Kinesis Money, Incomplete Audits and Little Transparency

A $130+ million gold and silver token project with a lot of red flags

After carefully examining PAX Gold $PAXG and Tether Gold $XAUT one thing is immediately apparent, Kinesis and their $KAU gold and $KAG silver token are fundamentally different from PAX Gold and Tether Gold. A key difference is that rather than launching an ERC-20 token on the Ethereum blockchain, Kinesis created their own blockchain by forking Stellar.

A critical piece of the transparency around a token is the ability to easily audit the token’s supply, it’s movements on the blockchain (transactions), the number of holders of the token and how much they hold as well as mints (issuance) and burns (redemptions). The ability to independently verify this data via the cryptographic proofs provided by the blockchain is the primary pillar the concept of “trustlessness” rests upon but with Kinesis, users do not have easy access to this information.

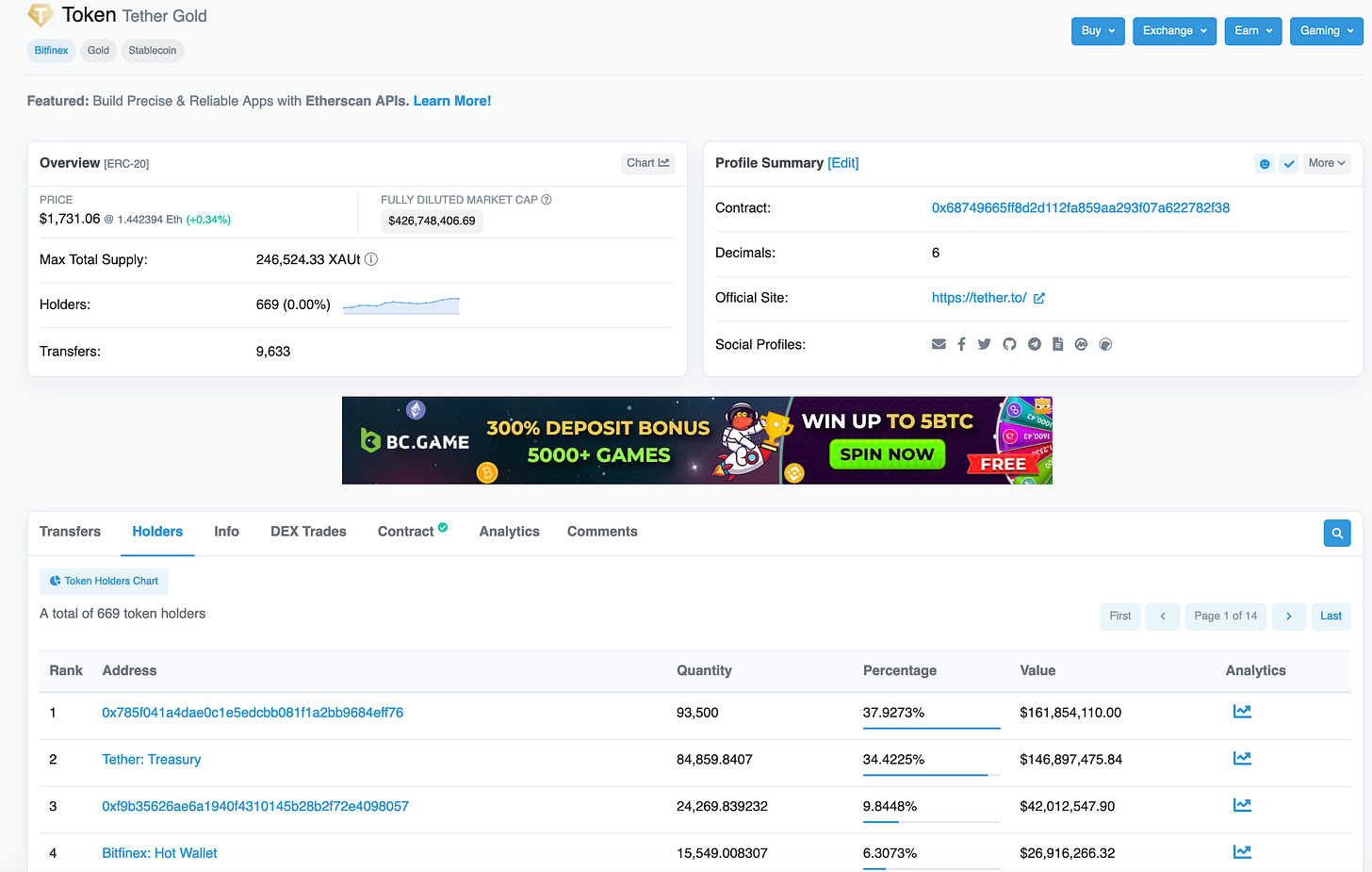

On the other hand, for ERC-20 tokens, auditing this data is easy with Etherscan or any other block explorer. More advanced users can always query the blockchain directly or even run their own node to confirm and validate the data.

Consider Tether Gold $XAUT as an example. It is easy to see how many unique addresses hold the token, how many tokens each address holds and how many tokens exist in total at any given time.

The entire transaction history is also provided (“Transfers”) and can be downloaded in csv format in batches of 5,000. For tokens with lots of transactions Etherscan and other block explorers provide APIs as an alternative to the option of simply running an Ethereum node and querying it directly.

With this data the total number of tokens in circulation as of any date can be easily determined as well as the number of addresses holding the token and how many tokens each address holds. It also provides the total “on chain” volume which is the amount of tokens transferred from one address to another over a certain time frame.

None of this data is provided by the Kinesis Chain Explorer. Kinesis only provides the most recent transactions and the ability to search for a specific address or transaction if already known. The key statistics about how many tokens are circulating, how many unique addresses hold tokens and how many tokens are held by each address are missing. Perhaps a skilled developer may be able to extract this information. To date, it doesn’t seem as though anyone has undertaken this task, including the auditors.

Although both PAX Gold and Tether Gold provide limited attestations and transparency data, neither ignores the obvious fact that the number of tokens circulating is a key detail required to determine whether or not an asset backed token is actually fully backed.

The number of $XAUT tokens matches the number of fine troy ounces Tether’s transparency report claims they hold and the number of tokens shown by Etherscan matches the figure on report.

Although the circulation of $PAXG has gone down since their last report dated October 31, 2022, on October 31, 2022 the supply of $PAXG tokens was 301,512.599. This number matches the number of tokens issued and the amount of gold held referenced in the report.

The documents provided by PAX Gold and Tether Gold are not audits. Kinesis attempts to paint itself as more transparent than others by claiming “biannual indepent third-party audits” in multiple places on their website.

The biannual audit claim is both false and extremely misleading. Kinesis has not performed biannual audits. The Kinesis Dashboard shows the first $KAU and $KAG tokens were already in circulation by April 2019 but only three audits have been provided to date:

March 11, 2020

October 16, 2020

June 20, 2022

Furthermore, the the Kinesis Chain Explorer does not provide any “live record” of “all KAU and KAG in circulation” or “all Kinesis currencies in existence” and the auditors from Bureau Veritas make no references to tokens, blockchains, explorers, smart contracts or addresses. It also claimed that “the auditors” will “assess whether or not the quality of the storage facility was satisfactory” but as you will see below, for more than 35% of the gold and more than 15% of the silver neither the metals nor the storage facilities were inspected by the auditor.

The audits provided by Kinesis are not financial audits, they only inspect and attest to the quantity and quality of the physical metals held by Kinesis. The first page of the latest report makes reference to the supply of tokens in circulation but it isn’t part of the audit, it’s a letter from the CEO of Kinesis Money dated almost two months after the audit.

In the case of $PAXG and $XAUT the attesting authority does make specific reference to the token supply, but even if they did not, it is easy to independently verify this data on the blockchain as described above.

The June 2022 audit is also incomplete. Pages three through sixty are indeed physical metal audits provided by Bureau Veritas but the last two pages are something else. Page 61 is a letter from “hititVal Cargo Transport Co.Ltd.” claiming to hold 412.3224 kg of gold on behalf of “Kinesis Cayman”. The market value of this gold is almost $24 million USD and represents more than a third of their total gold holdings.

Page 62 is a letter from “INTLHRM” claiming to hold 340,760.655 troy ounces of silver worth almost $8 million USD and representing almost 15% of their total silver holdings.

Both of these letters seem to indicate that the gold and silver is stored in Istanbul, however according to an archive of Kinesis’ website at the time of the audit, no assets were stored in Istanbul. Specifically:

”Secure and fully insured vault storage

All bullion is securely held within fully insured vaults.

All precious metal held by Kinesis is fully allocated. Kinesis gold (KAU) and silver (KAG) are based 1:1 on physical gold and silver bullion, stored within fully insured, secure vaulting facilities in Sydney, Brisbane, Singapore, Hong Kong, London, Zurich, New York, Dubai, and Liechtenstein.”

Istanbul was not added to the website until weeks after the audit date.

Setting aside the question of why only a portion of the gold and silver was audited, another obvious question is, “What good is an audit of the physical metal without an audit of the token supply?”

There are other key reasons that it is critical to audit the $KAG and $KAU on chain data, particularly because Kinesis pays a yield to token holders and the yield is based on the volume of token trades, transfers, mints and redeems. Collection of these fees is what generates the yield that is paid to token holders. Without a proper audit of the blockchain data, it is impossible to tell whether this yield is created out of thin air, through legitimate transaction activity, through wash transactions or some combination of the three.

Kinesis can only be traded, minted and redeemed on a centralized exchange (CEX) maintained and operated by Kinesis. Within the exchange is a dashboard that indicates total fees generated to date which they call “The Master Fee Pool.” The dashboard also provides a chart with the total claimed circulation of $KAG and $KAU. This is not the same as verifying the supply on the blockchain, this is an unsubstantiated claim on a fully centralized website under full control of Kinesis themselves. The various fees charged are detailed on their website, 0.95% for “Virtual Card Transactions”, 0.45% for on chain transfers, 0.45% to mint or redeem, and 0.22% to trade on the Kinesis CEX. To generate $23.46 million in fees would require $5.2 billion in mints, redemptions and on chain transfers or $10.6 billion in trades on the Kinesis Exchange or some combination of the two. The high 0.95% fee from “Virtual Card Transactions” could not have contributed a significant amount to the fee pool because it was only introduced in the second half of 2022 while the second half of 2022 generated only about 5% of total fees to date.

A simple audit of the blockchain data would clarify what proportion of the fees were generated by minting, redemption and on chain transfers. The remainder of the fees could only be attributed to CEX transactions. A full audit of this data would be enlightening but given the relatively low circulation of $KAU and $KAG, the amount of fees generated already seem highly suspect.

The fact that these tokens are issued on their own blockchain, have little to no adoption outside of the CEX owned and operated by their issuer begs the question “Who is transacting in these tokens at such high volumes with such high transaction fees ranging between 0.22% - 0.45% and why?” The vast majority of tokens and cryptocurrencies have transaction fees, but they are fixed based on supply and demand for block space at the time of sending rather than a percentage of the value transacted. Using Bitcoin as an example, sending $1 million or $1 of bitcoin would have roughly the same fee which is currently about $0.30 USD, compare this with $4,500 USD to send $1 million of $KAG and $KAU.

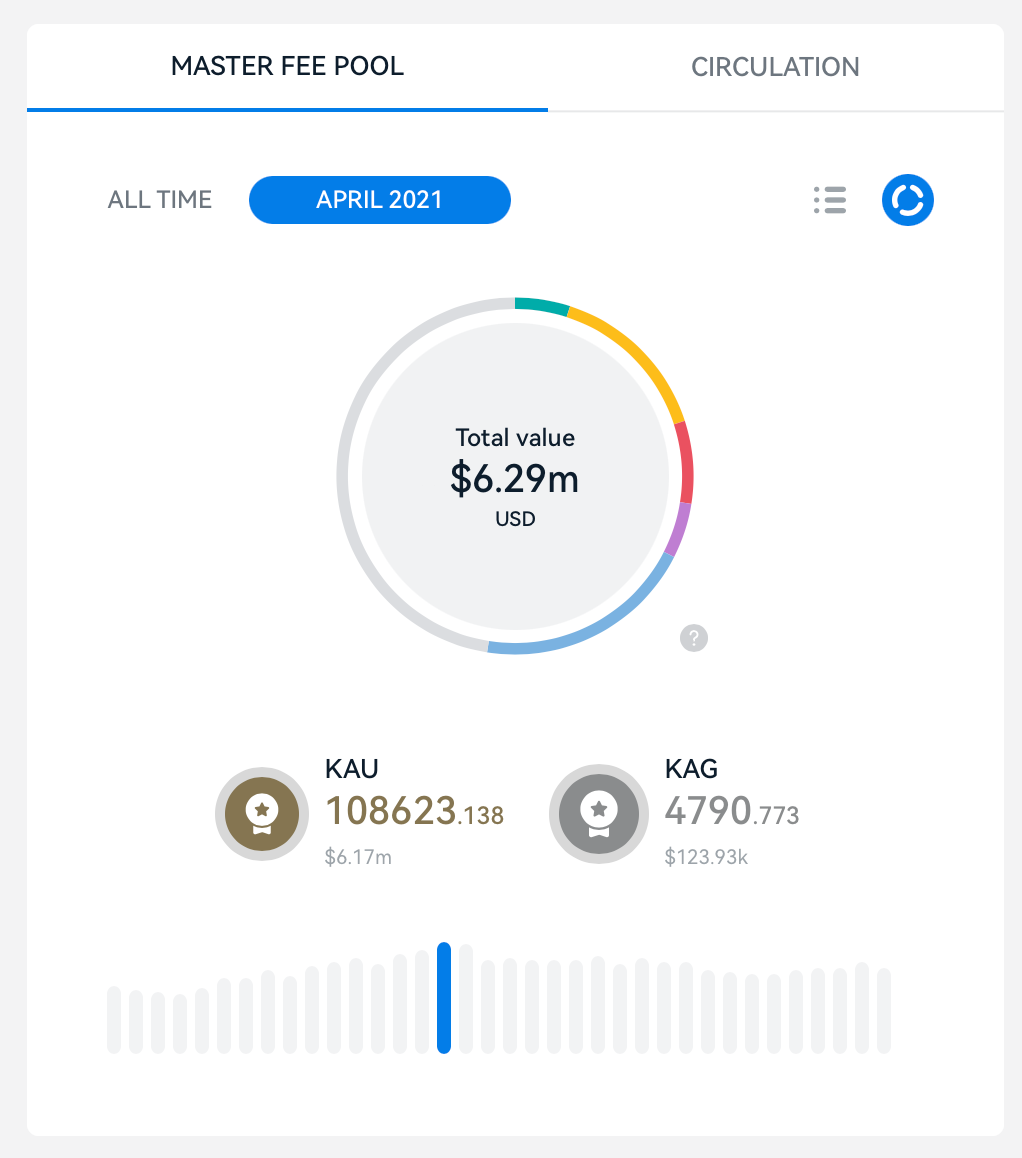

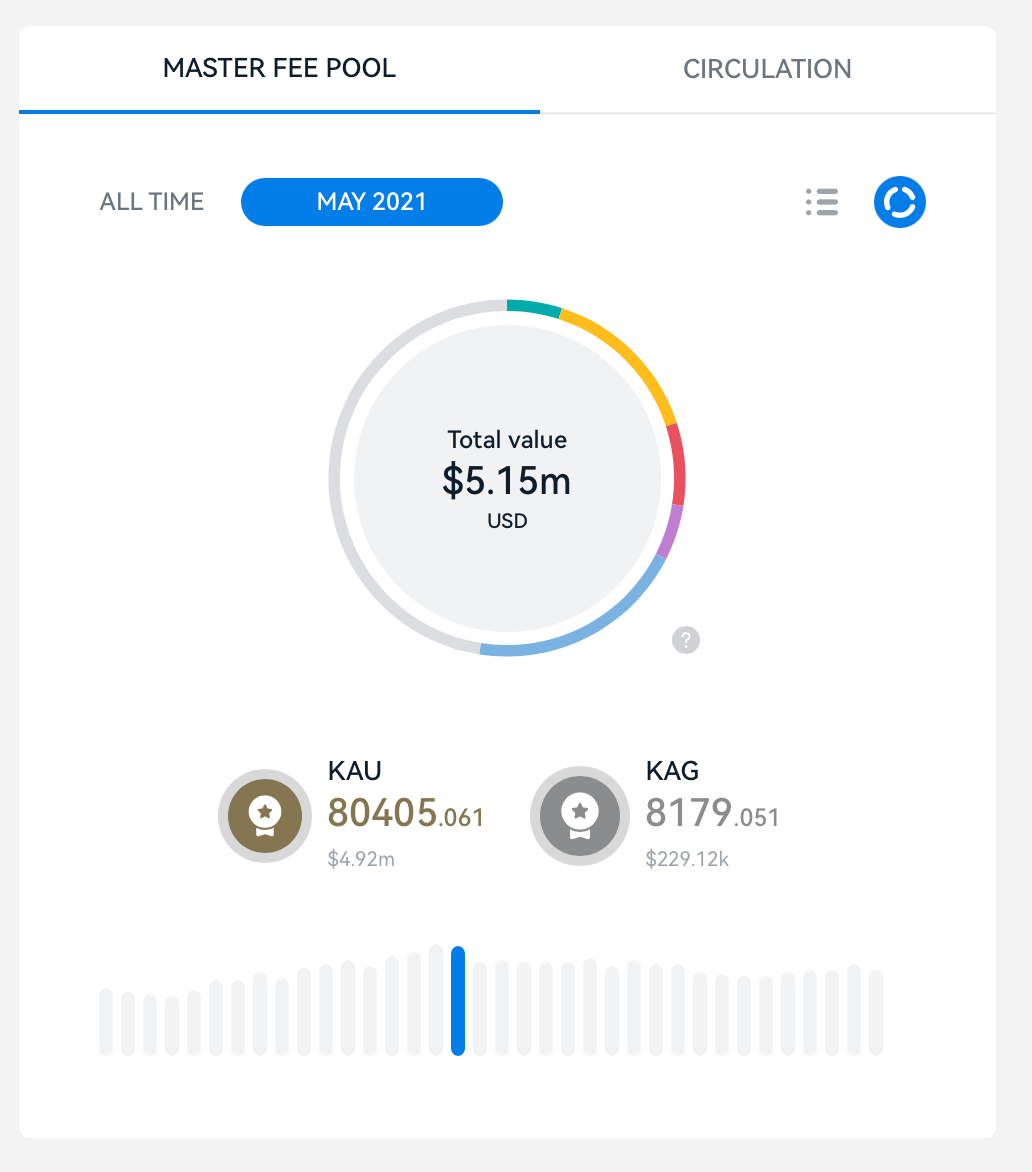

The Kinesis Dashboard provides circulation as well as fees generated in total and by month. Although this data is not audited, nor can it be confirmed on the blockchain, if it is assumed to be correct, some interesting analysis can be presented regarding claimed $KAU and $KAG activity and fees.

When examining the fee data for January 2020 - December 2022 four months are immediately apparent as extreme statistical outliers:

Feb 2021 $1.10 million

March 2021 $2.12 million

April 2021 $6.29 million

May 2021 $5.15 million

Two months, April and May 2021, generated $11.4 million which is 48% of the $23.46 million in total fees generated over the course of 35.5 months. Four months, February, March, April and May 2021 generated $14.7 million which is 62.5% of the total fees generated. Only one other month, $960,000 in November 2021, exceeds $650,000 in fees.

Average fees generated Jan 2021 - Dec 2022 is $909,000, but if we remove these four statistical outlier months, average monthly fees generated are only $357,000. If we also remove the $960,000 for November 2021 the average drops to just $250,000. This means that in April 2021, 17.5 times more fees were generated than the average for June 2021 - December 2022.

Looking more closely at the details shows that $KAU generated 98% ($6.17 million) of April 2021 fees with a circulation of only $27 million. From those figures some truly eye-popping statistics can be deduced. To generate these fees at the 0.22% fee level would require $2.8 billion in trading volume or a monthly velocity 104 (the average number of times each token is traded). At the 0.45% fee level, it would require $1.4 billion of mints, redemptions and on chain transfers or a monthly velocity of 52.

To put these figures in perspective, coinmarketcap.com reports $USDT’s April 2021 total volume at $3.998 trillion with an average supply of $46.5 billion giving it a velocity of 86. Tether is listed on hundreds of exchanges, many known for tremendous amounts of fake volume and wash trading. It seems highly implausible that a token with only $27 million in circulation, operating on a proprietary blockchain that is only traded on a single CEX operated by its issuer has a velocity that is nearly equal to or even greater than Tether. Who would be trading, transferring, minting or redeeming this token so frequently at a high cost of between 0.22%-0.45% per transaction? The fees generated in April 2021 represent almost one quarter of $KAU’s entire claimed circulation at the time.

This simply does not make sense. However, due to the “Kinesis Yield System” (the MLM style fee generation and distribution scheme devised by Kinesis) there is certainly an incentive to create fake volume, especially since “Kinesis & Partners” keep about 47% of the fees for themselves ($10.97 million of the $23.46 million total).

Another fact to consider is the huge spike in volatility of the supply of the $KAU token between October 29 2020 and June 20, 2022. Even more interesting is that all of this activity takes place during a time when no audits were conducted. The abnormal activity starts on October 29 just thirteen days after the second audit on October 16, 2020 and ends abruptly on the same day as the latest (and last) audit on June 20, 2020. That’s quite a coincidence. It was also during this time period that 91.8% of total fees to date were generated.

It also seems odd that despite a similar market caps ($70 million $KAU vs $69 million $KAG) $KAU is responsible for 92.7% of all fees generated to date. Why does $KAU appear to have so much more activity than $KAG if they are both approximately equal in market cap? If $KAG has little use, who keeps minting more of it and why? Why don’t market forces result in more $KAU and less $KAG since the ROI on $KAU is more than an order of magnitude higher than that of $KAG?

The fees and claimed circulating supply of $KAU and $KAG may be just the tip of the iceberg. Kinesis not only allows customers to convert their own physical gold and silver to $KAU and $KAG but also to purchase $KAU and $KAG with fiat currencies (USD, EUR, GBP, AUD, CAG, SGD, CHF, AED), Bitcoin ($BTC), Ethereum ($ETH), Tether ($USDT), Bitcoin Cash ($BCH), Litecoin ($LTC), Dash ($DASH), Ripple ($XRP), Stellar ($XLM), Xfin ($XDC) and Circle USDC ($USDC).

Without a full financial audit, there is no way to determine how much gold, silver, fiat and crypto has flowed into and out of the Kinesis CEX, nor can it be known how many $KAU and $KAG have been sold or are currently in circulation. Only a financial audit plus an audit of the Kinesis blockchain could determine if $KAU and $KAG are fully backed and if their volumes and fee generation are legitimate. Neither is available.

The incomplete audit provided by Kinesis also raises questions as to the exact corporate structure of Kinesis Money. Page one and two of the June 2022 audit appear to indicate that an Australian company (Allocated Bullion Exchange or ABX), holds gold and silver on behalf of a Cayman Islands company (Kinesis Cayman) that is stored in multiple different vaults around the world on behalf of ABX. Both page one and two of the audit use the language “attributed to” rather than “owned by”.

This raises several more important questions:

Does “attributed to” mean the same thing as “owned by” in a legal sense in the relevant jurisdictions where Kinesis operates? If not, what entity actually owns the gold and silver?

Does the corporate structure adopted by Kinesis Money actually provide ownership rights over the gold and silver stored by ABX on behalf of Kinesis Cayman to $KAU and $KAG tokenholders?

What assurances are there that the gold and silver covered by the audit aren’t used for anything other than the sole purpose of backing $KAU and $KAG, such as pledged as collateral for a loan?

Does a Cayman Islands entity provide an end run around regulations similar to the way FTX used the Bahamas to avoid regulations?

Overall, Kinesis provides far less transparency than Tether, Paxos, Circle and most other stable coin issuers. On paper, it appears small compared to its peers, but due to its complete and total lack of transparency over most aspects of its business, it is unclear how much gold, silver, crypto and fiat currencies are flowing into or out of their systems. Kinesis is a black box with only the thinnest veil of blockchain transparency covering it. This transparency immediately collapses upon even the most casual investigation of available information.

The analysis above is based upon fee and circulation data from the Kinesis Dashboard, screen shots of the complete data are available here.

https://www.reddit.com/r/Wallstreetsilver/comments/wo3dvs/kinesis_monetary_system_due_diligence_based_upon/