Recap of the Wall Street Silver Twitter Space Discussion on Kinesis and Allocated Bullion Exchange (ABX)

Tom Bodrovics of Palisades Gold Radio and Bob Coleman of Idaho Armored Vaults hosted a Twitter Space to discuss Wall Street Silver and a bit about Kinesis and Allocated Bullion Exchange (ABX)

The first 2 hours and 43 minutes of the space were dedicated to Wall Street Silver and the outstanding investigative reporting by Jon Little of The Pickaxe and The Happy Hawaiian as well as commentary from many others. For those that missed this story, listen to the space, check out the articles at The Pickaxe1 and read through the lengthy thread below. TL;DR: Jim Lewis is actually James Morrison, a convicted criminal. He used Wall Street Silver as a vehicle to enrich himself while scamming almost everyone else involved.

2:43:00: Bob Coleman opens the topic of due diligence for precious metals dealers and storage facilities.

2:44:25: The conversation turns to Kinesis. We’ll go over the highlights below.

2:45:00: Apparently Tom Coughling of Kinesis was supposed to join the space but did not. Bob raises questions about the $53,000 “donation” from Kinesis to Wall Street Silver. Bob suggests that recipients of sponsorships and those that promote products and services with referral links should be doing proper due diligence.

2:46:30: Jim Forsythe responds and states that his non-profit, Citizens for Sound Money, has done extensive due diligence on Kinesis.

2:47:15: Jim suggests that Bob’s company, Idaho Armored Vaults, has a similar user agreement to that of Kinessis. Bob refutes this claim at 2:49:15.

2:47:26: Jim: “We do not get paid by Kinesis.”

Everyone that uses Kinesis gets yields from Kinesis, that’s how it works. Many, including Jim Forsythe have promoted Kinesis with referral links. If new users sign up with referral links, the referrer receives compensation in the form of additional yields. Jim Forsythe has a Kinesis referral link pinned to the top of his Twitter profile that includes a sales pitch for Kinesis’ KVT security token.

2:49:45: Bob highlights what he sees as serious problems with Kinesis’ limitation of liability in their user agreement.

2:50:17: Bob mentions Allocated Bullion Exchange’s financial statements and their negative net assets of more than $10 million. Jim interrupts Bob (2:50:44), apparently confusing ABX’s financial statements with the incomplete June, 2022, bullion audit released by Kinesis.

2:50:45: Jim: “Wait wait. What you just said is not true. They didn’t have any negative $10 million dollars. They had an attestation letter for one of the vaults because, in Turkey, they found out last minute that the government regulations wouldn’t let people into that vault.”

Let’s check the receipts. It looks like two letters not one letter. The letters cover 340,760.655 ounces of silver (13.7% of the total) and 412.3224 kilograms of gold (37.3% of the total). The letter covering the gold looks like a letter from a “cargo and transport” company, not a vault. Either way, we find it alarming that Kinesis was able to move more than a third of the gold and more than a tenth of the silver to a vault that doesn’t allow audits. And furthermore, that they just found this out last minute? Who is doing due diligence for Kinesis on where they store gold and silver? Can anyone find anything on Kinesis’ website that mentions moving gold and silver to vaults where audits aren’t allowed? All we can find are multiple claims about full, biannual, independent third-party audits of all storage facilities.

2:51:43: Jim: “We demanded something be put in place so it doesn’t happen again [an incomplete audit], and we are eagerly awaiting the next audit.”

A biannual audit would have been due on December 23, 2022, at the latest.

2:52:20: Bob redirects the conversation back to ABX’s financial statements and emphasizes the significance of the Disclaimer of Opinion for both 2020 and 2021. Bob suggests that this is a material fact that should have been disclosed by anyone promoting Kinesis.

2:53:19: Bob points out that the Kinesis user agreement contains a clause stating “the user has complete knowledge and understanding of the software code”. Bob: “That’s a pretty bold statement to agree to!”

We agree, especially since it seems like even Kinesis doesn’t know how it works. They are confused about whether tokens can be burned or not on Stellar-based blockchains. It also took them nearly four years, until late January 2023, to publish an article on how their blockchain works.

Thomas Coughlin: “if they do that, that redemption burns the KAU or KAG”

2:53:50: Jim says “[Crypto Informer] hasn’t done any due diligence on any other system”.

What about this due diligence? Or this, or this?

2:53:55: Jim: “In fact, when people ask him about other systems, he blocks them.”

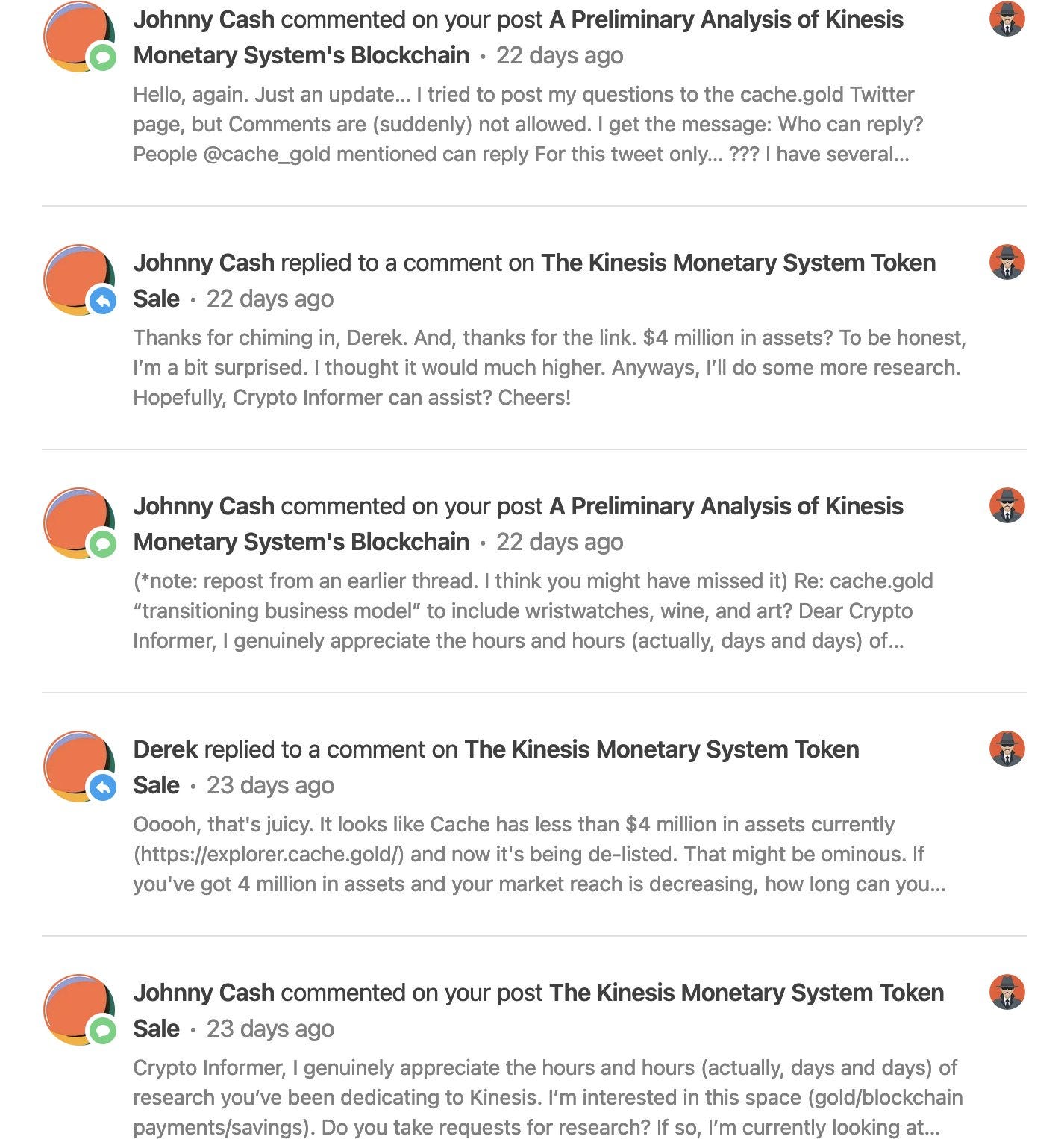

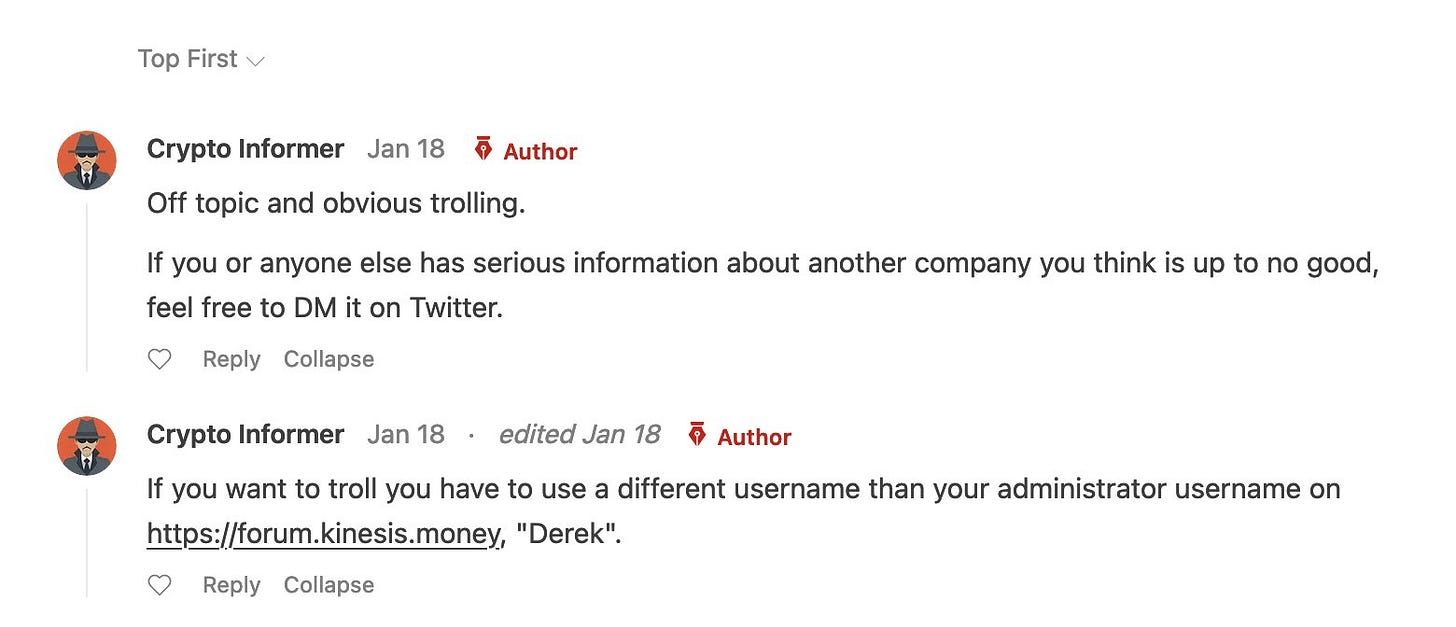

We’re glad Jim brought this up because we saved receipts. Yes, we block some people for spamming or posting repeated comments that lack any substance. In this case, Kinesis’ own employees repeatedly spammed a similar message in a short period of time that appeared to have little or no substance.

What was their point? That this company is going out of business? That it’s very small? What wrong doing were they alleging? It wasn’t clear. They were asked for clarification, but they never replied. Twitter Direct Message and the comment section is still open for everyone who can refrain from spamming.

Derek is one of the Kinesis forum administrators who keeps posting false information about Kinesis’ audits. An honest analysis of Kinesis’ audits indicates that they are nothing like what Derek claims (see the section after the ABX financial statements).

2:59:34: Jim is unhappy about the existence of this Twitter Space. Jim is also unhappy because he has to waste so much time defending Kinesis.

It’s not clear why, Tom Coughlin has been advocating for a public “debate” for some time now. Why is it Jim’s job, rather than Kinesis’ job to defend Kinesis? This isn’t clear either.

3:00:00 Jim: “Some fair points from the article were it’s confusing how to calculate circulation, so we worked with Kinesis to figure out how to do that, and we have published that.”

Yes, they did, three days after we published it on January 22, 2023.

We fully acknowledged that it is possible to calculate the figures Kinesis wants considered as the ciruclation. It’s actually not complicated or confusing at all. It is difficult to get the blockchain data needed to make the calculation. Calculating the circulation simply requires ignoring the balance of several addresses. Why didn’t they publish this earlier? It also means that even if their circulation calculation is correct, their blockchain explorer is still providing incorrect information.

Four years into their project is awfully late in the game to just be figuring out how to calculate the circulation of the tokens and to be creating a working block explorer. It is really a remarkable claim that tens of thousands of people have invested over $100 million into Kinesis without ever wanting to check the token circulation. Some kind of sound money that is!

3:00:27: Jim exits the space.

3:03:24: Bob opines that it’s a little unorthodox for Europeans to deposit money to a Cayman Islands cryptocurrency exchange by way of Indonesia.

3:08:02: Bob discusses digital gold generally and the potentially fatal flaw of a platform that requires constant trading volumes to succeed.

3:07:20: Liberty Lyss brings attention to Thomas Coughlin and Kinesis’ supporters’ insistence that we must be doxxed in order to get answers to our questions.

We thank Liberty Lyss for her support.

3:09:53: James Andersen warns against using any type of precious metals storage program where customers would be unsecured creditors in the event of bankruptcy. He also suggests that it can be risky to store precious metals with the same company that sells them.

3:12:00: Bob discusses how negative market conditions can result in legitimate businesses becoming Ponzi schemes. Bob also reiterates the need to go through user agreements with a fine-tooth comb.

Things Are Getting Worse for WallStreetSilver. Is Jim Lewis the Silver Version of Sam Bankman-Fried?, Is Jim Lewis Really James "Jim" Morrison? We want you to Decide for Yourself, Are Gold Celebrities Flooding WSS with Cease and Desist Letters?, Jim Lewis of Wall Street Silver. First Extortion, Next Stop Child Abuse. Is last step Jail or Worse?, Tonight 6pm EST, Twitter spaces moderated by Palisades Gold Radio's Tom Bodrovics

3:00:15 or there abouts, Jim F checks with his wife who tells him, just when he might have to answer serious questions, to get the fuck off the computer.

I heard that show. The feeling I get from listening to guys like Bob Coleman is that they are just trying a liiiiittle too hard to be convincing. Understanding that this show is about a scandal that originated at Wallstreetsilver and its mods, it is hard to see why they should use this as an occasion to go after one of its sponsors. - Just my opinion or a hunch you could say, there is something foul here. - And if they were really so concerned, why not clear it up and take Jim F & the sponsor guys up on the offer for an open debate. That is the way honorable business men would clear it up. But this... feels shady, sorry.