The Kinesis Monetary System Mint Cycle Scheme

Today we explore "mint cycling" and its impact on the revenues and sustainability of the Kinesis Monetary System

Disclaimer: Crypto Informer makes no guarantees, expressed or implied, that the data, the analysis, or the conclusions reached below are complete or accurate. We made our best attempt to accurately interpret all available data. We encourage those involved with Kinesis to reach out to us on Twitter if any of our analysis is demonstrably incorrect. The KAG data analyzed covers March 11, 2019 through December 30, 2022. The KAU data covers March 12, 2019 through January 5, 2023. In this article, we focus on KAU because it represents the majority of the on chain volume and generates over 90% of on chain fees. Unless otherwise noted, we are referencing KAU data. Please refer to the end of the article for links to our sources and methods.

Data is a wonderful thing. With just one data set, many different analyses are possible and new conclusions can be reached over time. As we continue to learn more about how the Kinesis Monetary System works, we continue to refine and define our thesis that explains what really makes the Kinesis world go round.

We learned several important things over the past few days. First, it is possible to calculate a figure for circulation that matches what Kinesis claims. The calculation is quite simple. Why were we able to make the calculation public before Kinesis? Their blockchains are nearly four years old.

We also learned that it’s not possible to track and reconcile fees and yields on chain. Rather than reiterate the whole explanation here, readers can simply read Kinesis’ own long and convoluted explanation why token holders can’t track all the fees and yields on chain.

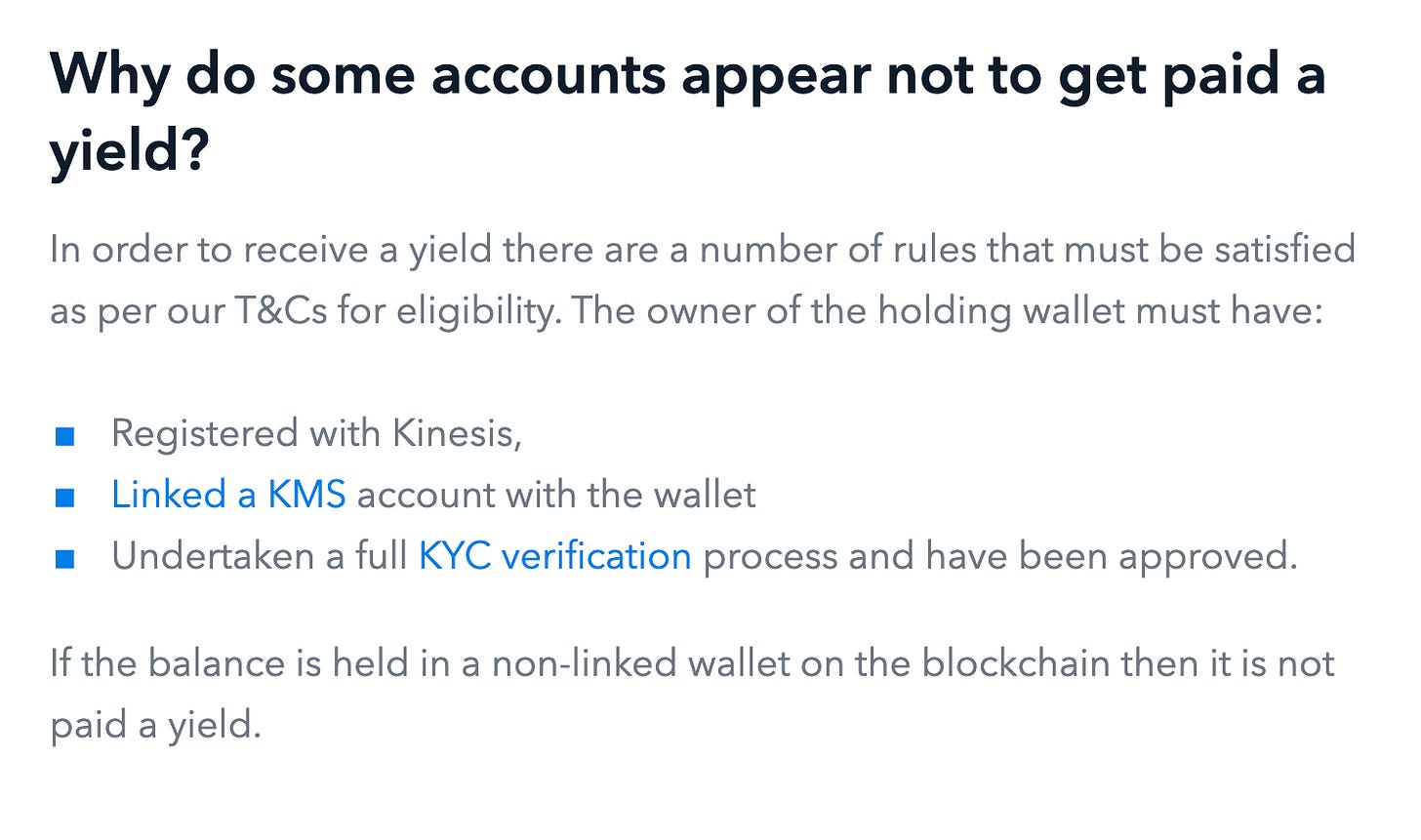

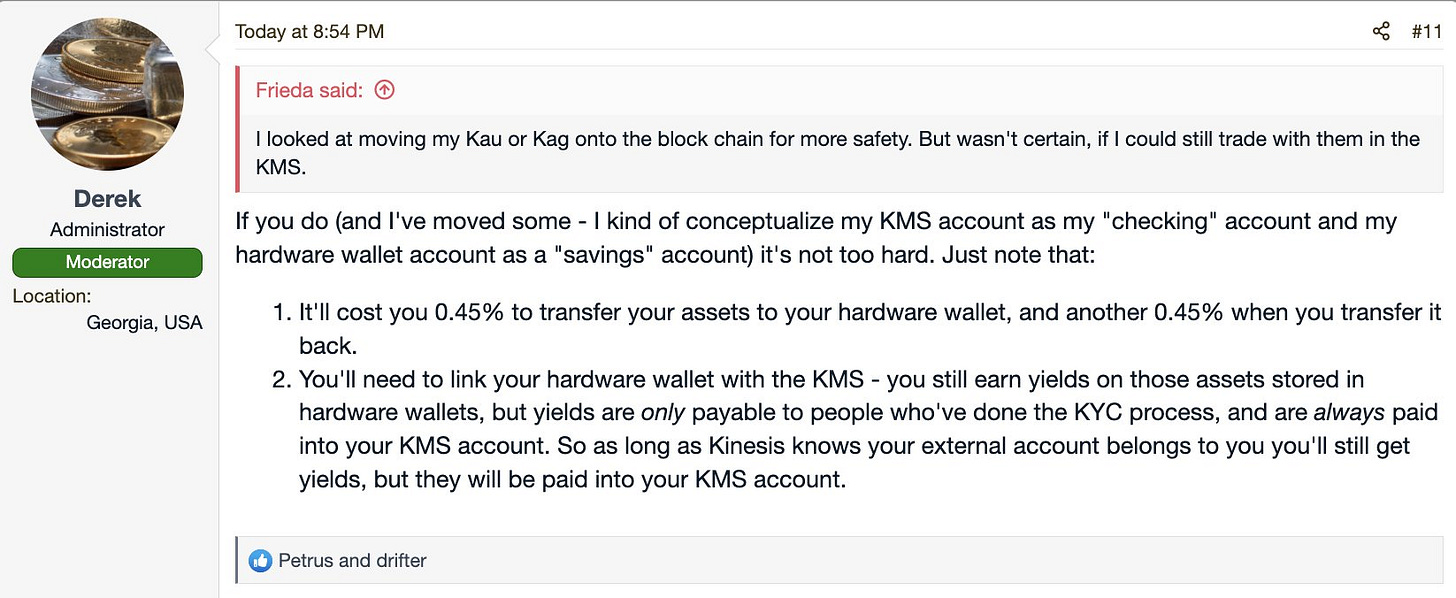

Furthermore, KAG and KAU holders cannot receive yields for balances held on chain unless they register for an account with KMS, Kinesis’ centralized exchange platform, and go through a KYC process.

Apparently, what they actually meant to write is that no accounts get paid yields on chain. The whole yield system is completely centralized within the KMS centralized exchange.

After all the hot air about decentralized, high performance, Stellar-based decentralized blockchains, the whole fee and yield system is completely centralized.

If token holders want to receive yields, they need a full KYC account on the centralized exchange platform. Not only that, but token holders must receive all their yields on the centralized exchange, not on chain.

Aside from the centralization issues, the yields themselves are the life blood of the system. Yields are the reason investors bought KVT security tokens. Yields are supposedly the reason KAU and KAG are superior to alternative asset backed tokens. Yields are the Kinesis Monetary System’s claim to fame.

But where do they come from? They come from transferring, minting and redeeming tokens on chain and from trading on Kinesis’ centralized exchange. More adoption means more fees. More volume means more fees. If the system is growing, the fees should be growing. Herein lies the problem, they aren’t.

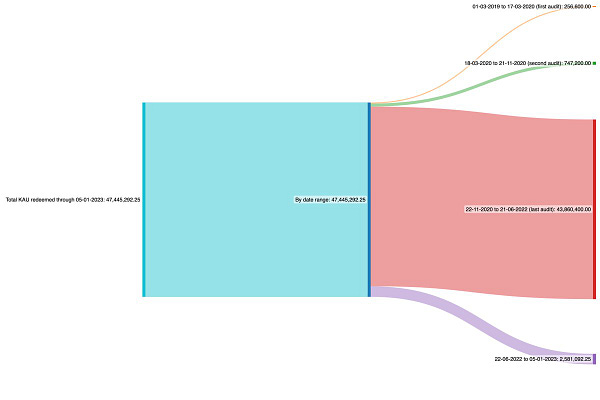

92% of KAU fees and 75% of KAG fees were generated during the months of November 2020 through May 2022. This was the same time period when no audits were undertaken. A large part of the fees generated during this time period appear to have been generated through a process called “mint cycling,” whereby investors repeatedly minted, redeemed and then minted tokens again in rapid succession in order to receive rewards paid in KVT. Readers can find a detailed description of “mint cycling” on reddit.

Whether “mint cycling” and the process of repeatedly minting, redeeming and then immediately minting tokens again is a good idea, sustainable or even legal, particularly in conjunction with security tokens paid as rewards, is beyond the scope of this article, but these are questions worth considering. What is within the scope of this article is that this activity appears to have come to a grinding halt hours before the last vault audits began on June 21, 2022.

The 14th largest redeem transaction in the history of the Kinesis Monetary System took place hours before the last vault audits began.

We don’t need to point out how coincidental the timing was on that transaction, do we?

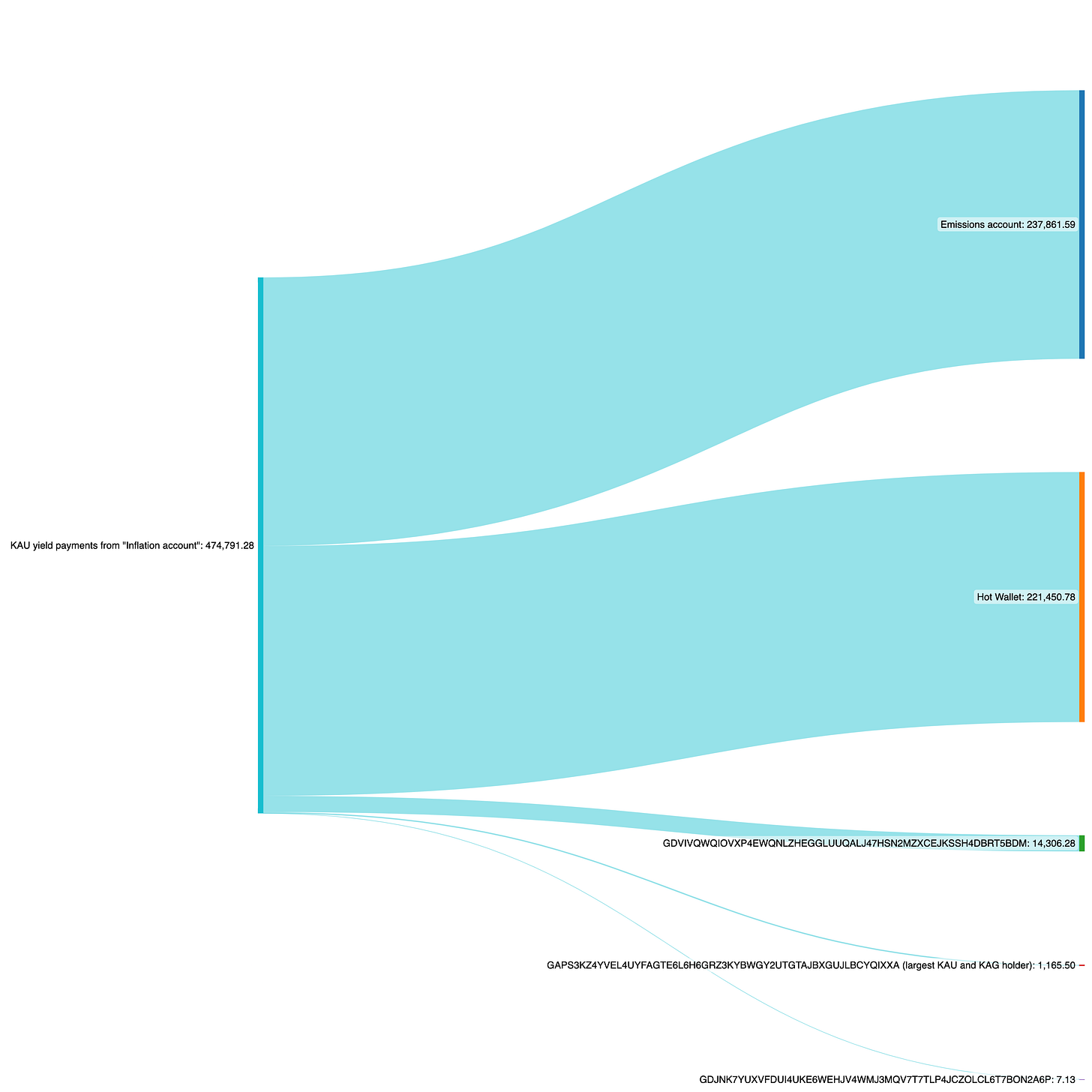

But let’s get back to “mint cycling”. The way minting and redeeming works in terms of the actual transactions we can see on the blockchain, doesn’t look exactly the way Kinesis describes it. It looks a little bit different. Kinesis describes the “Emissions account” as follows.

When a client ‘mints’ a token (adding to the coins in circulation) it is transferred to their wallet via a treasury account (the ‘Emission’ account). The Stellar blockchain does not have the capability to ‘burn’ or ‘destroy’ native tokens (when a token is redeemed for physical metal). Kinesis reduces the coins in circulation when a token is redeemed by transferring the token back to the Emission account, which takes it out of circulation.

The blockchain data looks more like the “Root account” and two “Inflation accounts” do the minting and the “Emission account” quite literally cycles tokens to generate volume and fees. The thread below provides Sankey diagrams that illustrate how this appears to work.

Kinesis claims there have been nearly 49 million KAU minted and nearly 48 million KAU redeemed. In reality, blockchain analysis seems to indicate that there have always been less than 4 million KAU in circulation that were repeatedly “mint cycled” to generate fees for the Kinesis Monetary System and to generate KVT rewards for the “mint cyclers”. This seems like a questionable practice and one that is not indicative of real adoption and real use. The problem is that without this practice, the Kinesis Monetary System’s revenue has collapsed. In just four months, February, March, April and May, 2021, $14.7 million in fees were generated. For the other 43 months Kinesis has been operating, only $8.8 million in fees were generated. In June 2022 revenue reached its lowest point, $73,500, since September 2020. This was again, coincidentally, the month of the last audit.

At the same time Kinesis has claimed that they have been aggressively expanding their operations and business. They are adding new vaults, a refinery, new partnerships and a bullion store. How can these collapsing revenues support all these new business operations?

At the same time, investors are still plagued by an inability to get a clear and concise explanation regarding the exact corporate structure of the “Kinesis Global Group” and exactly which entity is the bailee for their gold and silver.

Another issue that remains unclear are the addresses of the “Cold Wallet” and “Fee Pool account.”

Kinesis only provides the “Root account,” “Emissions account,” “Inflation account,” and “Hot Wallet account” addresses.

Regular, everyday users shouldn’t fret if they find all these accounts, their purposes and definitions confusing. The Kinesis team would like users to know that they can simply read the Stellar code and all will become clear.

In conclusion, everything about the Kinesis Monetary System appears to be highly centralized and dependent on “mint cycling” rather than legitimate adoption and usage to generate revenue. The Twitter thread below provides some Sankey diagrams that further illustrate how incredibly centralized the KAU blockchain is. The KAG blockchain is similarly centralized but with only a small fraction of the volume KAU has.

Many of the explanations published by Kinesis make it sound as though Kinesis has no idea how their own blockchains really work, are purposefully obscuring how they work or a bit both of both. It’s difficult to say what the true case is. Why it took them nearly four years to publish “Understanding the Kinesis Blockchain” article is mystery that remains unsolved.

This all seems like a clever new twist on Mashinsky’s Flywheel to us, but different enough to warrant its own name: The Mint Cycle Scheme. Mint KAU and KAG to generate fees which generate yields and KVT token rewards. A KVT token is security token that pays the holder a yield from the system. Is it not just another another monetary perpetual motion machine?

Update 3-2-2023: According to a post in the Kinesis Forum, it would appear that Kinesis CEO, Thomas Coughlin, was aware of, and personally endorsed “mint cycling.”

If anyone can help us make further sense of this data, we’d be happy to hear from you. Please find our sources and methods linked below.

Download the Kinesis blockchain history in csv format.

Download a Python script to save the full Kinesis blockchain history to a csv file.

Download Postgres SQL queries to help analyze the data.*

*Thanks to Michel de Cryptadamus @cryptadamist

I think you are over the target...I have read a few accounts regarding Kinesis holders looking to move their metals out of the accounts they set up, only to be jawboned into staying put. One of the accounts forced the issue and had the metals moved...but only after they were forced to liquidate them. I have no dog in this fight, but am unnerved by the fact you post this one articles and the shills for this group are out en masse...not just in your comments but on Twitter too...and its only been a couple days.

Wow, my timing is still perfect. Just sell any stock right when I buy it and you will do great! I fairly recently bought into Kinesis (KVT/KAU) and then just found your analysis (should have joined reddit sooner). See, my perfect timing again! I thought I had done DD but your expertise in several areas is impressive and much better than mine.

I guess I could hold on for a flyer (was not the plan and would probably reduce my holdings) but what do you think they are up to? Options I see are, trying to scam entire countries (although I see that as a less than optimal concept) or (and this is were I was caught out it seems) investing in a long scam to catch as many small fish in the net as they can before rug pull. If it is the second one then I have time as based on your analysis they have a long way to go.

Any help is appreciated, keeping it simple for me, considering all that you have found out, probably more than you have shared, bottom line, a) what do you think the Kinesis plan is and b) do you see any way to profitably participate?