Meet Allocated Bullion Exchange (ABX), Founder of the Kinesis Monetary System

Allocated Bullion Exchange has net negative assets of $10.7 million and negative retained earnings of $26.7 million as of their last audited financial statements.

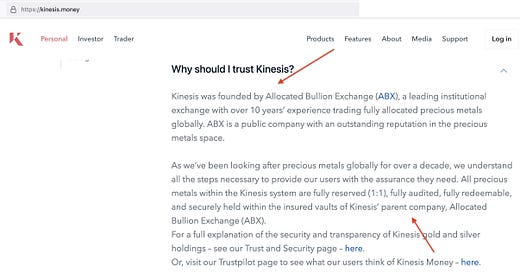

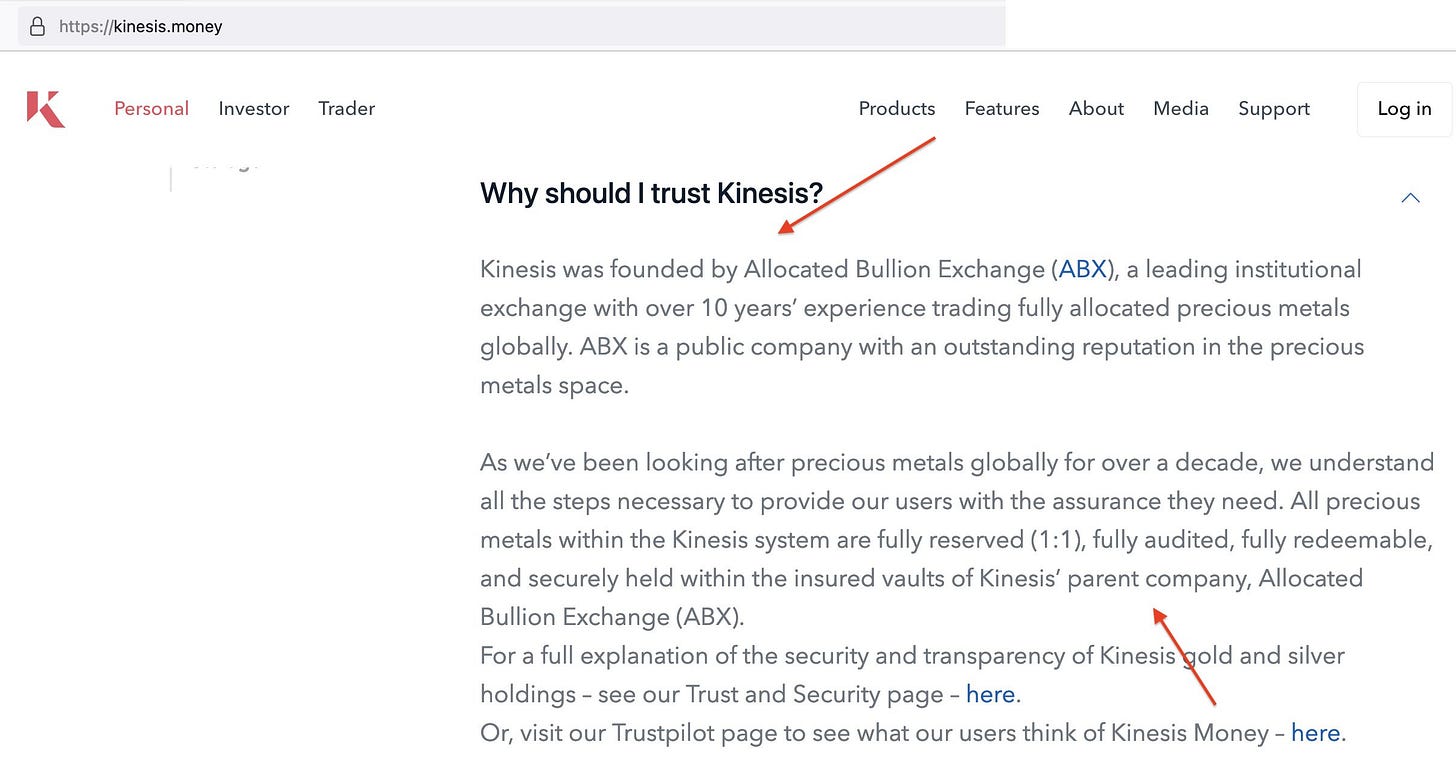

Meet Allocated Bullion Exchange Limited (ABX). According to Kinesis’ website, ABX is one of the primary reasons you should trust Kinesis.

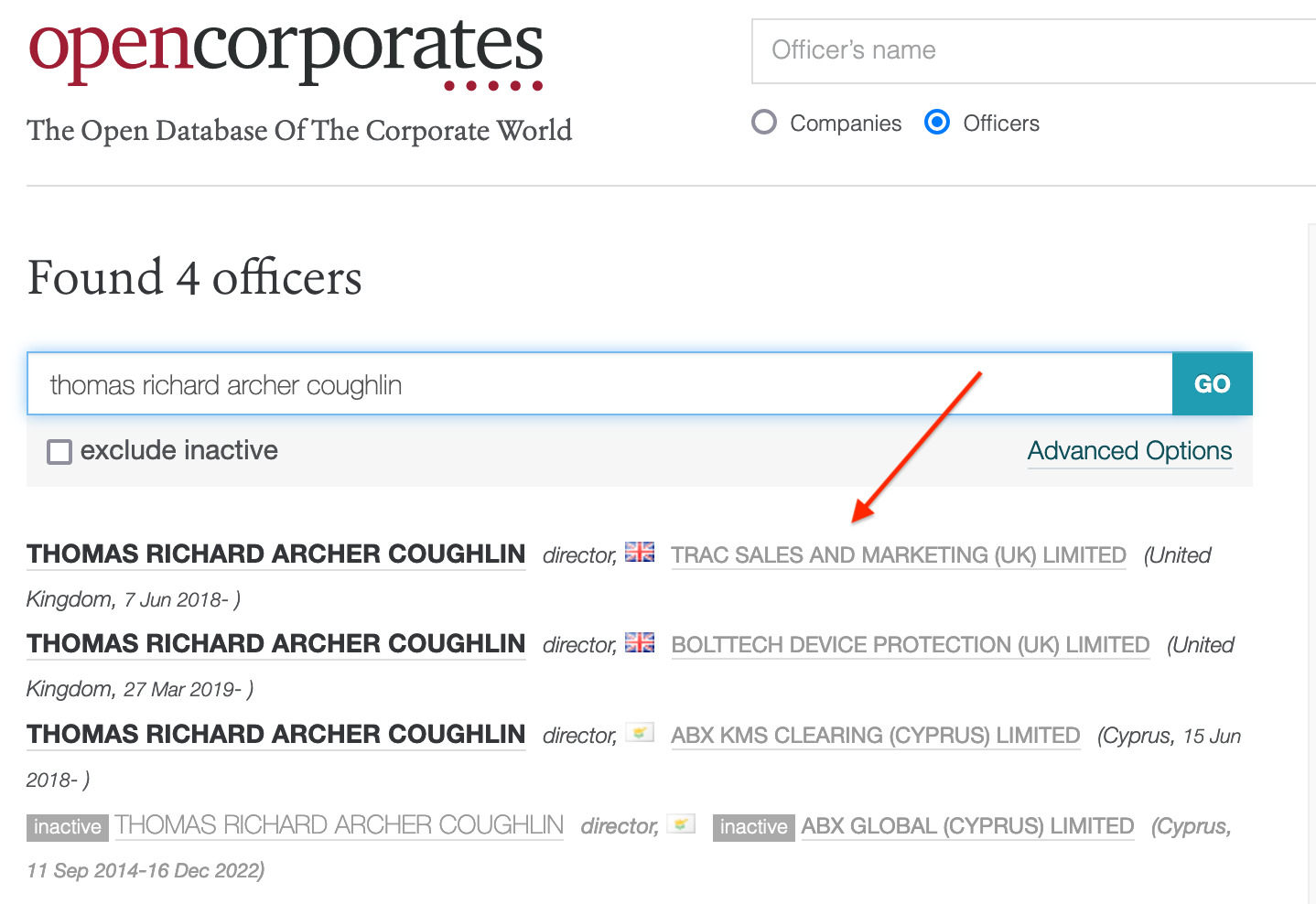

Until as recently as January 2023, ABX was also listed as the parent company of Kinesis. According to the CEO, this is false and was never the case, this was simply an “error” on the website.

Regardless of this parent company issue, Kinesis wants you to know that it is trustworthy because ABX is its founding entity and ABX is “a leading institutional exchange with over 10 years' experience trading fully allocated precious metals globally. ABX is a public company with an outstanding reputation in the precious metals space.”

What Kinesis investors and users need to know is that ABX sits between KAU and KAG token holders and their physical gold and silver. Based on currently available information, it appears that Kinesis Cayman issues KAU and KAG and operates a Cayman Islands based centralized cryptocurrency exchange where you can trade the tokens. Kinesis Cayman entrusts ABX with storing the physical gold and silver in various known and unknown storage facilities around the world. Therefore, KAU and KAG token holders need to have a high level of trust and faith in ABX.

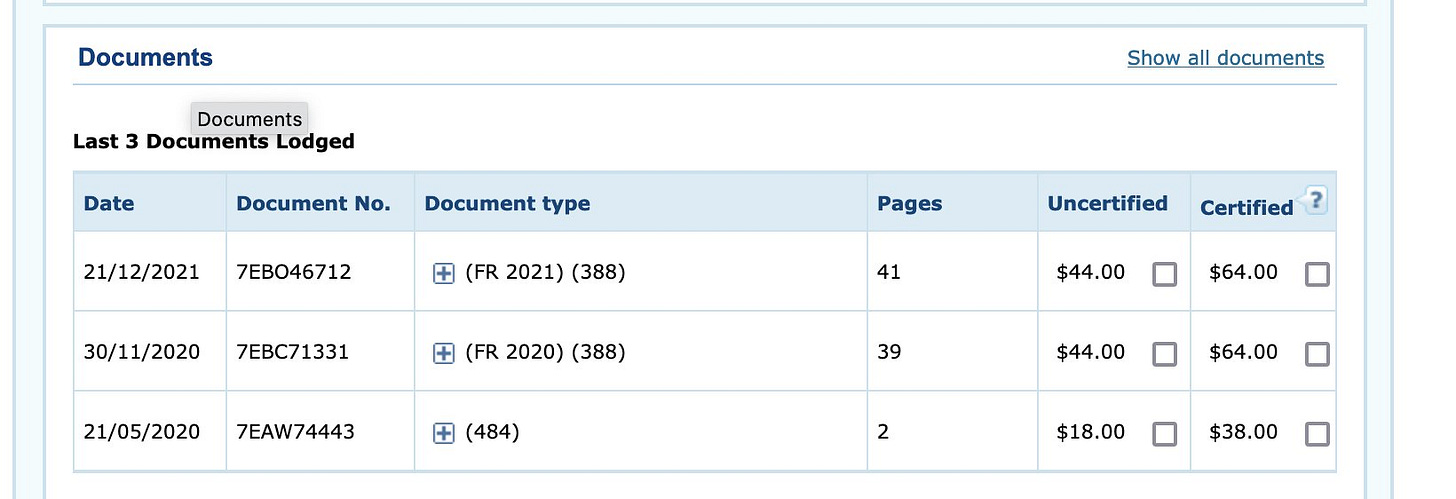

Let’s have a look at ABX’s financial statements, shall we? Let’s start with the P&L.

2019: ($5,341,407) loss

2020: $71,430 profit

2021: $130,652 profit

2022: Not filed yet (late)

Let’s see what ABX’s Statement of Financial Position, also known as the Balance Sheet, says.

That’s a whole bunch of net negative assets ($10,693,170), negative retained earnings ($26,693,862), and negative equity ($10,693,170). This has not improved in any significant way over the past three years.

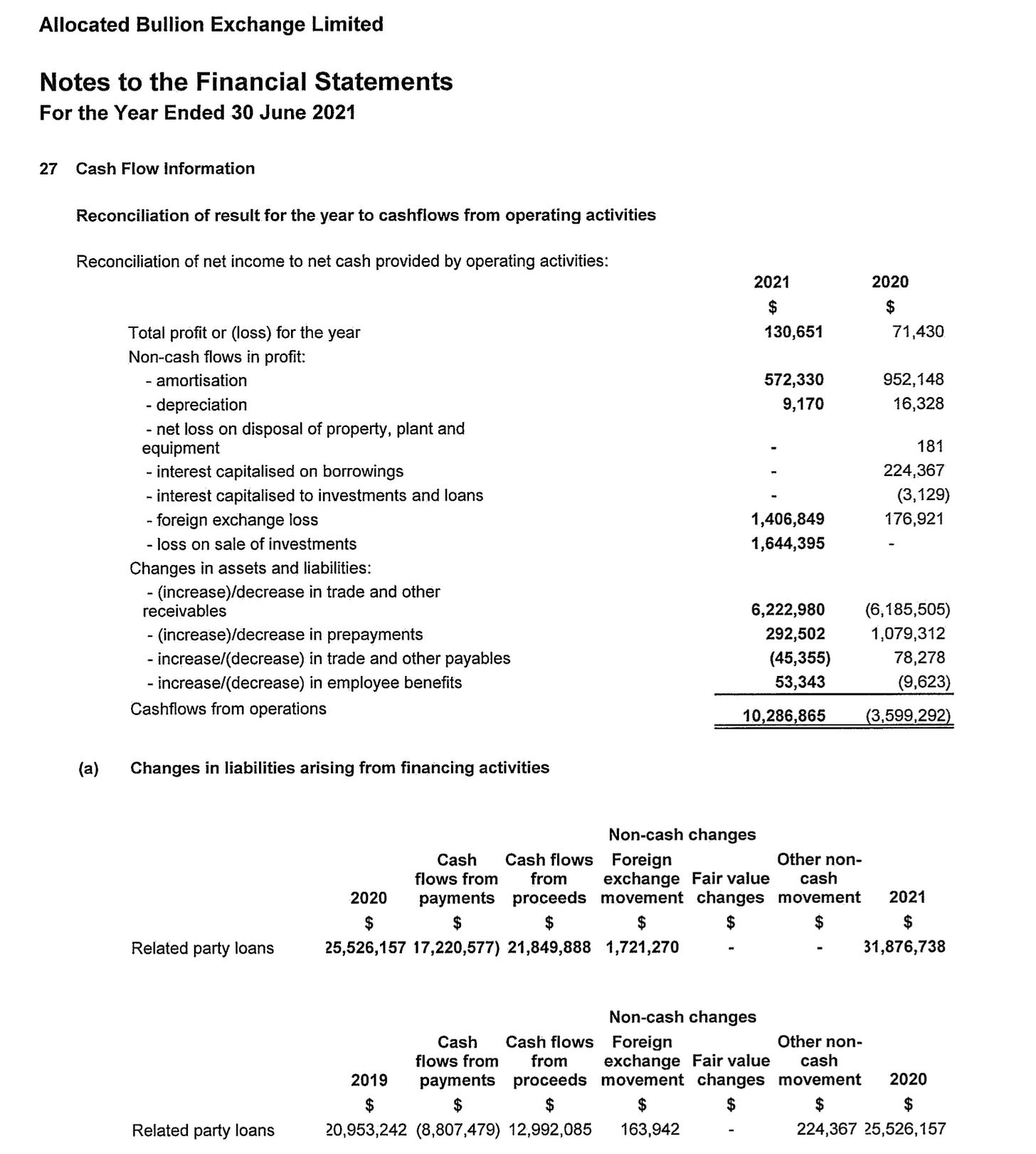

What other interesting tidbits can we find in these statements? How about all these lending, borrowing and other transactions with related parties?

There are quite a lot of related-party transactions, but the largest are with Kinesis Cayman. In 2020, ABX had $6,272,036 in sales to Kinesis Cayman, but they also paid Kinesis Cayman $2,048,597 and owe Kinesis Cayman $5,790,849. This means that 97.5% of ABX’s 2020 revenue came from Kinesis. Isn’t that a bit strange if ABX is a “a leading institutional exchange with over 10 years' experience trading fully allocated precious metals globally” and Kinesis only started operating in early 2019? ABX only had $645,050 in revenue in 2019.

As at June 30, 2021 ABX had sales of $6,504,883 to Kinesis Cayman (82% of total revenues) for the year ended June 30, 2021, and still owed Kinesis Cayman $5,259,043.

The 2021 financial statements include a Disclaimer of Opinion that makes specific reference to this balance owed to “Kinesis Limited”1:

As at 30 June 2021, the Group has a loan with a related party, Kinesis Limited of $5,259,023. We have been unable to obtain sufficient appropraite audit evidence to support the valuation of the above loan.

That doesn’t sound good, but it’s not the only thing the auditors had misgivings about. Both the 2020 and 2021 audits included a Disclaimer of Opinion; however, 2021 also included “Note 31 Going Concern”:

As at 30 June 2021, the Group has negative net assets of $10,576,354. Although the company made small profits in 2021 and 2020 financial years, the Group has experienced substantial operating losses in the past. The continuing viability of the Group and its ability to continue as a going concern and meet its debts and commitments as they fall due are dependent on the Group being successful in:

Receiving the continuing support of its shareholders including the ongoing subordination of related party loans; and

Additional share capital injections from new shareholders/investors

As a result of these matters, there is a material uncertainty that may cause doubt on whether the Group will continue as a going concern and, therefore, where it will realise its assets and settle its liabilities and commitments in the normal course of business and at the amounts stated in the financial report. However the Directors believe that the Group will be successful in the above matters and, accordingly, have prepared the financial report on a going concern basis.

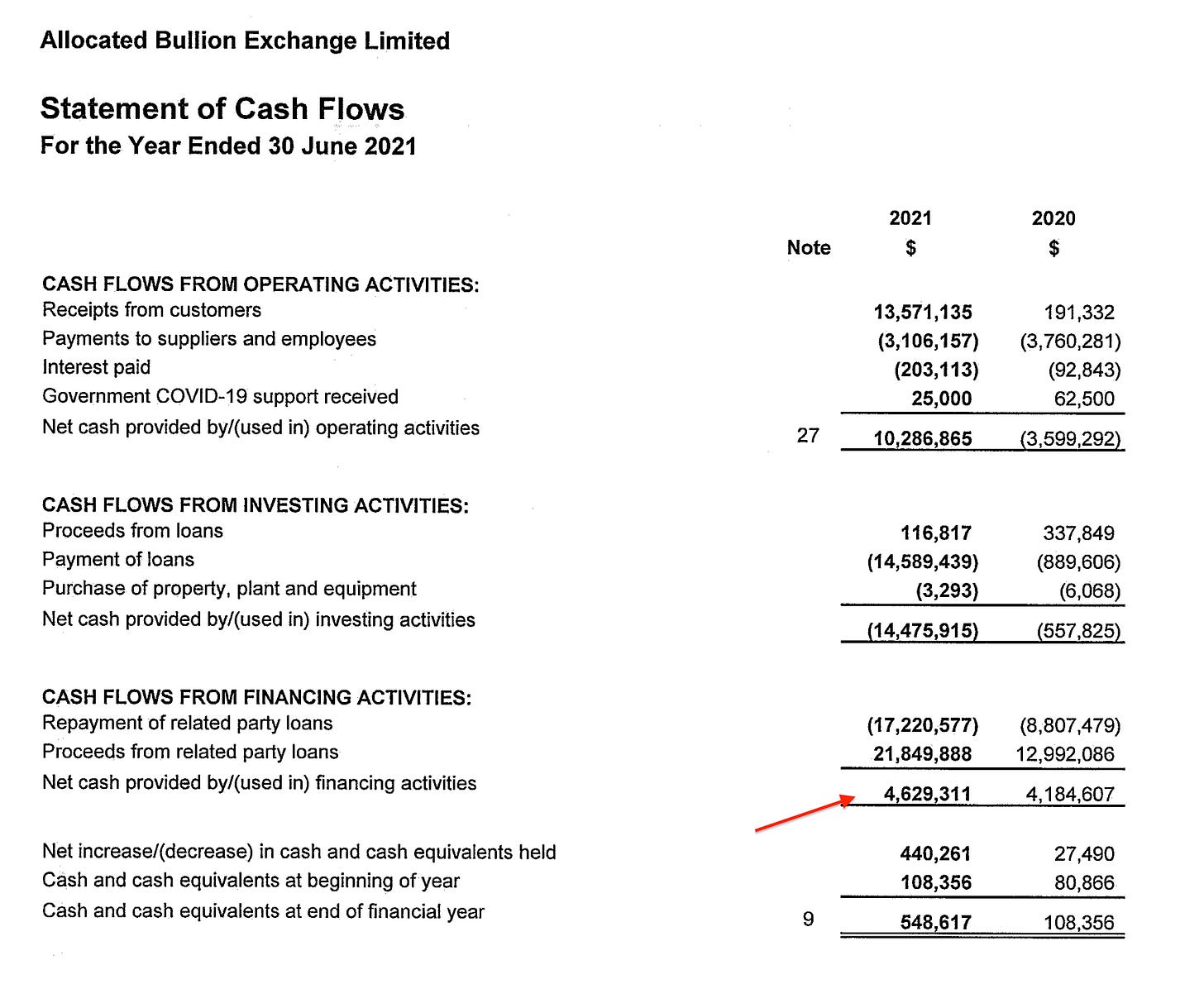

Despsite minimal changes to net assets and total equity between 2020 and 2021, we can tell from the Statement of Cash Flows that there was a great deal of borrowing and lending activity in 2021, especially from related parties.

It appears that the $5.3 million loan from Kineis Cayman to ABX made the difference between positive cash flows and negative cash flows. In 2021, $21,849,888 in total proceeds from related party loans resulted in $4,629,311 in net proceeds from related party loans. Without net cash from related party loans, ABX would have had negative cash flows of nearly $4.2 million instead of positive cash flows of $440K.

Are related party loans the only thing keeping ABX afloat? More specifically, is the $5.3 million loan from Kinesis Cayman the difference between slight positive cash flows for ABX and significant negative cash flows? That is exactly what it looks like.

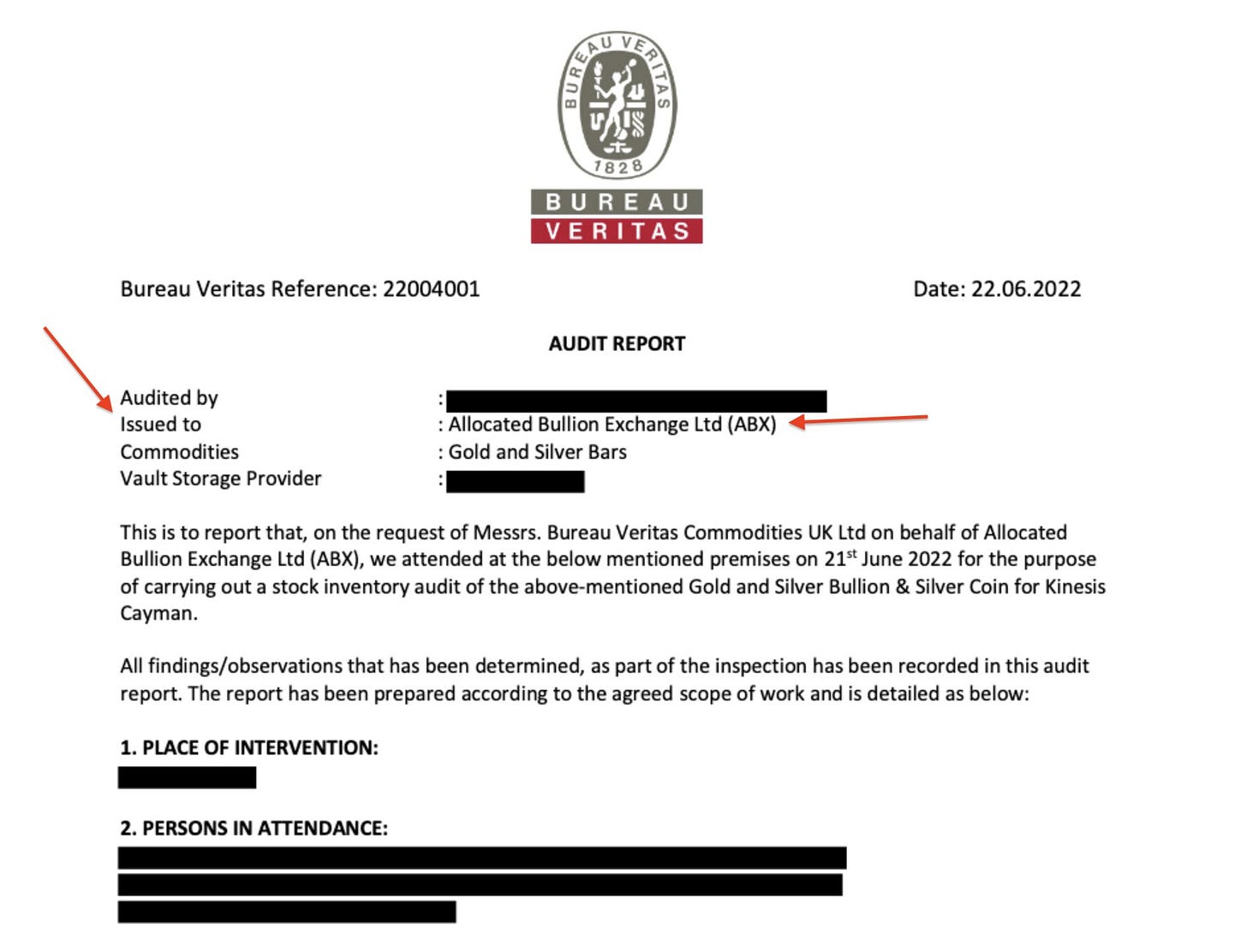

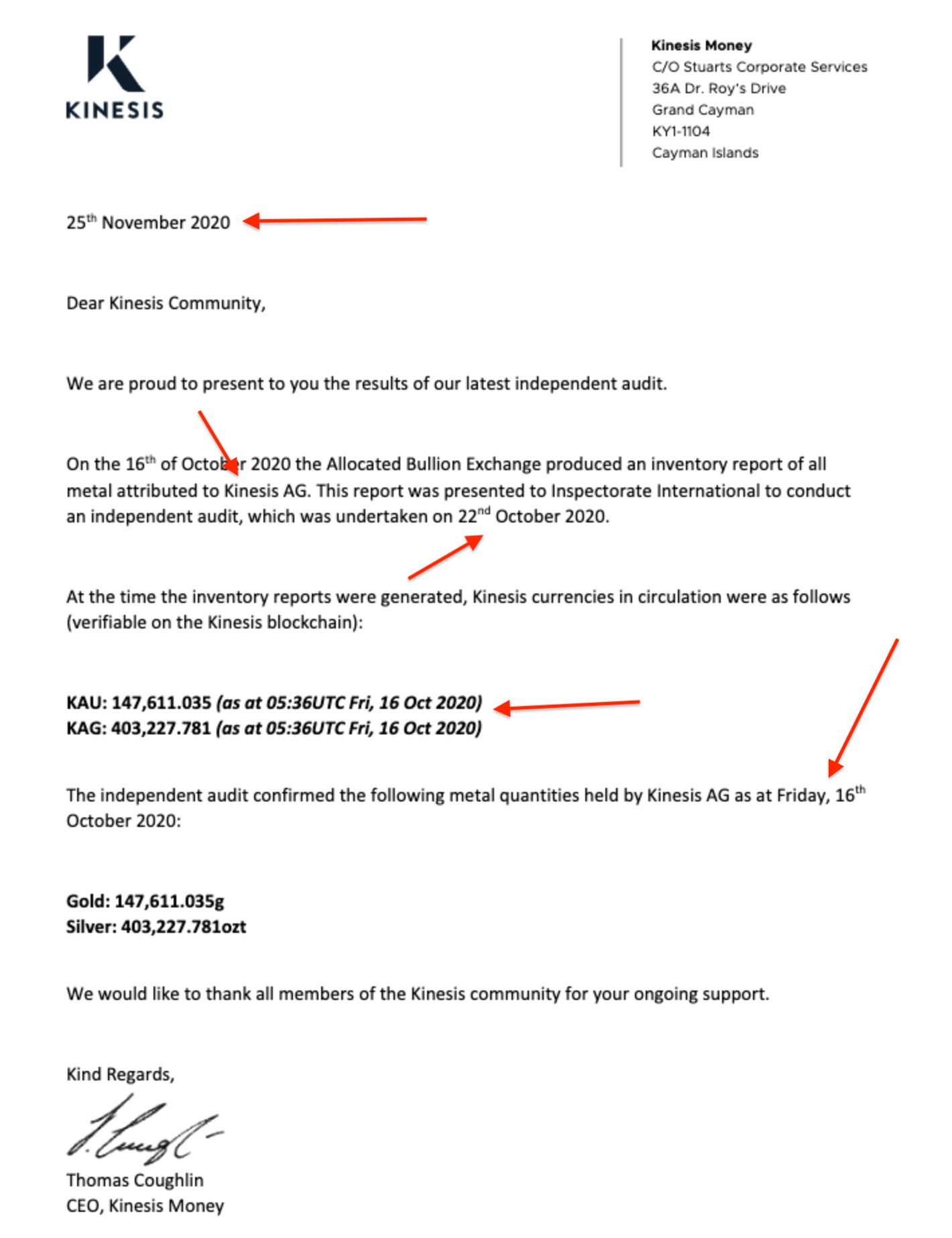

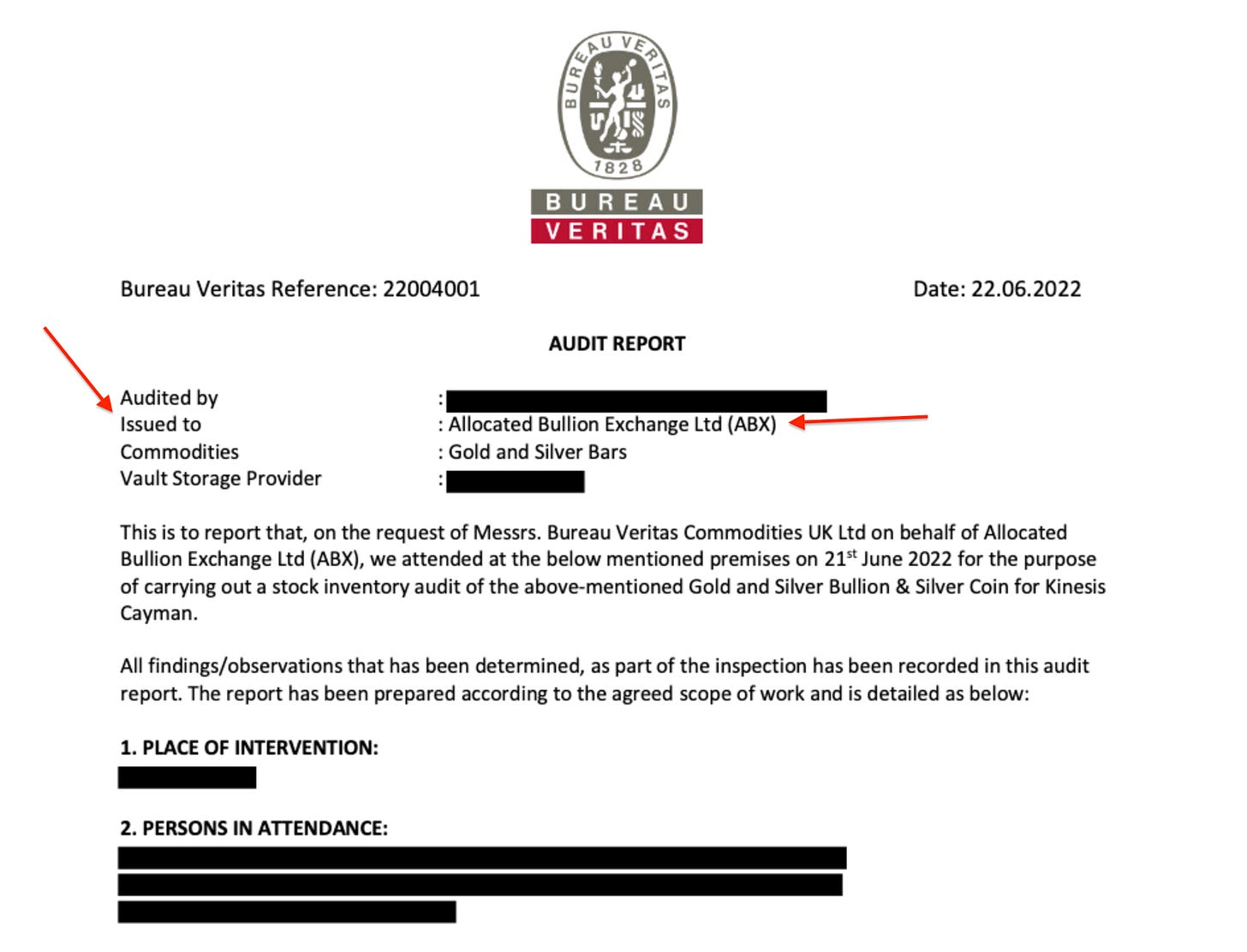

In addition to these issues with ABX’s financial statements, new problems with the gold and silver audits from 2020 and 2022 have also come to light.

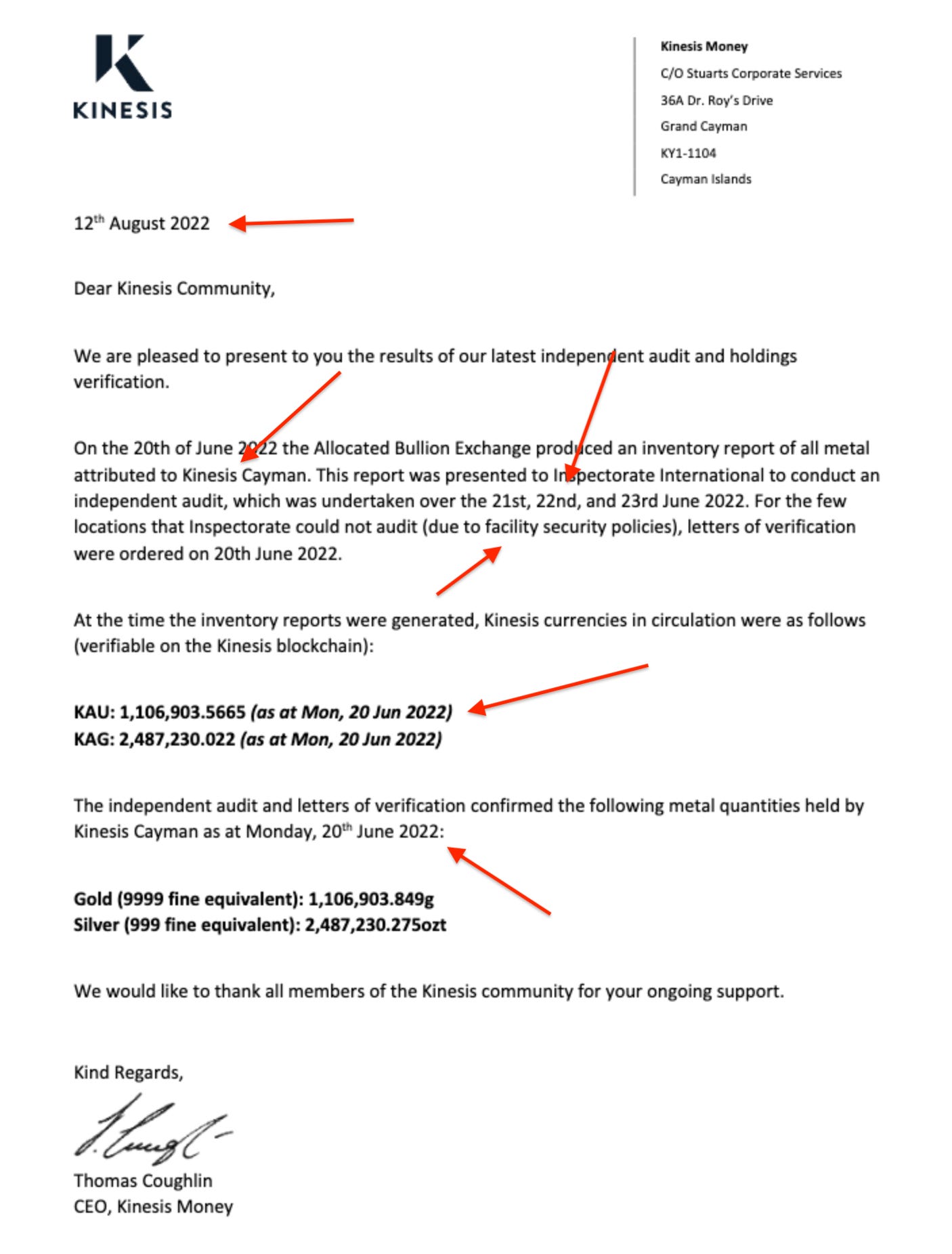

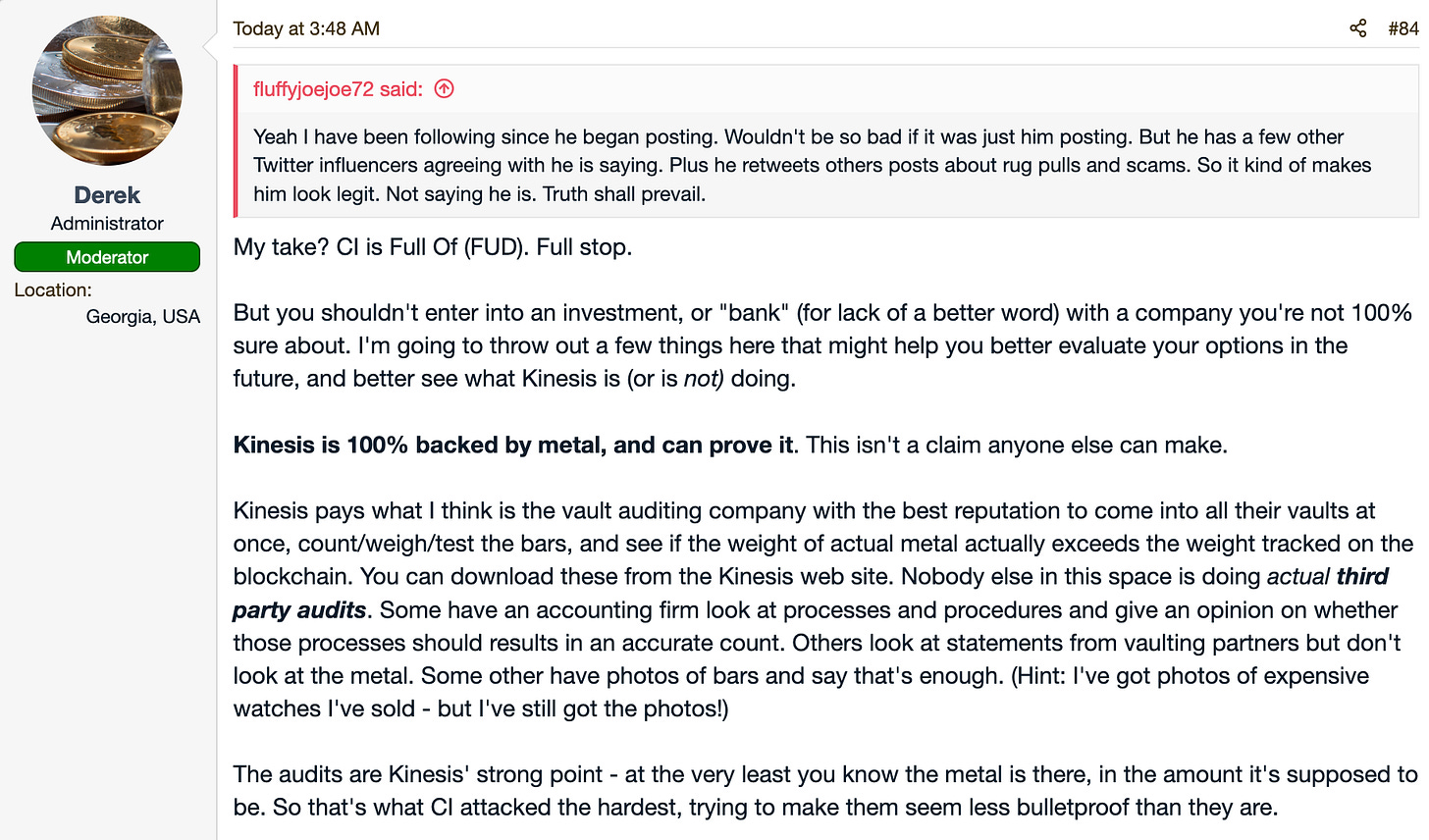

As we previously covered, these audits are not biannual. The most recent audit in June did not examine all the gold and silver, nor did it examine all of the facilities allegedly storing gold and silver backing KAU and KAG. The auditors make no claims, assertions, or references whatsoever regarding token circulation, smart contracts, or blockchains.

This has not stopped Kinesis and Kinesis representatives from continuing to claim that they do have biannual audits covering all the gold and silver backing KAU and KAG and all the facilities storing gold and silver backing KAU and KAG. They also claim that these audits prove that KAU and KAG are 100% backed. This is all completely false.

Not only are audits infrequent and the latest audit incomplete, but a pattern appears to be emerging regarding the release of the audits.

March 2020 audit - released 14 days later

October 2020 audit - released 34 days later

June 2022 audit - released 50 days later

None of the audit reports were dated more than seven days after the audit. Kinesis claims to have completed another audit as of January 20, 2023, but no audit has been published on their website as of February 7, 2023. The second “biannual” audit for 2022 was due on December 23, 2022, if we consider the due date of a “biannual audit” to be six months after the previous audit, however, the first two audits were conducted in March and October 2020.

One of the new details we have noticed is that the self attested token circulation provided by Kinesis does not match the dates the audits were conducted.

Token circulation - March 11, 2020

Audit date - Mar 17, 2020

Token circulation - October 16, 2020

Audit date - October 22, 2020

Token circulation - June 20, 2022

Audit date - June 21-23, 2022

What purpose do audits have that compare physical metals to token circulation on a different date than the audit? Kinesis has frequently promoted speed as one of the primary advantages of their fork of the Stellar blockchain and calimed that they settle transactions within a few seconds. What could be the reason for using token circulation figures from up to seven days prior to the audit?

There was also a major KAU redeem transaction of more than $10.8 million just hours before the June 2022 audit.

Another issue we noticed, the language “all metal attributed to Kinesis AG” in the two 2020 audit reports changed to “all metal attributed to Kinesis Cayman” in the June 2022 audit report. How can Kinesis simply transfer the metals from a Liechtenstein entity to a Cayman Islands entity?

Why would Kinesis switch from Liechtenstein to the Cayman Islands if the CEO thinks Liechtenstein is the best country in the world for Kinesis’ business?

19:13 “We’re just bringing online our own big vault based out Liechtenstein. That has arguably has the best property title laws in the world.”

Does it have anything to do with this?

Another issue, not only are the locations of the vaults removed from the audit reports, but some of the names of the vaults are removed too. What could be the reason to hide this information?

One of these secret vaults did not have a scale!

How can Kinesis move 37.3% of the gold and 13.7% of the silver backing KAU and KAG tokens to storage facilities that prohibit audits due to “security policies” while at the same time telling investors that all gold, silver, and all storage facilities are fully audited biannually?

Is there any way to interpret this as anything other than a clear and obvious misrepensetation of the facts surrounding these audits?

Do investors really want to store their gold and silver with a company in such a precarious financial position as ABX? Do investors think it’s appropriate that Kinesis can shift their assets from entity to entity and vault to vault, including to storage facilities that prohibit audits?

What would happen in the event of an ABX bankruptcy? Will ABX become insolvent if related parties stop extending loans or providing capital injections?

Find the gold and silver audits at https://kinesis.money/audits

Download a copy of ABX’s 2020 and 2021 audit reports

Is “Kinesis Limited” the same as “Kinesis Cayman”? Is this a mistake?