The Kinesis Monetary System Token Sale

A 2018 $255 million 506(c) token sale with questionable marketing practices and disappointing investor returns

In 2018, Kinesis Cayman Ltd launched a $255 million securities offering under SEC rule 506(c), according to two public SEC filings in early 2019.

According to the SEC filings and the Kinesis Money white paper, 255,000 KVT tokens were offered for $1,000 each with 45,000 tokens earmarked for distribution “to other persons, including advisers and employees.”

According to the Form D filed on January 28, 2019, they raised $60,350,000 from 110 individual investors with $2,617,000 raised from US persons and the remaining $57,733,000 from non-US persons under Regulation S.

In addition to the basic facts described above, there were two other details of interest. In the initial filing dated January 28, 2019, section 15 indicated $190,681 in “Finders’ Fees” while the Form D amendment filed on March 4, 2019 indicated $0 for “Finders’ Fees.”

Although the original filing did stipulate that “items 14 and 15 pertain to U.S. investors only,” a couple of questions come to mind. Is such an exclusion actually allowed under SEC rules? How would US persons be specifically excluded from marketing while promoting an offering such as an online digital token sale? This question seems particularly relevant since the KVT token sale was almost certainly promoted with websites, social media, YouTube videos, and podcasts.

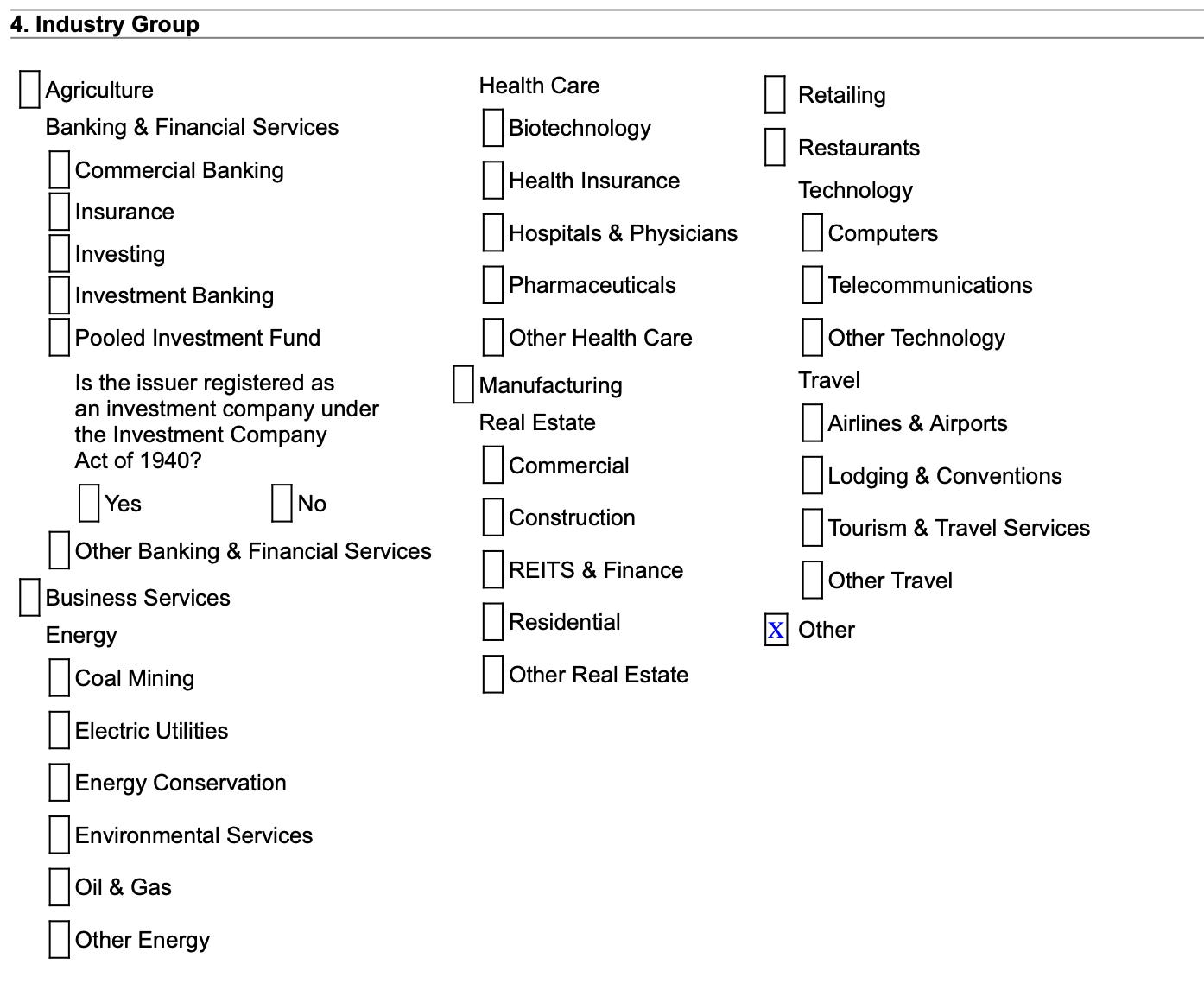

The industry group selected was “Other.” In their white paper, Kinesis bills themselves as a “monetary system” and a “kinetically charged asset backed yield bearing monetary system of shared economic wealth for a successful and sustainable future.” Doesn’t a “kinetically charged asset backed yield bearing monetary system” fall under any of the provided categories, such as “Investing,” “Other Banking & Financial Services,” or “REITS & Finance?”

Moving forward, let’s examine the investment proposition that is the Kinesis Velocity Token, or KVT itself. The entire 53 page white paper as well as the website provide further details, but in short, the sales pitch was a 20% share of “all transaction fees from the Kinesis cryptocurrency suite,” “20% of all commissions received from the Kinesis Commercial Centre (KCC),” “the exclusive right to participate in the Kinesis currency Initial Minting Offer (IMO) preferential rates,” and a buy-back program that promised to dedicate "a minimum of 5% of total transaction fees” to be “increased to 20% of transaction fees if the token price goes 5% below the listing price.”

This short video also provides the “elevator pitch” which explains how investors may expect to receive up to $8,541 for each $1,000 KVT they hold.

The white paper further indicates that investors can expect all yields, including KVT, to “come online” in 2021.

For those who were unconvinced by this scintillating investment offer, Kinesis also provided a handy KVT yield calculator, which allowed potential investors to analyze projected yields by inputting different economic assumptions. They also provided convenient low, moderate, and high presets.

Even dragging all the sliders all the way to the minimums projected a payback period of less than 42 months on a $1,000 investment. Could KVT tokens provide investors with the illusive financial independence so many seek? With a projected annual return of nearly 130% on the original investment by the fifth year in the most pessimistic scenario, it certainly looks like it could!

If investors were unable to purchase KVT during the token sale, investors could also receive one KVT token for each $100,000 of cumulative mints of KAU and KAG. Investors were allowed “multiple mints” to reach the required cumulative sum of $100,000 and could use a combination of KAG and KAU. Does this sound similar to a hypothetical promotion by Binance to reward users with BNB if they were to reach $100,000 in purchases of a target token or tokens? Allowing “multiple mints” means users could mint, then sell, then mint again to reach the $100,000 threshold. Some Reddit users referred to this as “mint cycling,” and the practice was allowed, if not encouraged. This seems like a questionable practice designed to offload unsold KVT while at the same time generating additional volumes and fees for the Kinesis Exchange.

How well has KVT performed to date, readers may be wondering. Let’s refer back to some of the data provided in an earlier article. According to Kinesis, by late December 2022, total revenues generated by the Kinesis Monetary System were $23.46 million. This equates to $4.692 million in revenue designated for KVT holders, or $15.64 per token holder. Astute readers may recall that the first KAU and KAG token transactions took place in March 2019, and the token sale concluded on August 30, 2019 with “token activation,” whatever that means.

Sadly, KVT holders have enjoyed a yield of just 1.56% for the first 40 months following the token sale. That’s a bit disappointing, especially coming from a company that spends a lot of time talking about currency debasement and inflation.

To generate even these anemic returns for KVT holders, unusual trading volumes and fluctuations in the supply of KAU were necessary. This unusual activity, perhaps explained in full or in part by “mint cycling,” took place during a period when no audits were performed.

The yield on KVT is now declining rather than increasing. The Kinesis Monetary System had only generated about $2.8 million in fees for 2022 by late December, with a paltry $560,000 for KVT holders, or just $1.87 per KVT. This is a 2022 annual yield of 0.187%.

Unfortunately, this disappointing story doesn’t end here. Three years ago, Kinesis announced it was “temporarily suspending the trade of KVT tokens on the Kinesis Exchange.” Popular market data site, Coin Market Cap, doesn’t seem to provide KVT data at all. Another site, Coinranking, lists the token, but shows no trading activity at all. Whether or not Kinesis used any of their share of fee revenue to buy back KVT as detailed in the white paper is unclear.

One of many glaring questions remain: If KVT is a security, what legal and regulator framework do KAU and KAG fall under? They also pay variable yields based on total revenues generated by the Kinesis Monetary System. Legal experts, this is your cue to chime in in the comment section.

Up next: Analyzing the Kinesis Monetary System’s “decentralised blockchain.”

Off topic and obvious trolling.

If you or anyone else has serious information about another company you think is up to no good, feel free to DM it on Twitter.

If you want to troll you have to use a different username than your administrator username on https://forum.kinesis.money, "Derek".