Dissecting Nexo's October 2021 "Ask-Armanino-Anything" Livestream

A little over 1 year ago Nexo held an AMA with their audit firm, Armanino LLP, where they discuss their "real-time attestations"

You may remember Armanino LLP from such audits as FTX US as well as “real-time attestations” for $TUSD.

If you are unfamiliar with $TUSD, read this article and this thread by Cas Piancey. If you need a refresher on Nexo, see the previous article “What is known about Nexo”.

Now that you are familiar with Nexo and the previous work of Armanino LLP, let’s listen to this Nexo Armanino “AAA” with a critical ear.

04:02 Atoni Trenchev refers to real-time audit, neither representative from Armanino corrects him.

06:27 Thomas, asks a question about whether or not Nexo or a compeittor had the first “real-time audit.” Noah Buxton responds “both claims are true and can be consistent.”

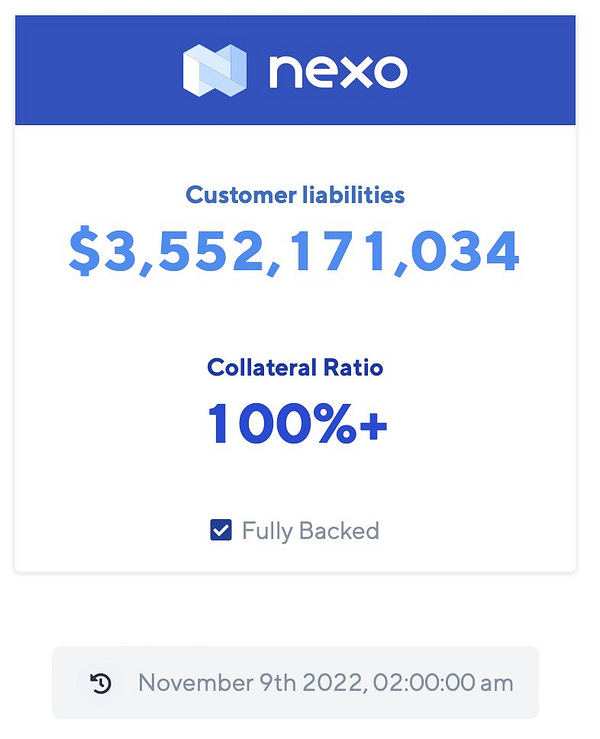

12:15 Noah Buxton asserts that if every single Nexo customer withdrew their assets at the same time, Nexo could cover it.

14:48 Antoni Trenchev talks about the possibility of Nexo acquiring a banking license without audited financial statements. He doesn’t want to say “get away with it” but he wants viewers to know “you can make it through the door.” He also talks about the possibility of Nexo acquiring an existing bank. Readers who follow the crypto world closely may recall the strange tale of Moonstone bank, formerly Farmington State Bank.

17:00 Rick, asks “Since Nexo is the first ever crypto lender to be audited, would you please share more about the differences and challenges you faced while auditing them?” For the first time Antoni Trenchev acknowledges that Nexo is not actually audited, stating “OK haha we gotta be careful with the language here, Noah you will clarify.”

17:30 Noah Buxton suggests that audit merely means “an independent third-party generally went in and checked something… …under a recognized standard” but states his firm is “sensitive about,” “using that term audit” He again refers again “real-time unit” but acknowledges that “technically under the standards” what they are doing is not an audit but “attest report,” but then says “people were refer to it as an audit” because “to most people it feels like an audit.”

23:14 Noah Buxton says, “I see this narrative all the time, particularly on Twitter, you’ll see people say ‘This is an attest, not an audit’,… …that’s a misunderstanding of the standards.” Earlier in the stream he acknowledged an “attest” is not the same as “an audit.” In sounds quite a bit like he’s contradicting himself. He contuses at 24:12 “The idea that an audit for instance is much different necessarily or gives users a higher level of confidence than the process that we’re doing, it’s just a misconception of the standards and the terminology. What more could you ask for frankly, than deep integration with the client’s systems pulling data in real-time and having the full picture of the assets and the liabilities.” That sounds suspiciously similar to “our real-time attestations are as good as, no wait, even better than audits.” His final comment on this topic, “We’re not trying to cut any corners and that terminology stuff Is just frankly misused, people don’t fully understand the attest standards as they are today.”

Some people on Twitter think they understand it pretty well, @rue_du_coin provides a high level summary:

Readers that just “don’t understand the terminology” may be forgiven for wondering “What about any liabilities that Nexo may have not related to customer accounts?,” and “What if Nexo doesn’t volunteer all the complete and correct details about all customer accounts?” Those may questions best posed to Nexo’s auditors attestors, but unfortunately they’re no longer in the crypto business. Skip ahead to 32:20 for the answer.

It also seems as though at least some industry experts would disagree with the characterization of an “attestation report” or “agreed upon procedures report,” as basically the same as an audit.

28:10 Talion asks, “Does the audit attest that Nexo isn’t unsustainably borrowing money to pay interest, or are such potential liabilities (ie junk bonds) not included?” Atoni Trenchev answers with a non-answers “What I can absolutely assure you is that fundamentally the business model of Nexo is sound, there is no mystery as to how we generate our revenue, it’s very simple we borrow from our clients at a certain rate and we pass on that money to clients at a higher rate.”

Wouldn’t it be interesting to know who is the client that borrows $NEXO tokens at over 12% interest? Are they “institutional”?

29:30 Antoni Trenchev says “We work with institutional clients, institutional partners, institutional liquidity providers from whom we can borrow much much cheaper.”

Are these “institutional loan agreements” going to be included in the Nexo real-time attestation?

32:20 Clayton Lowry finally answers Talions question, “We’re not attesting over any kind of your [Nexo’s] borrowing activity or what you guys are doing there,” but then claims “we see the whole picture, so if there is anything that sustainable it’s going to show up on our platform.” How does that work? He doesn’t explain it.

39:20 Atoni Trenchev states “The audit is always... [unintelliglbe] …any sort of third-party…” the video freezes and the audio goes silent for the remaining 23 minutes.

Nexo also published an article on their blug just three weeks prior to the livestream where they use the terms “audit” and “attestation” as interchangible synonyms.

Question for CPAs and auditors, is it OK to use the term “audit” and “attestation” interchagably? Why or why not?

Read more about Nexo, their $NEXO token and their real-time attestations