Kinesis Money Due Diligence and Libel

Rob Kientz of Gold Silver Pros accused us of libel, we want to set the record straight

This misunderstanding began when we asked Kientz a series of questions about Kinesis, his previous recommendations for Kinesis, and his promotion of their platform via a referral link. Specifically, we wanted to know if he had changed his opinion on Kinesis since he published an overwhelmingly positive review of Kinesis to his YouTube channel on July 3, 2021.

A lot has changed since then, and much additional information is now available, but we think there were still many red flags that he missed even back in July 2021.

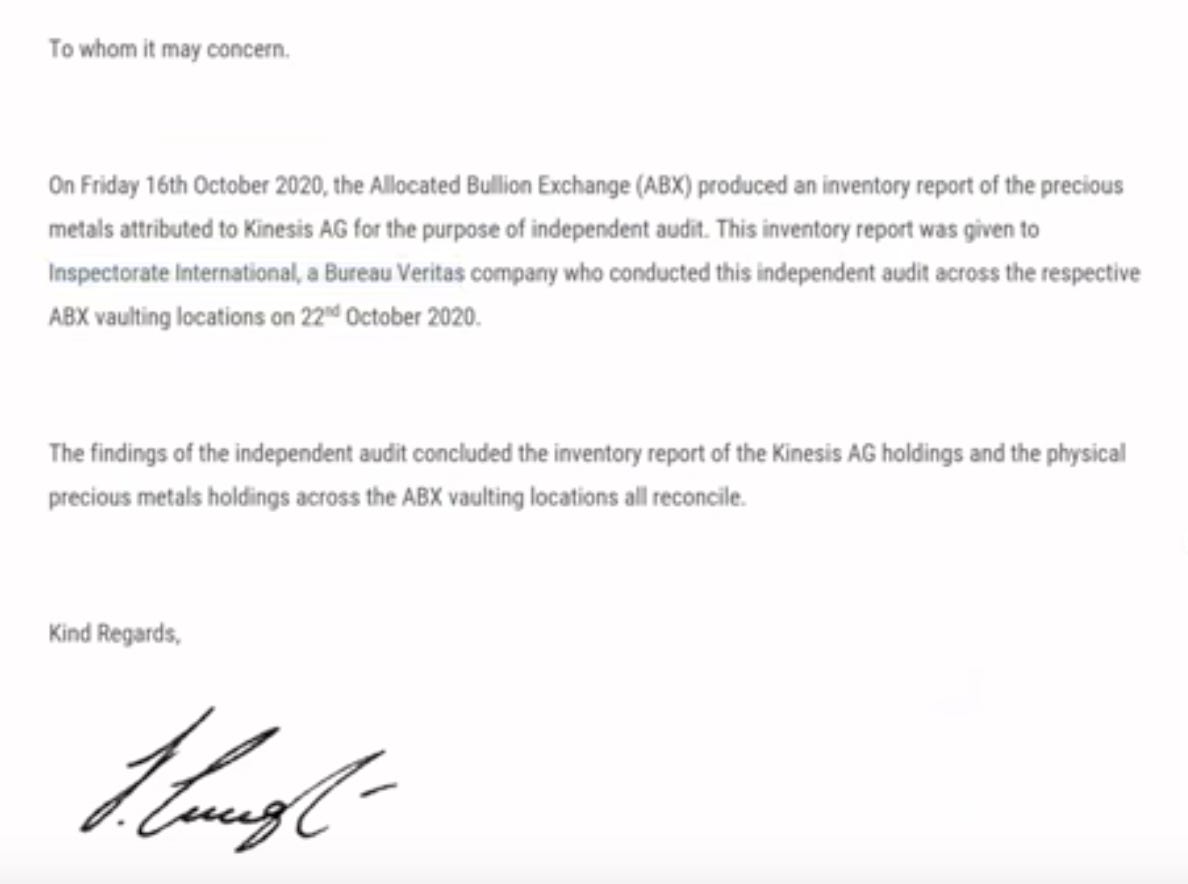

01:48: “I’ll show the audit report tht they had on the website from last November. They do two of these [audits] a year, there’ a little bit of a travel delay due to Covid but the next one is coming out very soon.”

Actually, the audit he’s referring to was completed on October 22, 2020. This means that as of the recording date of this video, the next “biannual audit,” which should have been completed by April 22, 2021, was already more than two months overdue.

It turns out that another audit would not be conducted until June 21, 2022, and would not be released to the public until August 12, 2022. This means that “very soon” turned out to be more than one year later, and the total gap between audits would be more than 20 months instead of the claimed six months. Furthermore, this audit failed to inspect 37.3% of the gold and 13.7% of the silver allegedly backing Kinesis KAU and KAG tokens.

Of course, Kientz probably didn’t know at the time of recording that no audit would be provided for more than a year, but this didn’t stop him from interviewing Kinesis CEO Thomas Coughlin on his channel on December 22, 2022, and allowing him to repeat the false claim that Kinesis conducts biannual audits and would now switch to quarterly audits going forward without any comment on it. Ironically, Kinesis’ next “biannual audit,” should they have actually completed it, would have been due to be completed by the date of this very interview.

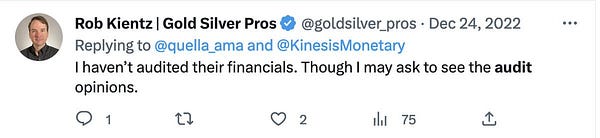

At the time, Kientz was still promoting Kinesis via a referral link on his Twitter profile, which he did not remove until early February 2023. He now claims to have “no existing commercial relationship with Kinesis.”

Of course, it’s possible Kientz didn’t notice any of these issues, but given the positive review above, the claims of extensive due diligence, and his previous job as an auditor himself, it seems hard to believe he didn’t notice incomplete and late audits, for a company he was promoting and recommending.

Let’s continue with the video.

04:11: “People know I have a 25-year history in technology and a master’s in information assurance, which is a cyber security degree.”

Kientz wants you to know he is not only an auditor, but a technology expert.

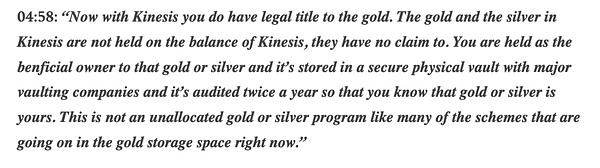

04:58: “Now with Kinesis you do have legal title to the gold. The gold and the silver in Kinesis are not held on the balance of Kinesis, they have no claim to. You are held as the benficial owner to that gold or silver and it’s stored in a secure physical vault with major vaulting companies and it’s audited twice a year so that you know that gold or silver is yours. This is not an unallocated gold or silver program like many of the schemes that are going on in the gold storage space right now.”

How does he know what’s on Kinesis’ balance sheet? Has he seen it? Has anyone else seen it? Is it public? We’d like to see a copy.

As of July 3, 2021, it was incorrect to say that the gold and silver were audited twice per year, and it’s still incorrect to say that. The first on chain transactions were in March 2019. As of February 12, 2023, there appear to be only two complete audits of all the gold and silver allegedly backing KAU and KAG, and both were completed in 2020.

09:01: “The cool thing about Kinesis is they take about 20% of the fees generated from the trading on the network and they give out to Kinesis holders, Kinesis recruiters such as myself which has an affiliate or the minters which are the ones that create the new Kinesis.”

This statement clearly establishes that Kientz was promoting Kinesis for profit at the time this video was recorded.

13:36: “It [Kinesis] was born out of ABX. ABX the Allocated Bullion Exchange was formed first and it was formed for the purpose of digitizing the gold trade and then on top of ABX was built a Kinesis platform. So ABX was the first digitized international gold trade network and then Kinesis rides on top of that. Kinesis was built purposefully not specifcially as a token first, it was built to allow digital trackable trade to allocated gold on the ABX. Once the ABX was established and all those relationships built within the gold and silver industry, then Kinesis was built on top.”

It sounds like ABX is really important to Kinesis. It almost sounds like Kinesis can’t function without ABX. Wouldn’t that make it fair game to question the financial stability of ABX? We thought so. Kientz however, accused us of libel and then blocked us shortly after we asked him for comment on ABX’s financial statements. ABX’s 2020 financial statements were publicly available at the time this video was recorded, although a $44 fee was required to download them from the ASIC.

15:53: “The trade volume has absolutely exploded.”

15:59: “You’re actually seeing facilitation of trade on the Kinesis network, and it’s going basically exponentnail. This looks like a hockey stick chart, a positive hockey stick chart.”

16:29: “There is an incentive to use it [Kinesis KAU and KAG] as an actual currency or an exchange and that’s what’s happening and you can see it clearly in their data.”

We think that was mostly “mint cycling,” not usage as a currency. Did Kientz continue to follow Kinesis’ trade volumes and did he ever update his opinion on any of this? We aren’t sure. The collapse in volume on the Kinesis network was just as spectacular as its rise, and the collapse was already well under way at the time this video was published.

16:57: “Now I wanted to talk about the audit, they do have an audit twice a year.”

That’s false. It is still false today, and it was false on July 3, 2021, when this video was published. It was also false on December 22, 2022, when Kientz interviewed Thomas Coughlin, and Coughlin repeated this false claim.

17:02: “I have been told the next audit is due out any moment. They’re actually perfomring those procedures now and I’ve talked to management several times on that. There were some delays due to travel restrictions remaining from Covid but they’re working through that and we’ll have the next audit.”

If that’s true, it sounds like Kinesis management lied to Kientz about the audits. What other explanation could there be for failing to conduct the next audit until almost one year later (June 21, 2022) and failing to release it until more than six weeks after that (August 12, 2022). Isn’t this cause for concern? Wouldn’t this be a reason to update this flawless review and recommendation for Kinesis? Shouldn’t an unbiased interviewer with a background in auditing have at least questioned the CEO when he made more obviously false claims about audits in December 2022?

17:15: “But I wanted to go over the November audit, the very first one, it was very successful.”

It’s actually the October 22, 2020, audit, and it was the second audit, not the first audit. It has been referred to as “the November audit” because Kinesis waited 34 days to release it to the public.

17:19: “I’m actually going to go over the audit report, I’m a former auditor, for those of you who may not have watched my channel before. So I’ve done this type of audit work, inventory counts and things like that, physical inspections, actually did this for many years. I’m just going to walk you through what they have.”

This means viewers can benefit from his expert opinion, right?

17:33: “This is very key to understand that what Kinesis is publishing on their audit report, they’re publishing not only their own statement but they’re [Kinesis] also publishing the auditor’s statement as well including the actual samples that they took to audit the actual metal and the confirmation that the gold and silver being held actually met the amount on the blockchain at a specific period of time. With other audits that you see in the gold and silver storage space you do not get this level of detail. I rarely, if ever, see this level of detail.”

This is totally false; the audit reports do not comment on the token circulation or the blockchain. The first two pages of the audit reports are letters from Kinesis and ABX signed by Thomas Coughlin; those are not audits.

18:47: “I didn’t have a business relationship with Kinesis at the time that they did this aduit.”

Did Kientz have a business relationship with Kinesis at the time this video was recorded or at some other time (besides promoting them with a referral link)?

19:07: “They did a comparison of the KAU and KAG and the independent audit confirmed that Kinesis currencies in circulation were as follows (verifiable on the Kinesis blockchain).”

False, the auditors made no comment on tokens or blockchains.

If Kientz is an experienced auditor, why didn’t he pick up and comment on this important distinction? And why didn’t he notice and comment on the fact that the token circulation figures provided by Kinesis are from a different date than the audit? Even one day can make a big difference (see below), but this document shows token circulation on October 16 and the audit date as October 22. What could be the reason for that, since the blockchain updates every few seconds.

Aren’t these the types of issues someone with years of audit and technology experience should easily indentify?

How could the auditors confirm the metals on October 16th if they performed the audit on October 22nd? Are they implying that there were no mint or redeem transactions between October 16 and October 22, so it didn’t matter? Wasn’t this worth commenting on?

Since we have downloaded an analyzed the blockchain data for both the KAU and KAG blockchains, we can tell you there were hundreds of transactions between October 16 and October 22, 2020, some of which appear to be mint transactions.

The next page of the report also references a October 16, 2020, inventory report but an October 22, 2022 audit date. How does that work?

21:16: “Issued to ABX, commodities gold and silver, at Loomis at a certain location, they blacked that out because they don’t want you to know where the location is for security reasons.”

”Issued to ABX”; doesn’t this make the financial stability of ABX extremely relevant? It looks like it’s ABX and not Kinesis that is storing all the KAU and KAG gold and silver.

Hiding the vault’s street address is one thing, but what about the city and the country? Don’t investors want to know how the gold and silver are distributed around the world, and don’t they have a right to know? Claiming security reasons here doesn’t make any sense. In some audits, they even hid the name of the vault. Why? “They don’t want you to know.”

25:43: “Kinesis is fully audited.”

At the time this video was published, one could argue all the gold and silver backing Kinesis were audited in October 2020 (more than 8 months earlier), but Kinesis had no public financial audits. No full audit of the gold and silver allegedly backing KAU and KAG has been made available since November 2020.

25:54: Speaking again about growing volumes: “Proving therefore that it’s actually being used not only as a store of value but as an actual exchangable currency, as an exchange of value.”

Not really; it looks like it was mostly just “mint cycling,” and even Kinesis’ CEO seems to acknowledge that in a Kinesis forum post.

27:58: “The cool thing about Kinesis is you get the benefits of both and they actually do what they say they do, they have independent third parties and you can see people using it so it’s built a community. And I think it’s kind of the best of the both worlds, it’s allowing you the token to use as an exchange and it’s allowing you to have vault metal storage that’s dependable and reliable so you don’t have to store it in your house. So it’s kind of the best of both worlds and they’re very transparent and forthright and answer questions and would satisfy you know a former auditor like me. So that will wrap it up for the Kinesis review.”

We are somewhat surprised a former auditor would not be interested in looking at ABX’s financial statements as part of this analysis, nor any financial statements for any of the Kinesis’ entities. It also seems like an auditor might want to see some kind of audit, proof of reserve, or other transparency data for Kinesis’ centralized exchange where they take custody of users fiat and cryptocurrencies in order to make a judgement call on Kinesis. Perhaps we just have higher standards than most auditors?

In an interview with Wall Street Silver, Kientz provided additional details about his technical background and qualifications.

19:53: “My background is technlogy, I had 25 years in tech, three degrees in the space, have an IT degree. I actually created my own IT degree at the associate level because I wanted to go into technology and they didn’t have the degree I wanted so I went to the dean of the department and said ‘Can I create my own degree?’, she said ‘Sure.’ So I took Unix administration and Cisco networking. So I was in IT for a long time doing server administration and networking. Then I moved into business and technology. Then I did a masters in cyber. So three degrees in the space. 25 years experience, worked for big companies, big fours as a consultant and all that stuff. So I understand crypto probably at a level a lot of people don’t because when I read the whitepaper, I can actually understand this at a technology level.”

That is an impressive background in technology, auditing and consulting. This is what led us to wonder aloud why Kientz didn’t find any of the same red flags we did with Kinesis’ blockchain or block explorer.

21:26: “The guy that follows this best [blockchain technology], his name is Kirian Van Hest, he goes by DesoGames on Twitter. He is the guru that’s just written three books, I’m reading through his books now before he publishes them, on the cryptos. Brilliant guy.”

Kienntz has referred to our research both as “rumors” and as “evidence” that “isn’t good enough yet.”

Kientz is certainly entitled to his opinion. We believe we have published a significant quantity of “hard data.”

Here’s what @DesoGames said after reading some of our research.

Does Kientz really have no “existing commercial relationship” with Kinesis?

Аccording to the last quarterly update from Kinesis, published in mid January 2023, they had an active partnership with “GoldSilver Pros.”

It also appears that Kientz is involved with Silverback Precious Metals, a reseller of Kinesis bars, and Citizens for Sound Money, a major promoter of Kinesis.

To summarize, our intent was to critique the accuracy and credibility of Kientz’s review of and recommendation for Kinesis. Our intent was not to attack his character, attack him personally, or defame him. We feel there were obvious red flags with Kinesis that any professional auditor should have found easily, long before today. We also feel there were red flags with the blockchain and block explorer that any competent blockchain expert should have found easily, long before today. We don’t think this is libelous, and it’s our opinion.

Our comments on Kientz’s December 2022 interview with Thomas Coughlin are linked below.

Please let us know what you think on Twitter.