A Deeper Analysis of Kinesis Monetary System's Blockchain Data

"If there's something weird, and it don't look good..." -Ray Parker, Jr.

Disclaimer: Crypto Informer makes no guarantees, expressed or implied, that the data, the analysis, or the conclusions reached below are complete or accurate. We made our best attempt to accurately interpret all available data. We encourage those involved with Kinesis to reach out to us on Twitter if any of our analysis is demonstrably incorrect. The KAG data analyzed covers March 11, 2019 through December 30, 2022. The KAU data covers March 12, 2019 through January 5, 2023. In this article, we focus on KAU because it represents the majority of the on chain volume and generates over 90% of on chain fees. Unless otherwise noted, we are referencing KAU data. Please refer to the end of the article for links to our sources and methods.

TL;DR: There is a simple calculation that closely approximates the circulation claimed by Kinesis, but it requires some significant leaps of faith and ignoring the CEO’s claims about redeemed tokens being burned. The Kinesis Chain Explorer did not match the blockchain, and some addresses still do not even after the latest update, which added the circulation calculation. On chain fees are higher than what Kinesis claims. There are few holders and few active addresses. There is unusually high volume given the number of holders and active addresses. The supply of both KAU and KAG is highly concentrated within few addresses. Many addresses that hold tokens on chain do not seem to receive regular monthly yield payments.

Token Circulation

After a careful analysis of Kinesis’ blockchain data, we have reached the conclusion that a figure that is remarkably close to Kinesis’ claimed circulation figures (within 0.2%) can be easily calculated. The calculation amounts to “Add up all the balances, subtract the Emission account and, subtract Inflation.” It is remarkably simple, which begs the question, “Why didn’t didn’t Kinesis share the methodology?”

The two big assumptions required for Kinesis’ circulation calculation to be correct are as follows:

The inflation operation that Kinesis retained for nearly four years after Stellar deprecated it serves no purpose. Inflation is therefore created only to be immediately burned, which is not only pointless but completely different from its intended functionality (it looks like it has no place on a blockchain designed for gold and silver backed tokens).

The tokens in the “Emissions account” are not part of the circulation regardless of what the explorer and blockchain data indicate.

There is little else to say about inflation. It's a mystery why Kinesis kept this feature if the intention was only to create inflation and then burn it. It’s an interesting curiosity that inflation is close to the total on chain fees but not exactly matching.

The “Emissions account” is something entirely different. In order for the circulation calculation to work, we must assume that the “Emissions account” is actually the burn address for redeem transactions. The block explorer and blockchain data show something different. As of January 22, 2022, the block explorer shows the “Emissions account” holding a balance of 1,905,035 KAU, which directly contradicts the CEO’s claim that redeemed tokens are burned. Additionally, the “Emissions account” has actually received more KAU than claimed redemptions. The “Emissions account” had received 50,744,968 as of January 5, 2023, but Kinesis claims total redemptions of 47,770,129 as of January 22, 2023.

The “Emissions account” is also apparently one of the mint accounts (more on this below). It sends out numerous transactions with memo fields reading “Mint #XXXXXX”. The “Emissions account” also sends other payments that do not reference “Mint”. The total amounts sent from the “Emissions account” do seem to be a close match for “Minting” according to Kinesis’ own calculation, 48,669,200 as of January 5, 2023 compared to 48,944,376 as of January 22, 2023.

The “Emissions account” is not the only account that “mints tokens,” however. It actually appears that the “Emissions account” never mints tokens, it instead sends tokens from its positive balance. Three other addresses appear to “mint” tokens because they have negative balances, meaning they sent tokens that they did not hold in the first place, creating them out of thin air or “minting” them. Those addresses are: GDTYNME5HX3FCFDS4D3R3LTVH3DFLSB5HWVTV3VVL4PBGQ6SCKC7J3PD, GCO75U2EVO3HKGYO2PUO2ZO7CEL52JPQL5WYUHHKPEORQSASSKT4MA3B, and GDCQANEHPUIIT6CQGJO2NTKGCRFD5NETJNC33CJG3PWCSRVYNHISHLHK.

Collectively, these three addresses have a negative balance of (4,026,170.25) KAU as of January 5, 2023.

Let’s try to determine what each address does and compare its blockchain balance with its Kinesis Chain Explorer balance. The blockchain data is as of January 5, 2023 the explorer shows current data as of January 22, 2023, but none of these three addresses have had transactions since January 5, 2023, therefore no adjustment is necessary.

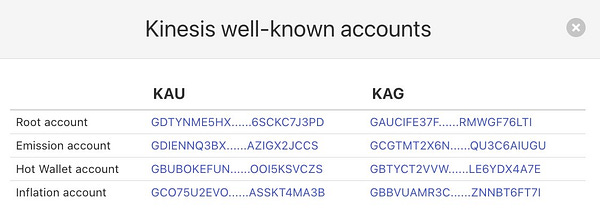

GDTYNME5HX3FCFDS4D3R3LTVH3DFLSB5HWVTV3VVL4PBGQ6SCKC7J3PD, Kinesis calls this the “root” account. Its balance on the blockchain appears to be (3,074,484.00) while the block explorer shows a balance of 99,996,925,516 KAU.

GCO75U2EVO3HKGYO2PUO2ZO7CEL52JPQL5WYUHHKPEORQSASSKT4MA3B, Kinesis calls this the “Inflation account” but it actually sends out payments referencing monthly yields in the memo field. Its blockchain balance appears to be (476,064.50) while the block explorer shows a balance of 0.0306816 KAU.

GDCQANEHPUIIT6CQGJO2NTKGCRFD5NETJNC33CJG3PWCSRVYNHISHLHK is not one of the four “Kinesis well-known accounts” (see below) and is the account that actually creates inflation transactions. Its blockchain balance appears to be (475,621.75) and its explorer balance is 0.4157099 KAU.

What exactly is going on here? These three addresses all appear to have large negative on chain balances. The Kinesis Chain Explorer displays wildly different balances for these three addresses than the blockchain data indicates. The monthly yields seem to be paid from tokens created out of thin air to the “Emissions account,” which appears to be both the mint and the redeem address. The inflation transactions have a blank or NULL receiver address. Does this mean they are burned as soon as they are created? If so, what purpose does that serve?

Until the recent explorer update, which added the circulation calculation to the top of the page, the root account (and perhaps other accounts) had a hidden transaction history on the Kinesis Chain Explorer.

In conclusion, subtracting two accounts from the total on chain balances yields a figure that is similar to the claimed circulation but the Kinesis Chain Explorer still shows wildly different balances for key and “well-known” accounts. Why doesn’t the explorer match the blockchain data and the claimed circulation figures? Why aren’t redeemed tokens burned? Burned tokens should not be part of an on chain balance.

On Chain Fees

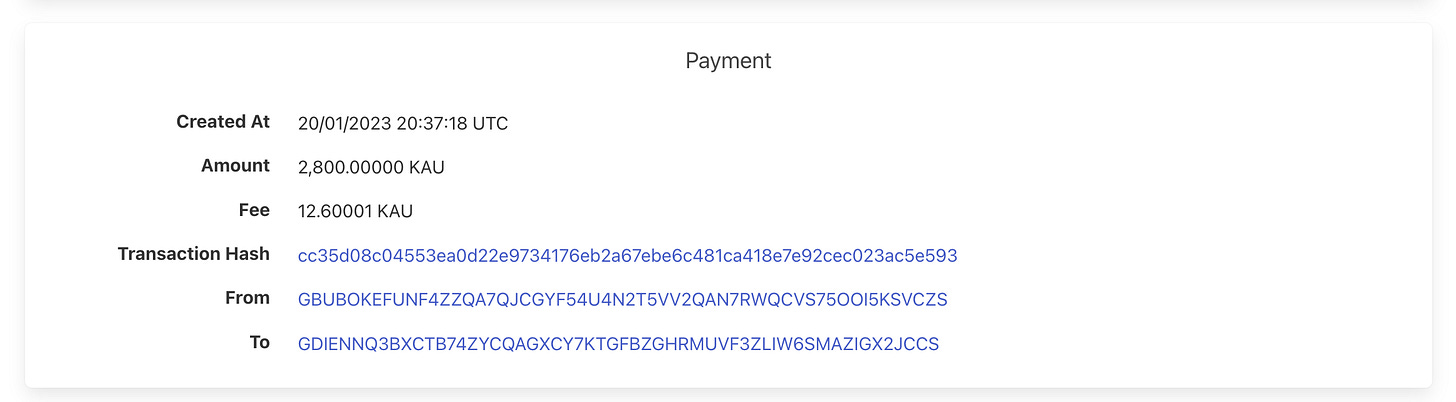

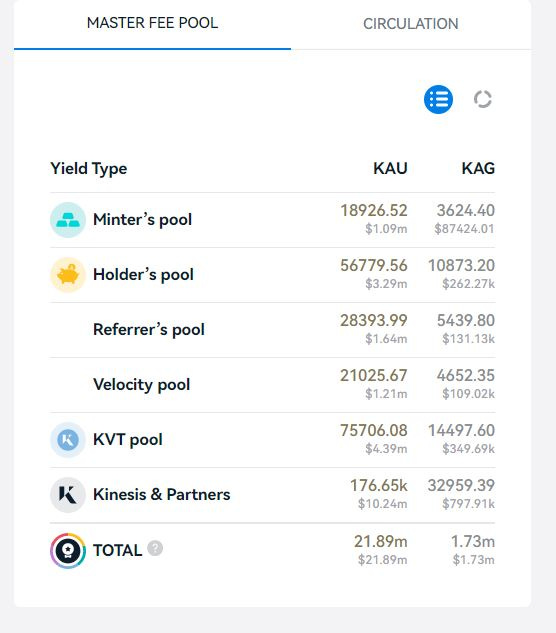

On chain fees are significantly higher than what the Kinesis Dashboard indicates. This is significant because on chain fees are shared with KAU, KAG, and KVT token holders as yields. On January 9, 2023, the Kinesis Dashboard showed a total of 377,481.82 KAU in the “Master Fee Pool,” while on chain fees as of January 5, 2022, were over 470,000 KAU. This difference of over 93,000 KAU is worth approximately $5,761,000 since each KAU is supposedly backed by 1 gram of gold (currently about $61.95). This is a big difference, in percentage terms, it’s also about 25% of the total fees generated according to the dashboard. This is potentially even worse than it appears at first glance because the Master Fee Pool is supposed to be accumulating fees from off chain sources such as the Kinesis CEX and the new Indonesian POSPAY app partnership (fact check needed).

The yield system looks like a muddled, nonsensical, nontransparent disaster.

Holders, Active Addresses, and Volume

There appear to be 2,597 unique addresses that have at least one KAU transaction as of January 5, 2023. There are only 326 addresses that hold 1 or more KAU ($61.95), including Kinesis’ own addresses.

There appear to be 4,395 unique addresses that have at least one KAG transaction as of December 30, 2023. There are only 460 addresses that hold 1 or more KAG ($23.91).

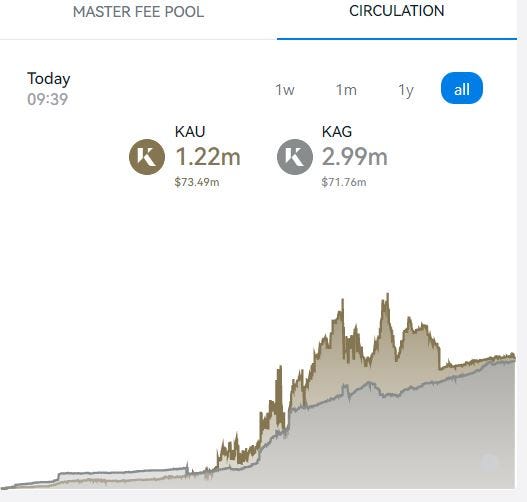

Both blockchains show a remarkably low number of holders and active addresses for a project that was claiming more than 70,000 active users nearly two years earlier. It is surprising that KAU has fewer active addresses and holders than KAG since KAU generates far more fees (KAU $21.9 million, KAG $1.73 million) and far more volume than KAG (KAU $9.5 billion, KAG $684 million).

Active addresses and the number of holders look very small relative to on chain volume and fees.

Centralization of Token Holders

On January 5, 2023, 68% of the total claimed KAU circulation was held by GAPS3KZ4YVEL4UYFAGTE6L6H6GRZ3KYBWGY2UTGTAJBXGUJLBCYQIXXA. Another 21% was held in the hot wallet. 97% of KAU was held by the top 30 addresses. Only 158 addresses held 100 or more tokens.

On December 30, 2022, 64% of KAG was held by GAPS3KZ4YVEL4UYFAGTE6L6H6GRZ3KYBWGY2UTGTAJBXGUJLBCYQIXXA. Another 19% of KAG was held in the hot wallet. 96% of KAG was held by the top 30 addresses. Only 301 addresses held 100 KAG or more.

It would be interesting to know who the address GAPS3KZ4YVEL4UYFAGTE6L6H6GRZ3KYBWGY2UTGTAJBXGUJLBCYQIXXA belongs to since it holds the 68% of all KAU and 64% of all KAG.

The calculations above assume the tokens held by the “Emissions accounts” are burned, even though this is not what the blockchains or the Kinesis Chain Explorer actually show. If the Emissions accounts in fact hold active tokens, the centralization is even worse.

Kinesis users clearly need to learn about “not your keys, not your coins,” but maybe it doesn’t matter much with such a centralized blockchain.

No Monthly Yield Payments for Many Addresses

Many addresses hold KAG or KAU but do not appear to receive monthly yield payments. GA2FTWONTSPD6FEA5J6BQ3HBYZRNY7BSRZIKDJO55QLBDZUY4GOPQN65 holds 1,500 KAU ($93,000) and has not received an incoming transfer since May 18, 2022, for yields or otherwise. GDJ526NMR762YLM3XXVPHXF4B5GUAKPKJ6NUGWTVRNP7LKLYWVOBTG6K holds 1,100 KAU ($68,000) and 2,800 KAG ($66,000); it has no incoming transactions since August 15, 2019. What is going on here? The stated reason for forking the Stellar blockchain was to support Kinesis’ complicated yield system and to achieve high performance of up to 4,000 transactions per second which Kinesis clearly does not need since they have averaged less than one transaction every 15 minutes over the past four years. Does the yield system work at all? Can it be audited? On chain fees definitely do not match the Kinesis Dashboard described above. According to the current version of Kinesis’ roadmap, all yields were supposed to be online by the end of 2021. Why is it so easy to find addresses that do not receive monthly holder, minter, and other yields they may be owed, if any?

Update 25-01-2023: Kinesis released a new blog article, “Understanding the Kinesis Blockchain.” TL;DR: You can’t trust account balances on the Kinesis Chain Explorer, they do not mean what they say. You can’t verify and validate the fees and yields. KAU and KAG holders cannot receive yields unless they KYC and register their wallet address with the Kinesis CEX. The whole system is incredibly centralized and not at all decentralized as described in the whitepaper.

If anyone can help us make further sense of this data, we’d be happy to hear from you. Please find our sources and methods linked below.

Download the Kinesis blockchain history in csv format.

Download a Python script to save the full Kinesis blockchain history to a csv file.

Download Postgres SQL queries to help analyze the data.*

*Thanks to Michel de Cryptadamus @cryptadamist

Your post is a little misguided, for someone who claims to be a crypto expert you get most of the detail wrong. For example your tweet about the hidden secret account is just incorrect, most blockchains have a root account where the tokens are issued at the time of creation, of course it is going to have a large balance, it does not go toward the in circulation. Given they have an exchange, not surprised they have a couple of big accounts in the system to provide liquidity, this gives me some confidence.

I checked out their project and git code and the fact they pay a yield on the tokens backed by gold is pretty sweet, can't find anywhere on your pages where you are willing to pay me for anything?