A Preliminary Analysis of Kinesis Monetary System's Blockchain

Kinesis claims to operate an open source, decentralized blockchain featuring token circulation that is "verifiable on the Kinesis blockchain." This article attempts to verify that claim.

Disclaimer: Crypto Informer makes no guarantees, expressed or implied, that the data the analysis or the conclusions reached below are complete or accurate. We made our best attempt to accurately interpret all available data. We encourage those involved with Kinesis to reach out to us on Twitter if any if any of our analysis is demonstrably incorrect.

Readers that are unfamiliar with Kinesis and the Kinesis Monetary System may wish to first familiarize themselves with the company by visiting their website.

Kinesis offers three digital tokens:

Kinesis Gold (KAU)

Kinesis Silver (KAG)

This focus of this article is limited to KAG and KAU. KVT is an Ethereum ERC-20 which is easily analyzed with any Ethereum block explorer.

The Kinesis Monetary System blockchain is based on a fork of another open source blockchain project called Stellar.

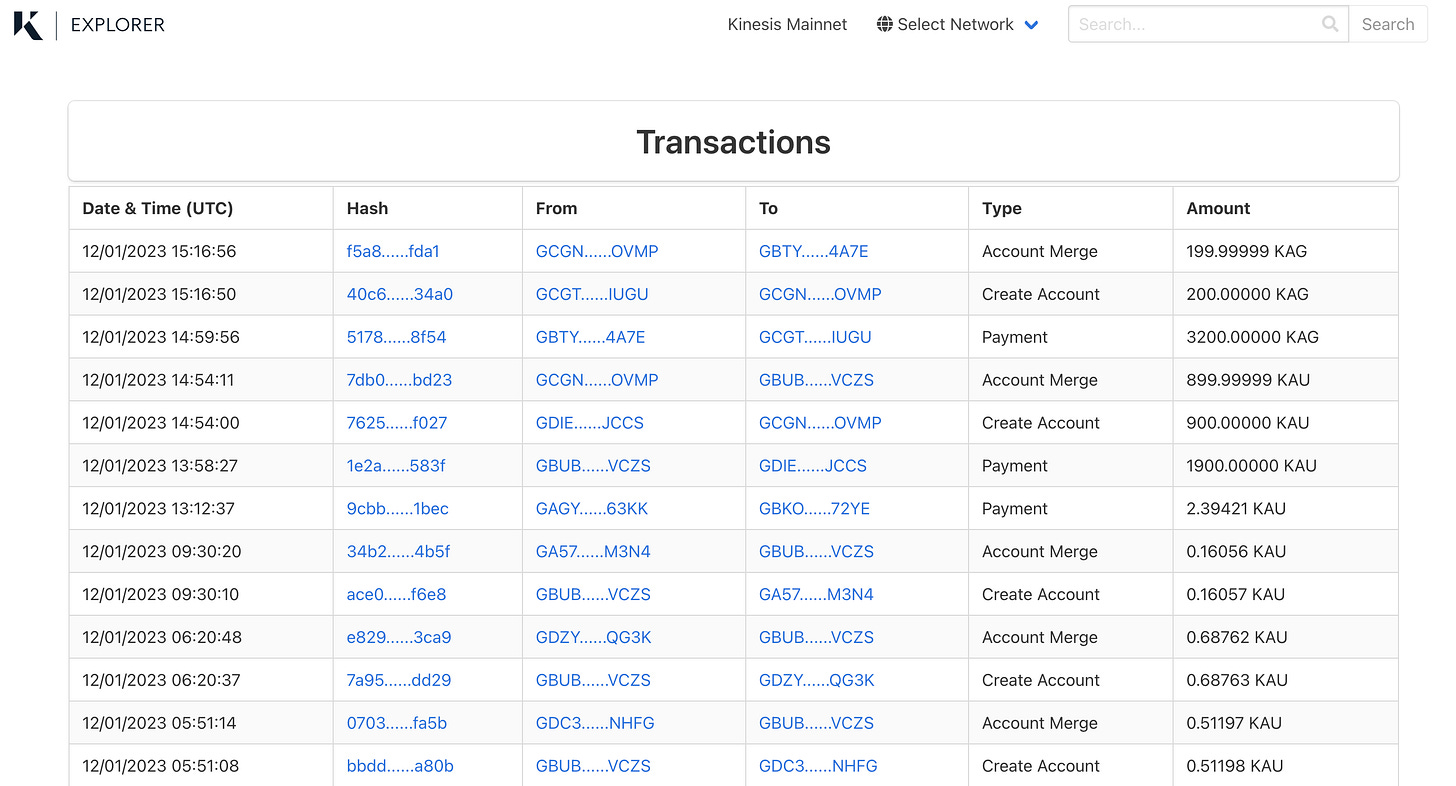

Although Kinesis claims that KAU and KAG circulation can be verified on their blockchain in their audits and on their website, no such data is available on their block explorer which they call the Kinesis Chain Explorer.

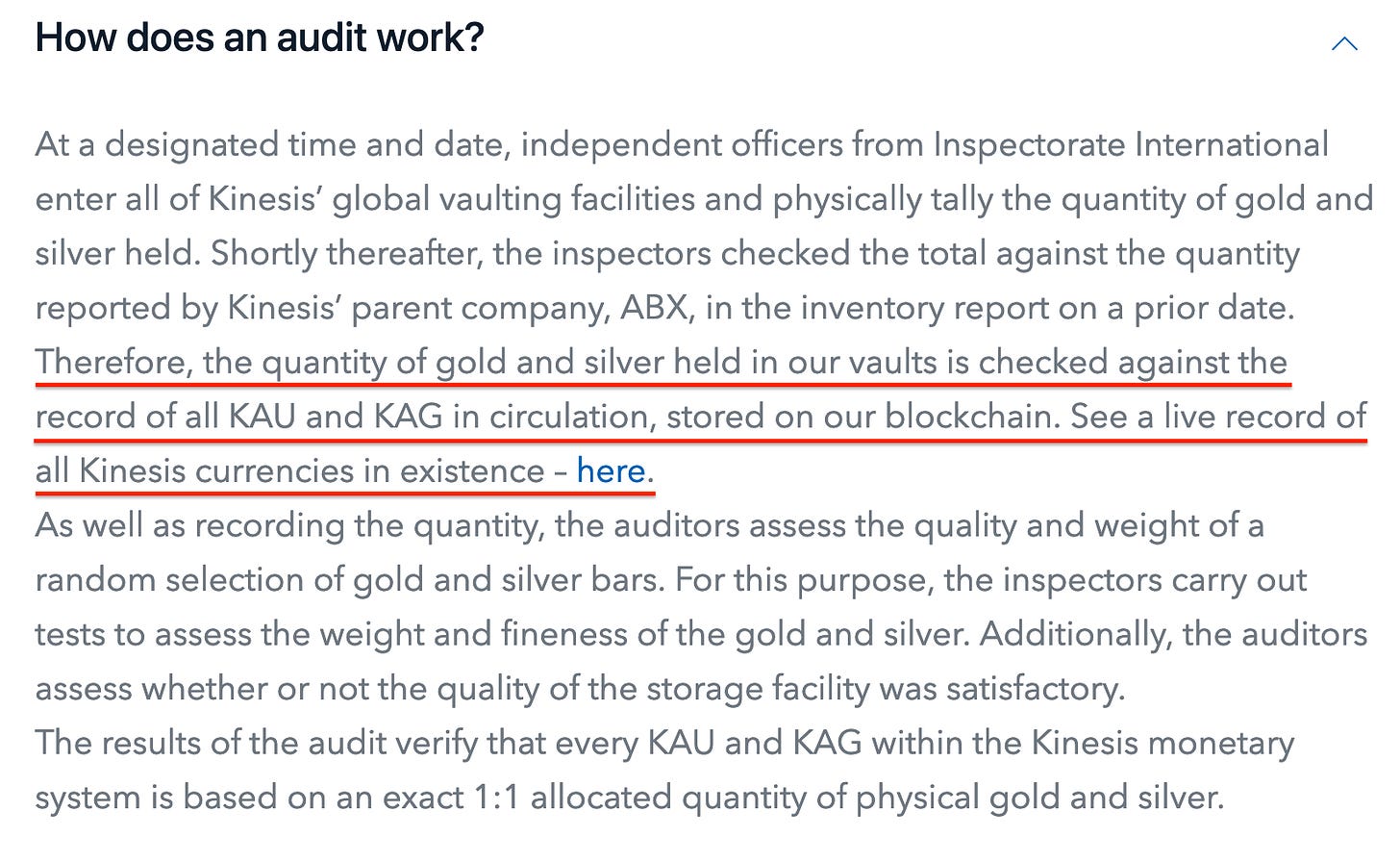

From Kinesis’ latest audit:

From Kinesis’ webiste:

How exactly can the token circulation be checked against their blockchain? An examination of the Kinesis Chain Explorer shows that it does not provide sufficient information to determine the total circulation of KAU and KAG tokens. The Kinesis Chain Explorer only allows users to view the most recent transactions, the balance of a known address or the content of a known transaction hash.

Compare this with tokens on the Ethereum blockchain using any Ethereum block explorer such as Etherscan. Even a non-technical user can easily and immediately determine the circulation of a token which Etherscan labels “Max Total Supply”. The screen shot below shows the Etherscan page for the wildly popular Tether token (USDT) stable coin.

A quick glance at this screen shot reveals key details about USDT. In the top left quadrant, we see the total number of tokens currently circulating, the total number of unique addresses holding the token and the number of on chain transfers of the token.

If a user clicks on the “Holders” tab, they will find a list of all the unique addresses that hold USDT ranked in order from largest to smallest. The top ten are provided below for illustrative purposes.

Easy public access to these types of statistics is what gives blockchain its widely lauded reputation for transparency and “trustlessness”. Although Etherscan is an independent website, there are many such block explorers and users always have the option of verifying the data between different explorers or even running their own node to keep the explorers honest.

None of this additional data is available through Kinesis’ singular block explorer. For this reason it remains a mystery exactly how the circulation of KAU and KAG can be verified.

Fortunately, Kinesis’ blockchains are similar enough to the original Stellar project that through a collaborative effort with several other curious blockchain researchers and developers, we were able to download what appears to be a complete transaction history directly from Kinesis’ KAU and KAG nodes.

A few revelations were immediately apparent:

The Kinesis Monetary System is not a single blockchain, it’s actually two. One for KAG and one for KAU.

According to the on chain data and the Kinesis Chain Explorer, there are far more KAU tokens in circulation than there should be according to Kinesis and their latest partial audit1.

They still make use of the “inflation” operation which was deprecated in 2019 with the release of Stellar Protocol 12.

On chain fees are higher than what Kinesis claims.

There are few active addresses for a project of the size Kinesis claims.

Most of the tokens are owned by few addresses.

Redeemed tokens don’t seem to be burned.

The blockchains may no longer be open source.

Two Blockchains

Instead of creating a single blockchain with two tokens, Kinesis created two blockchains, one for KAG and one for KAU. There may or may not be good technical reasons to have done this. The Kinesis Chain Explorer only makes the data appear as a single blockchain.

More KAU Gold Tokens Than Physical Gold

On the KAU blockchain, just three addresses held far more tokens than Kinesis claims are currently in circulation and more than 2.4 times the amount of gold their last audit showed.

Below is a screen shot from kms.kinesis.money on January 9, 2022 indicating the circulation of KAU is 1.22 million and KAG is 2.99 million.

This means that just three address hold over $176 million worth KAU tokens, $102 million of those aren’t even supposed exist according to Kinesis.

Inflation

Blockchain data indicates that Kinesis has used the “inflation” operation to create 90,185 KAG and 476,064 KAU. What does this mean? Stellar has not used “inflation” since 2019.

An article on the now deprecated “inflation” operation describes it as follows.

What place does a function like this have in tokens that are supposed to have 1:1 gold and silver backing? Kinesis’ documentation on how their modified Stellar blockchain actually works could perhaps be best described as “sparse.” They do not mention “inflation” at all, nor do they explain how mint and burn (or redeem) transactions work.

Fees

The blockchain data indicates that more than 470,600 KAU and more than 91,300 KAG in on chain fees have been collected. These numbers are similar to, although slightly less than the inflation on each chain. Are they directly related? Perhaps.

Kinesis promises to share all the fees generated by the Kinesis Monetary System with its users and KVT holders. Kinesis explains the fee split, which they refer to as yields, on their website. The on chain fees however, are significantly higher than what Kinesis users have been told were generated to date. The Kinesis website indicates that only 377,500 KAU and 72,000 KAG have been collected in fees as of January 9, 2023. Why are the on chain fees so much higher than they are telling users? The exact opposite should be expected, because Kinesis promises to also share off chain fees with users such as fees generated from trading volumes on their centralized exchange.

Few Active Addresses

Analysis of the blockchain data seems to indicate that both KAG and KAU have less than 5,000 addresses with on chain activity over Kinesis’ nearly four year history. Far less than that currently hold tokens. For a system that supposedly has over 70,000 active users, more than $130 million in underlying assets and billions in on chain volume, the number of token holders is far less than expected.

Centralized Ownership

The overwhelming majority of KAU and KAG tokens are held by a very small number of addresses. Three addresses on the KAU blockchain alone hold 2.4 times more tokens than Kinesis claims exist.

Burn Transactions

There doesn’t seem to be any evidence of burn transactions in the blockchain data despite the fact that the CEO claims redeemed tokens are “burned within the system.”

Open or Closed Source?

Kinesis claims they “updated” their “blockchains” in July 2022 but there are no commits to their implementation of the Stellar blockchain since February 2019. Does this mean that their blockchain is now closed source?

From the article “The Kinesis blockchain,” dated November 16, 2022:

Note that the Kinesis blockchains for KAU and KAG have been updated fairly recently. This means that they incorporate more up to date Stellar features.

KAG network upgrade 9th July 2022

KAU network upgrade 16th July 2022

More “more up to date Stellar features”, but not this one from 2019?

We encourage independent researchers and journalists to download the source data and attempt to replicate our findings as well as to uncover new information.

Download the Kinesis blockchain history in csv format.

Download a Python script to save the full Kinesis blockchain history to a csv file.

Kinesis “audits” are only audits of their gold and silver holdings at specific place and time. These audits are similar to what is known as an “attestation” and are not at all similar to a financial audit.

Where has Kinesis ever referred to themselves as a decentralized platform?