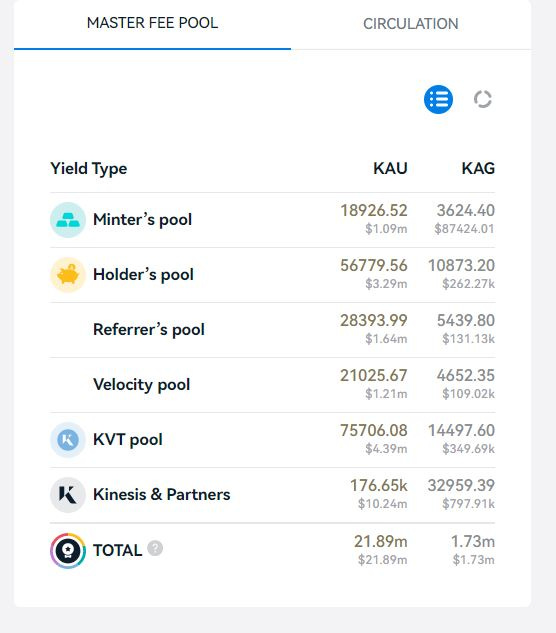

The “Master Fee Pool” only had $23.62 million in early January, 2023. Is Kinesis holding out on their users, or is Coughlin overstating earnings? We don’t know because Kinesis doesn’t provide financial statements.

18:12: Coughlin “Kinesis has also raised around $10 million dollars since listig KVT for sale on our exchange. The Kinesis Global Group is well capitalized with a runway of years and we continue to receive large investment offers.”

So where are the audited financial statements backing that up? Is Kinesis’ cryptocurrency exchange properly licensed and regulated to trade securities?

18:43: Coughlin “For Indonesia we are rolling out a parallel monetary system in country in collaboration with key government owned organizations like their post office, their two exchanges along with numerous banks and many other large national corporations in the country. We also building the nation’s first purpose built gold vault at Jakarta airport.”

Is this the same Indonesian project Coughlin has been claiming will launch any day now since ealry 2021? How are they going to do that without storing a single ounce of gold or silver in Indonesia? Despite the claim on their website that they store in Batam, their latest audit shows no metals stored in Indonesia.

19:37: Coughlin “Our gold and silver digital currrencies KAU and KAG are purely physical gold and physical silver with titles of ownership represented on the blockchain. There is no counterparty risk as they do not sit on any balance sheet apart from the holders.”

How exactly is that proven? Does anyone know what sits on the balance sheets of Kinesis’ complex web of legal entities spread around the globe? “No counterparty risk” sounds like a vast understatement of actual risk.

20:13: Coughlin “Kinesis’ systems have been established in a way where no counterparty risk has ever existed because the only way the title to be represented is via KAU and KAG digital currencies.”

What a bold statement. They can move the metal around the world, they can change its form, and they can move it from a Liechtenstein entity to a Cayman Islands entity. But don’t worry, there is no counterparty risk and there never has been.

22:30: Coughlin “Two attestation letters were required for metal held within boursa Istanbul and another government registered vault operated by Ferrari as auditors were unable to enter.”

Kinesis is not actually “fully audited,” but this has not stopped them from claiming it all over their website.

At 26:36 Jason Noorman, Kinesis CTO, repeats the claim that it’s impossible to burn tokens on Kinesis’ blockchains. Whether that is true or not, Stellar is able to burn Lumens (XLM). If it is truly impossible to burn KAU and KAG tokens on Kinesis’ Stellar-based blockchain, it’s a very poor design that makes auditing difficult and confusing. Furthermore, Noorman seems to misrepresent native versus non-native assets on Stellar. Rather than issuing KAG and KAU as non-native assets on Stellar, Kinesis created two copies of Stellar’s blockchain and replaced XLM with KAU on one copy and KAG on the other. On Kinesis’ implementation of Stellar, KAU and KAG appear to be the “Lumens,” or the “native asset.”

51:55: Forsythe “In the last audit [Jun 2022] even our C4SM rounds were on that audit, but that was an audit that was of ABX, maybe Bullion Capital as well and the Kinesis System. So those 1/5 oz coins were not part of the Kinesis Moneytary System.

The stuff that's backing KAG is 100 oz, kilo bars and 1000 oz bars. That's it. It doesn't change form. Meanwhile there is the physical mint that sits outside of the Kinesis Monetary System, but using the using the Kinesis Bullion Store.

…you could use KAG to buy 20 one ounce rounds using your KAG in which case you're taking your partial ownership of a bar inside the [Kinesis] monetary system and spending it to get one ounce coins that sit outside that monetary system."

53:11: Coughlin "The pool, as I said, is backed 100% of the time, one to one, normally it's backed, our reserves are over and above the coins in circulation and the metal content that represents."

How can it be determined if the tokens are backed 1:1 if we cannot calculate the fine weight of the total gold and silver stored and if gold and silver belonging to other entities are included in the audit. It appears as though only the first two audits contain sufficient detail to calculate the fine weight of gold and silver stored.

55:37: Forsythe “There was a difference between the last audit an the current audit. The last audit was broader than the Kinesis Monetary System and that was part of C4SM feedback to say 'This is really confusing people are seeing 1/5 oz rounds, 1 oz rounds that are part of the mint and so that was changed for this audit where it is Kinesis System.”

56:07: Coleman “The physical audit, who’s the physical for?

56:13: Coughlin “It’s for Kinesis. If you read the letters, this is for Kinesis and Kinesis exclusively. I understand that there’s confusion about all of this and that’s why we’re actioning a silo dedicated bailee entity that will be exclusively audited and the metal within that entity is exclusively for the Kinesis pool.”

Forsythe just finished saying the June 2022 audit, despite what the letter says (presumably the first page of the audit report), contained assets from “outside the Kinesis Monetary System.”

Which is it? If Forsythe was correct, does this make the June 2022 audit fraudulent? What else do you call it when you misrepresent the purpose and ownership of assets in an audit? Token holders own the metals according to Kinesis but earlier in the space, Forsythe said that the June 2022 audit contained assets not belonging to token holders.

Contrary to what Forsythe claimed, the same or similar assets were still included in the January 2023 audit as well.

2:04:43: Coughlin “The KVT is structured in the same way as KAU and KAG. So KAU and KAG and the KVT, by themselves are non-yielding assets.”

Coughlin is trying to make the argument that none of these tokens are securities despite having filed an SEC Form-D for KVT. It sounds to us like what he’s doing is shooting himself in the foot by acknowledging that since KAG and KAU have similar properties to KVT, they are probably securities as well. He also inadvertently admits that yields are totally centralized and permissioned, a far cry from the decentralized system promised in the whitepaper.

At 2:05:24 it almost sounds like Coughlin is describing Kinesis’ exchange as an unlicensed bank.

2:18:22: Forsythe “If it’s in KMS, which is a custodial account…”

It’s nice to see someone acknowledging publicly that Kinesis’ KMS centralized cryptocurrency exchange is custodial. Since they take custody of users’ cryptocurrencies, fiat currencies, and Kinesis tokens, why doesn’t the exchange have an audit? Even FTX had audits.