Nexo was founded in 2017 by the same people behind Credissimo, a Bulgarian payday lender also now active in Poland, Macedonia, Malta, Spain, and believe it or not, Columbia!

The founders of Credissimo and Nexo have interesting backgrounds and strong ties to the government. Atoni Trenchev, one of Nexo’s founders, was actually elected to the National Assembly of the Republic of Bulgaria, where he served until 2017, the year Nexo was founded. Some of the background on Nexo’s founders was carefully documented by @Otterooo on Twitter in June 2022.

The details of Nexo’s business model look nearly identical to those of failed crypto lender Celsius. Dirty Bubble Media does an excellent job of explaining exactly how the “fly wheel scheme” works in his article “Mashinsky’s Flywheel.”

Let’s go through the similarities between Celsius and Nexo one by one.

Similarity 1: Nexo is a centralized crypto lender that pays very high interest rates on cryptocurrencies, especially their own $NEXO token, for which they offer lenders 12% interest.

Similarity 2: As mentioned above, just like Celsius and their $CEL token, Nexo issues their own $NEXO token.

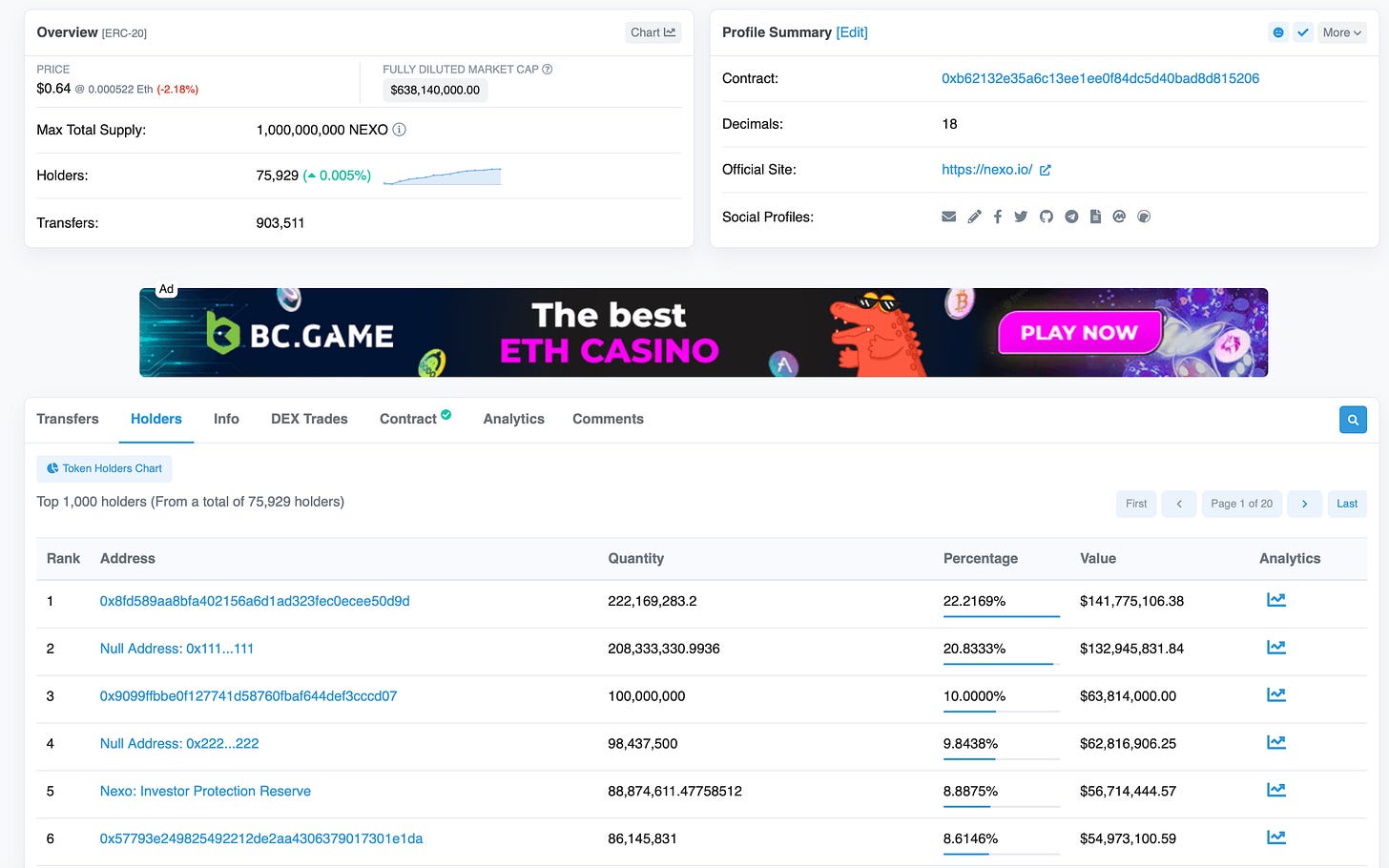

Similarity 3: Control of the $NEXO token is heavily centralized. The top five addresses control 71.8% of the total supply while the top ten addresses control more than 92% of the total. This leaves just 7.9% controlled by the other 75,919 token holders, one of which is the “Nexo Corporate Treasury,” which holds another 0.3% of the total supply.

Similarity 4: High market cap relative to trading volumes and market value of actively traded tokens. This is a recipe for easy manipulation of the token price, as demonstrated not just by ‘$CEL but also by FTX and their $FTT token. $NEXO’s current market cap is almost $652 million, but has had only $2.8 million in trading volume (just 0.4% of the total supply) over the past 24 hours, with no single pair’s trading volume even breaking the $1 million mark.

Similarity 5: Questionable corporate structures. Read the excellent research by @intel_jakal and @energi for some of the details.

Similarity 6: Nexo holds a lot of their own $NEXO token on their balance sheet. A court document indicated that they held 95.9% of the total supply as of July 31, 2022.

Red Flags

Red Flag 1: Nexo uses the same audit firm, Armanino LLP, as FTX US used.

Red Flag 2: Nexo blocks archives of their home page.

Red Flag 3: Like FTX, Nexo tried to acquire another crypto lender.

Red Flag 4: Credissimo wants to make sure everyone knows that Credissimo has nothing to do with Nexo.

Red Flag 5: Bulgaria has often been regarded as the most corrupt country in the European Union. Since all of Nexo’s founders are Bulgarian and have strong ties to the Bulgarian government, this fact seems worthy of note.

Red Flag 6: Nexo cofounder Antoni Trenchev repeatedly misrepresents Armanino’s “real-time attestations” as “audits” and “real-time audits”. Attestations are not the same thing as audits.

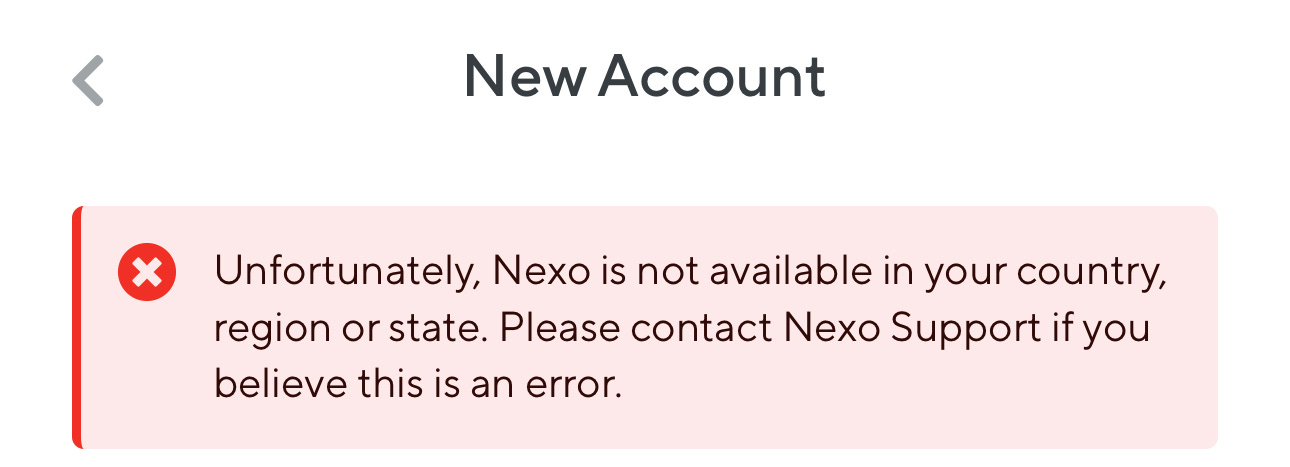

Red Flag 7: Nexo exited the US market after eight US regulators charged them with failure to register their Earn Interest product. Nexo is also unvailable to users in Bulgaria and Estonia.

Will Nexo be the next domino to fall in the world of centralized crypto lending? Only time will tell.

Read more about Nexo: