The Kinesis Monetary System and Their Tangled Web of Legal Entities and Related Party Transactions Around the World

Kinesis operates a network of 23 or more known and unknown, offshore and onshore, legal entities around the world, including Cyprus, the Cayman Islands, the United States, Australia, and more

As we continue to investigate the Kinesis Monetary System, we now turn our attention to the specific legal entities Kinesis uses to operate around the globe. Unfortunately, this is a question with a very incomplete answer. We are aware of the following related entities:

Allocation Bullion Exchange Limited (ABX), Australia

ABX KMS Clearing (Cyprus) Limited, Cyprus

ABX Global (Cyprus) Limited, Cyprus (inactive)

ABX Global (Hong Kong) Co Ltd, Hong Kong

ABX BCL Kinesis Group Holdings (UAE), United Arab Emirate

Bullion Capital Ltd, unknown jurisdiction

Bullion Capital (Shanghai) Co Ltd, China (deregistered)

Currency One Pty Ltd, Australia

Kinesis AG, Liechtenstein

Kinesis Altin Rafineri Anonim Sirketi (KİNESİS ALTIN RAFİNERİ ANONİM ŞİRKETİ (284712-5)), Turkey

Kinesis Altin Rafineri Anonim Sirketi Vizyonpark Subesi (KİNESİS ALTIN RAFİNERİ ANONİM ŞİRKETİ VİZYONPARK ŞUBESİ (437386-5)), Turkey

Kinesis Bailee Company Pty Ltd, Australia

Kinesis Cayman, Cayman Islands

Kinesis Global Pty Ltd, Australia

Kinesis Kuyumculuk Anonim Sirketi (KİNESİS KUYUMCULUK ANONİM ŞİRKETİ (327185-5)), Turkey

Kinesis Limited, unknown jurisdiction

Kinesis Trust Ltd, unknown jurisdiction

Kinesis USA, Inc., United States

PT Kinesis Monetary Indonesia

An entity in Lithuania has been mentioned in the Kinesis Forum, but we have been unable to verify this. The CEO recently began making references to the “Kinesis Global Group” but refused provide a list of the other 10-15 entities that make up the “group.”

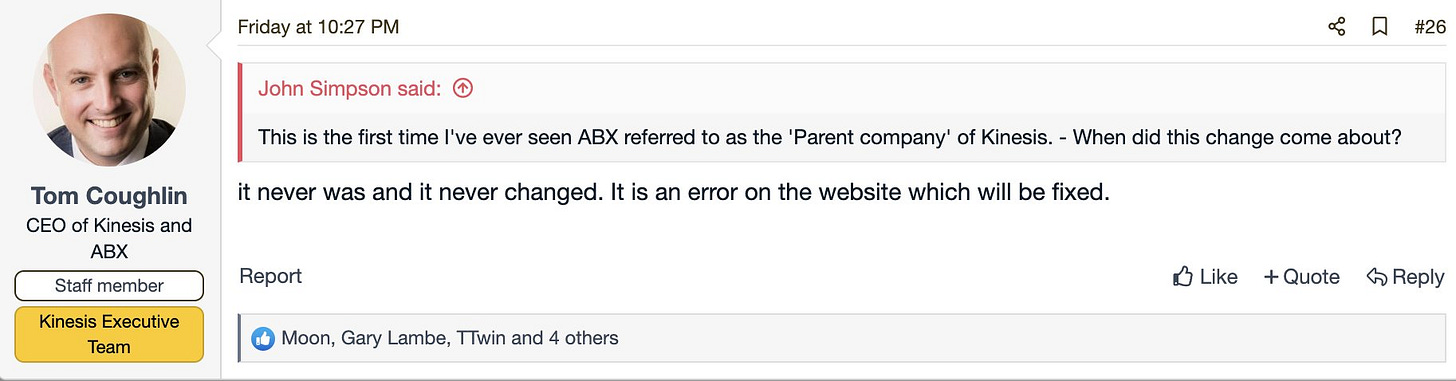

Despite his ambitious “Global Corporate Structure Roll-Out,” the CEO appears to be deeply confused regarding the parent company of Kinesis (or perhaps now the “Kinesis Global Group”). For years, would-be-investors and Kinesis Monetary System users have been told they should trust Kinesis because it was founded by Allocated Bullion Exchange (ABX) and that ABX is the parent company of Kinesis.

And then, just like that, on January 27, 2023, five years into the project, ABX was no longer the parent company of Kinesis; it became nothing more than a "strategic partner." ABX was actually never the parent of Kinesis; this was just an "error" on the website. Imagine that—a simple error! It’s amazing that nobody caught this until now!

Perhaps this is a good thing for Kinesis, since we recently made public the precarious financial position of ABX. It’s incredible what you can buy from public company registers for a few bucks!

ABX does seem like a bit more than “just a strategic partner.” Besides the “why you should trust Kinesis” explanation on the website for the past several years, in August 2019, ABX registered the name “Kinesis Money” as one of its business names in Australia, as well as several other names in previous years.

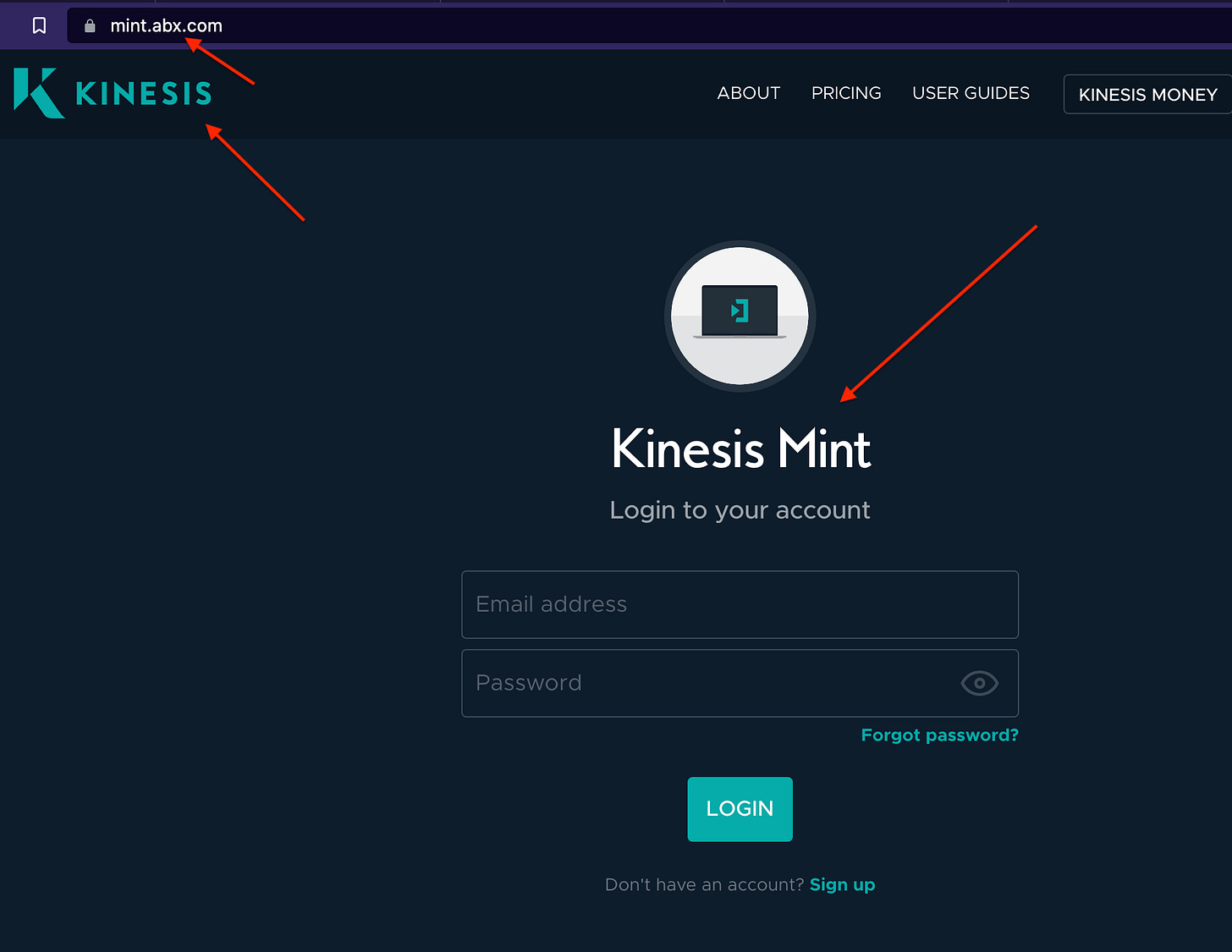

The “Kinesis Mint” also uses the abx.com domain rather than kinesis.money.

Confusion about who is and is not the parent of Kinesis is not the only oddity within the “Kinesis Global Group.” European customers have claimed that they deposit money to Kinesis by sending funds to Indonesia. This seems like a rather meandering route for funds to take in order to reach a crypto exchange in the Cayman Islands, doesn’t it?

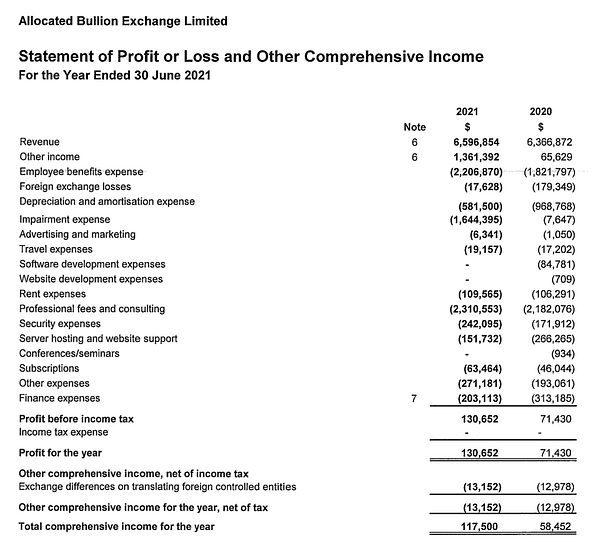

The generally precarious financial position of ABX is not the only thing we learned from their 2020 and 2021 Form 388 filings. The entire filings are worth a careful read, however, some key highlights are:

A $620,000 unsecured loan to M. T. Coughlin

A $5,259,023 loan from related party, Kinesis Limited

Note 31 (see below)

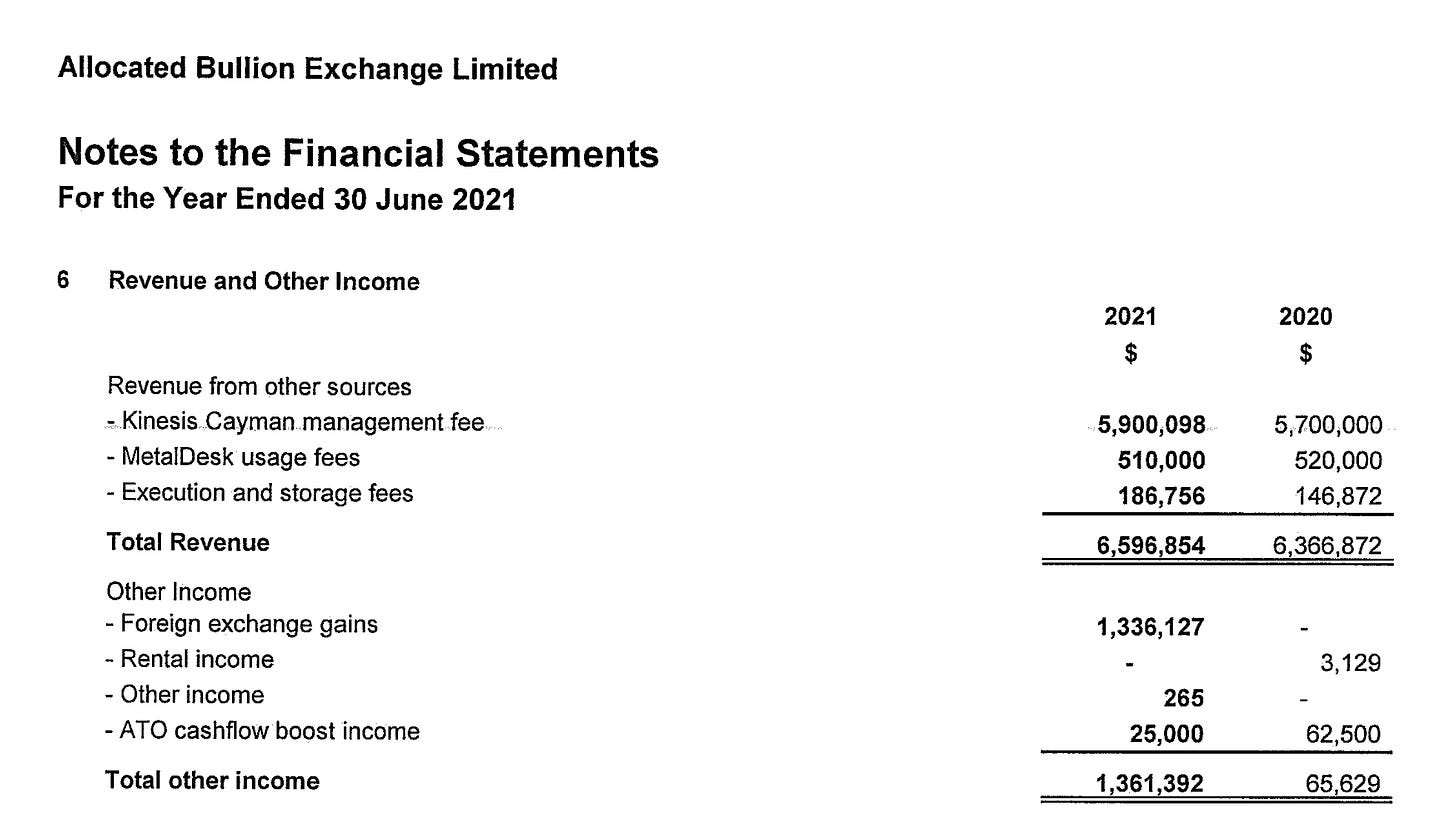

Note 6 (see below)

Lot’s of related party transactions including 0% interest, unsecured loans

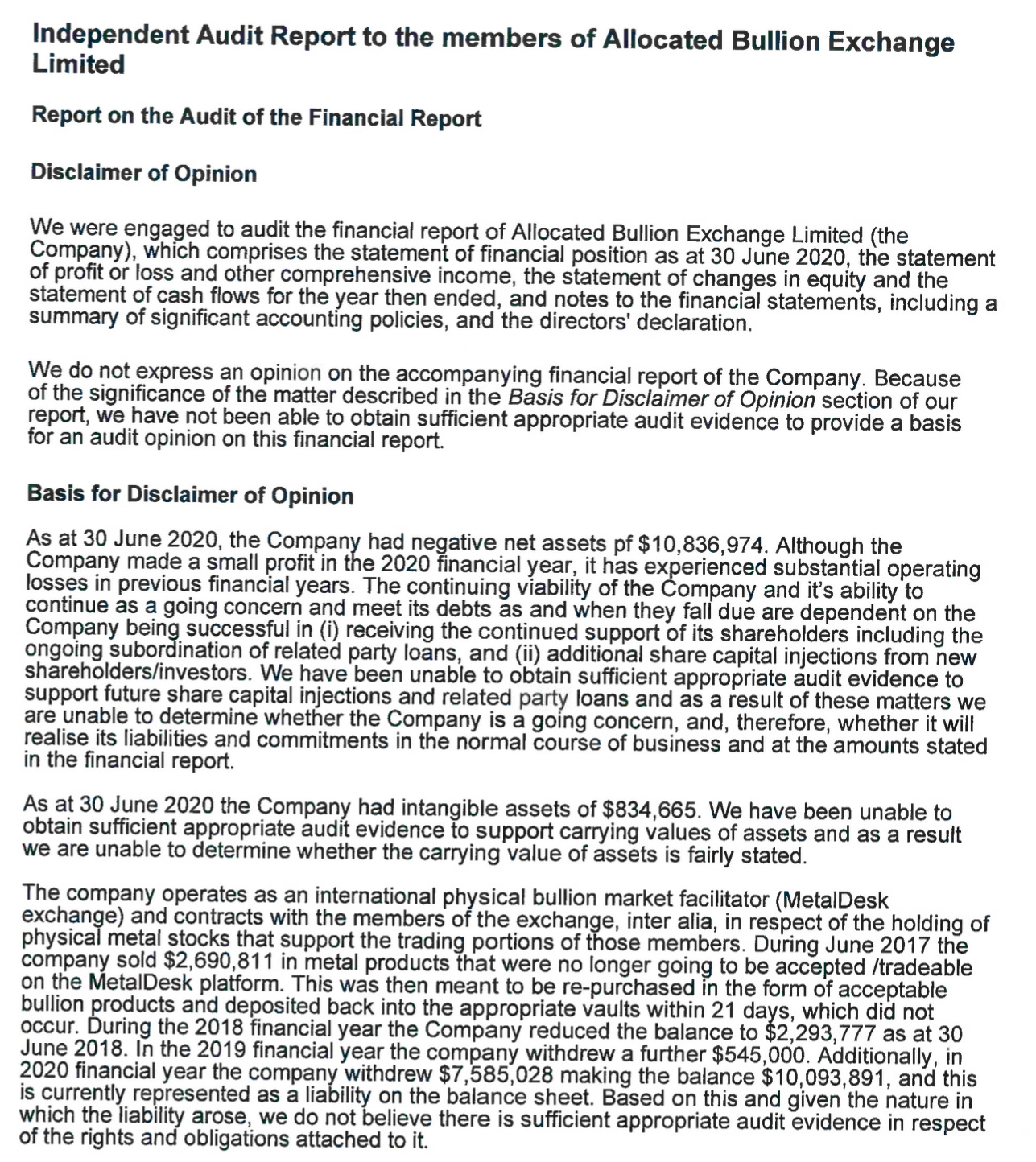

The Disclaimer of Opinion for 2020 and 2021

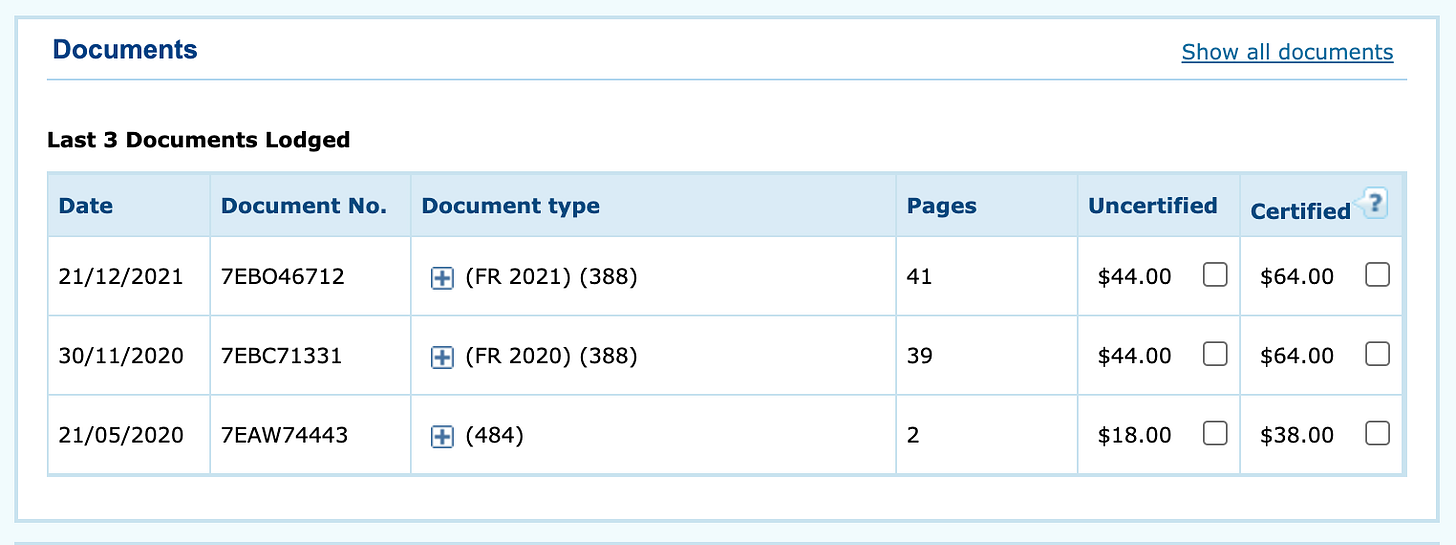

The absence of ABX’s 2022 Form 388 filing

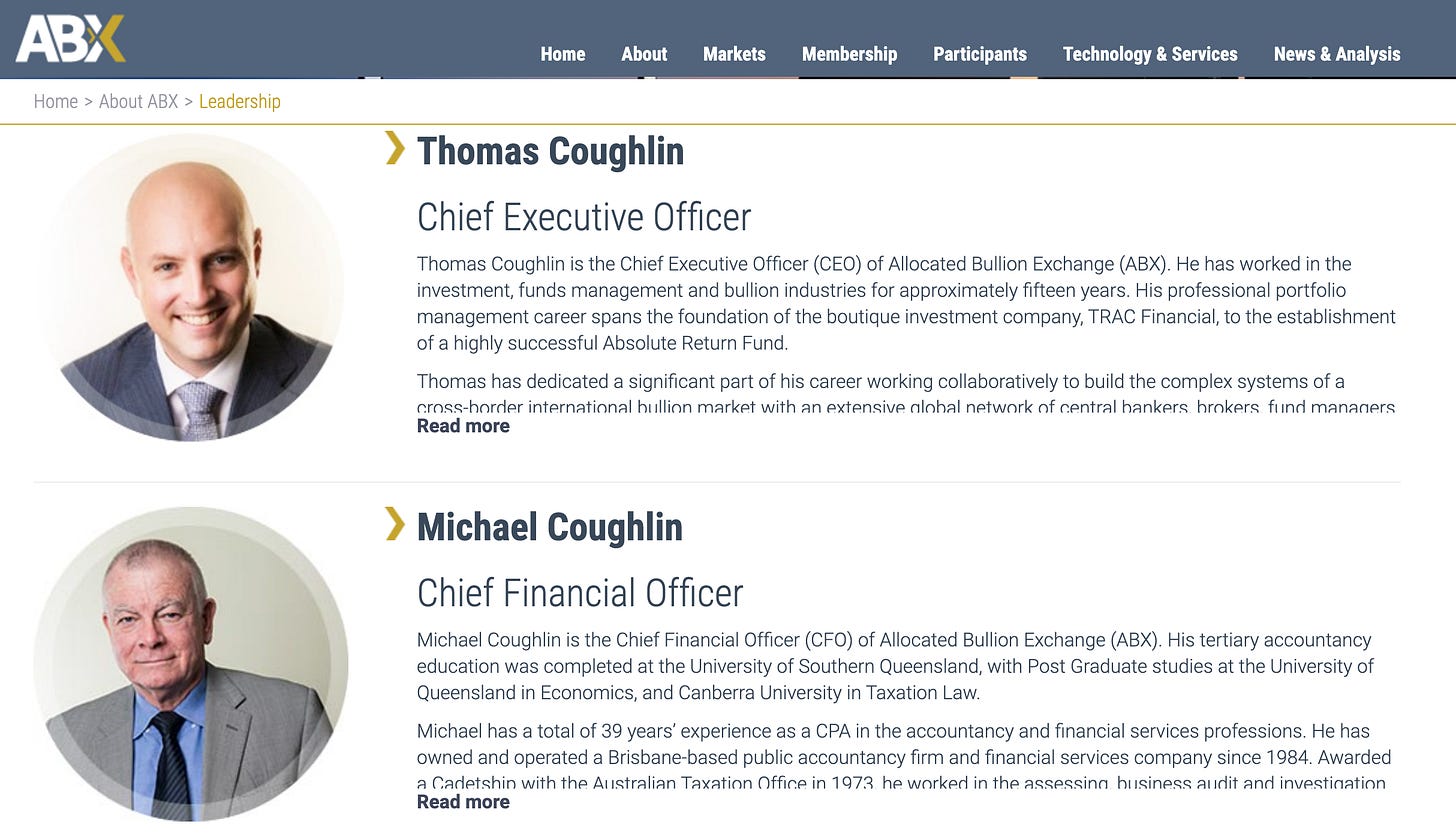

M. T. Coughlin would be Michael T. Coughlin, ABX’s CFO, and Thomas Coughlin’s father.

Kinesis Limited, for reasons unknown, has loaned $5.3 million to ABX, but ABX auditors have been unable to “obtain sufficient appropriate audit evidence to support the valuation” of this loan. Among other reasons, this is key because it speaks to the (in)solvency of ABX. ABX’s solvency matters because, parent company or not, ABX is entrusted with the storage of all of Kinesis’ physical gold and silver.

In addition to the $5.3 million loan from Kinesis Limited, the auditors were generally concerned about ABX’s ability to continue as a going concern without additional capital injections.

A significant proportion of ABX revenues come from “Kinesis Cayman” management fees. What are all these fees for? ABX receives millions from Kinesis and then engages in numerous borrowing and lending transactions with related parties. Why?

Look at all these related party loans and transactions.

TRAC Sales and Marketing (UK) Limited is yet another company Thomas Coughlin is a director of. Note that this $1.2 million loan is 100% impaired along with a $585,000 loan to subsidiary company, ABX Global (Hong Kong) Ltd.

Form 388 for both 2020 and 2021 include the auditor’s Disclaimer of Opinion.

ABX’s 2020 Form 388 was filed in November 2020; in 2021, it was filed in December 2021; where is the 2022 filing? It’s not available yet, much like Kinesis’ second “biannual” gold and silver audit for 2022.

Are these the actions and behaviors of a thriving and growing gold and silver business or the smoke and mirrors of a typical 2018-era crypto ICO? Only time will tell.

Read the article below to learn how the Kinesis Monetary System has generated the vast majority of its revenues to date. It’s all about the mint cycle!

Another great artical keep up the great work awesome read

A lot of shady shit here, especially the $630k loan.