Comparing Kinesis' Claims with Kinesis' Performance

In this article we listen with a critical ear to two 2021 interviews with Kinesis CEO, Thomas Coughlin.

It’s always interesting to listen to old interviews with the benefit of hindsight. Here we will explore two interviews with Kinesis Money CEO, Thomas Coughlin from March and April 2021.

Unfortunately the YouTube video was made private, however, we are providing an archive of the audio below.

00:30 “We appreciate you guys for donating $53,000 to the Wall Street Silver community.”

Kinesis is donating money to Wall Street Silver to promote their tokens.

08:19 “We bring specialist commodity auditors, Inspectorate is their name. They inspect literally all of our vaults at precisely the exact time twice a year.”

This is completely false. Kinesis had no audits in 2019 and no audits in 2021. When they finally did an audit in June 2022 the vaults were not inspected at the same time and a significant portion of gold and silver was not inspected at all.

08:25 “It’s a monstrous effort to get all inspectors to be inspecting at exactly the same time. At the moment it’s twice a year.”

Such a monstrous effort that they did not actually do this. The audit clearly shows that gold and silver that was actually audited was not all audited on the same day. The next audit was due by mid-April 2021, but no audit was conducted until June 21, 2022.

13:40 “Whatever is listed as money supply in the blockchain it’s backed 100% by gold or silver.”

No, it isn’t. The Kinesis Chain Explorer is broken, there are at least two addresses that it shows holding unbacked tokens. The Master Fee Pool also can’t be reconciled to the blockchain.

13:56 “I think we’ve got an audit coming up in fact, not too far away.”

Coming up in just 458 days. It’s biannual, didn’t you hear?

19:06 “We’re a fully insured, secure solution.”

Is this proven?

19:13 “We’re just bringing online our own big vault based out Liechtenstein. That has arguably has the best property title laws in the world.”

Why is Kinesis Cayman the company referenced in the audits and not Kinesis AG Liechtenstein? If Liechtenstein is the best, why aren’t the majority of the assets stored there instead of Istanbul and other locations?

At the 21:00 minute mark, Coughlin bizarrely suggest that somehow Kinesis tokens do not have counterparty risk or custodians. Kinesis has at least four corporate entities that we know about: Kinesis AG (Liechtenstein), Kinesis USA, Inc. (USA), Kinesis Cayman (Cayman Islands), Allocated Bullion Exchange (ABX, Australia) and perhaps others. Some investors have suggested they cannot get a clear answer regarding the exact corporate structure of Kinesis and what entity actually owns the gold and silver.

22:51 “We’re not a crypto because we’re just using the blockchain as the registry to register title and it’s done in a decentralized way so there’s no defeating it. Really, it’s just digital title to physical metal.”

Kinesis KAU and KAG are absolutely not at all decentralized. It isn’t clear whether or not the tokens are actually “digital title.” Regardless of whether not these tokens are legally “digital title”, Kinesis is not actually “using the blockchain as the registry to register title” for most of their claimed 70,000 active users.

24:20 “That fee immediately goes to what’s called the Master Fee Pool in the blockchain. You can see the Master Fee Pool accumulate in the blockchain.”

No, you can’t, see the Twitter thread below.

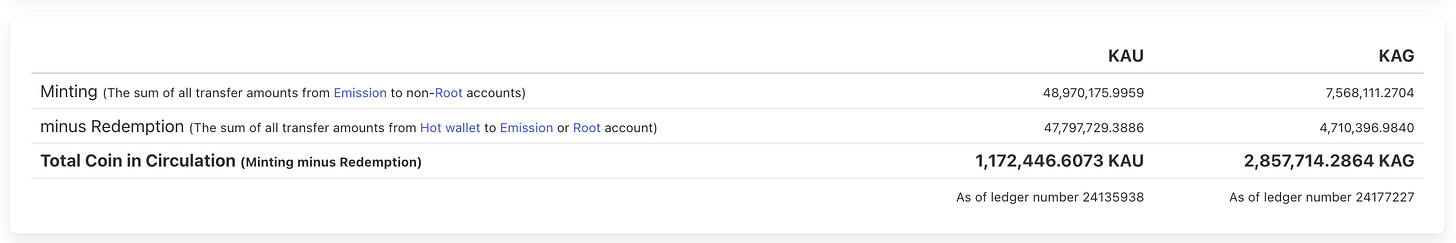

At 25:10, Coughlin claims that minters of KAU and KAG will earn a minter’s yield forever. Since over 48 million KAU have been minted but only 1,172,446 are in circulation, the math for this calculation must be very interesting. The minters yield also must be virtually nil if this works at all because it’s spread across such a large and growing number of minted tokens. The circulation has been relatively stable for months but the number of tokens minted keeps going up because they are constantly redeemed, or so Kinesis claims.

26:20 “We have an exchange which accepts Bitcoin, Ethereum and USDTether [sic].”

Straight from the horse’s mouth, they run a black box CEX that lists Tether

26:54 “All the transaction fees in our exchange… they go into the yield pool for KAU and KAG.”

It’s a centralized exchange. The only way this can be verified is with a full financial audit of the CEX. As far as we are aware, the CEX provides no transparency data at all. Not even weak attestations or proofs of reserve such as Binance and other questionable exchanges have sought to provide.

28:20 “We are listing on a number of exchanges at the moment.”

If the number of exchanges is one and the moment lasted 607 days, this is a totally truthful and accurate statement.

30:45 “There will be those integrations into QuickBooks, Xero I think is another one…”

Did they ever actually add these features?

32:52 “The big question there is whether the metal has been rehypothecated or leased.”

Indeed it is. Kinesis audits say nothing about whether or not Kinesis has leased its bars from someone, leased them to someone, pledged them as collateral or otherwise rehypothecated them. At the 34:05 mark, he suggests Kinesis is somehow safer than a trust. This is a truly looney assertion. Kinesis has no financial audits and only rare audits of the metal which are much more like attestations than financial audits. Kinesis audits only determine whether a certain quantity of metals was at a certain location at a specific time and nothing more. Kinesis also redacts the location and even names of some of the vaults. Not just the street address but even the city and country.

34:06 (talking about competing products and services) “It creates what’s called a daisy chain as it goes from one lessor to the next to the next to the next. If one defaults along the way the daisy chain falls, so there’s a lot of counterparty risk in that. I personally wouldn’t be holding a vehicle that is wrapped up in all this financial wrapping.”

Hmmm… Is that anything like Kinesis Cayman, Kinesis AG, Kinesis USA, Inc., Allocated Bullion Exchange and 15 vaults? Or are we talking about, like, longer chains than that?

36:05 “We’re setting up our own facilities as the primary locations now.”

Really? Where are these facilities? Could they have redacted the location and in some cases names of the vaults to hide the fact that they don’t actually have any of their own vaults? Or could it be that they don’t want investors to know where they are storing the gold and silver?

38:08 “It’s safe keeping on bailee arrangement.”

Why are investors still confused about this point years later?

38:20 “We’re creating this segregated deposit facility… …and it’s segregated in their name.

How does that work? If a user deposits gold for KAU and then spends the KAU, how could the bars remain segregated? If they don’t remain segregated, how does the system know whether they spent the tokens in a “decentralized blockchain system”?

02:28 “We looked to build out a facility that mitigated counterparty risk as much as possible. The way of doing that is providing ownership, allocated title to the ultimate beneficial owner, basically the end holder of the metals.”

07:15 “People will enjoy the collective success of the system as we organically grow.”

Collective success of the system via yields based upon how much the system is used. Does that not make KAG and KAU tokens securities since they pay variable yields based on the “collective success of the system”?

15:00 “I think we have around 70,000 active users currently and I still consider us in our infancy and that’s growing quite rapidly and the volumes are really accelerating as well.”

Does this look like a blockchain that had 70,000 active users nearly two years earlier?

At the 16:05 mark, Coughlin seems totally unaware of how much gold the system holds which seems odd since gold produces more than 90% of Kinesis’ revenue.

20:25 “The fees in the system get aggregated into what we call the Master Fee Pool. So, throughout a month of trading and transacting within the system all the fees generated go into the Master Fee Pool. Now at the end of the month we distribute those fees to the different groups, the different participants in the system.”

No, not really, at least not on chain. The “Master Fee Pool” is an abstract concept that doesn’t really exist on chain as implied. It doesn’t work in any way that it can be easily audited or validated as one would expect of a blockchain. Based on Kinesis’ latest explanation of how their “blockchain” works, it appears a financial audit of their centralized exchange would be required to actually track and validate the fee and yields system.

21:30 “A government could use this for example, and in fact we have deals with governments. One in particular which we’re days away from launching, is the Indonesian government, a country of 280 million people. We spent the last 5 years building out a parallel monetary system for them.”

Days away? On April 14, 2021? Is this the same system that is launching any day now as of January 2023? Perhaps he meant just 600 days away?

22:25 “We’re creating a collective system here. The fees generated out of the system they go off to this Master Fee Pool which everyone can see tick up in real time.”

Everyone can see this if they just want to look at a dashboard on Kinesis’ centralized exchange. If anyone wants to tie this back to the blockchain, they can forget it. It isn’t possible.

25:00 “There’s fees in the mint, there’s fees in the exchange and there’s blockchain fees.” “Those fees get sent off to the Master Fee Pool.”

No, they do not. According to the blockchain data there is no on chain “Master Fee Pool.” Fees flow out of the “Inflation account” and into just 5 other addresses. It is not possible to match the on chain fees with the “Master Fee Pool” shown on Kinesis’ centralized exchange dashboard.

26:10 “The merchant fees I’ve heard of some of the card providers 7% up to 10% merchant fees to the merchant. American Express they typically charge more. We beat them hands down.”

For what? Porn, online gambling and marijuana? Normal businesses pay 2-3% merchant fees. Then he suggests American Express charges more than 10% merchant fees? On which planet?

27:24 “You can buy it [KVT] on the exchange as well for $1,300 currently. In the coming months they [KVT] will become freely traded once we fully roll out our yield engine system.”

Doesn’t an exchange need to be licensed and regulated to sell securities?

36:07 “We offer a system that provides value to the underprivileged people in our society.”

Sounds like an SBF talking point.

36:50 “So far it’s been a year [2021] of exponential growth.”

Indeed, it was. Exponential growth followed by exponential collapse. Total fee revenue peaked at over $6 million in April 2021 and then steadily collapsed to a low of $73,500 in June 2022. No month has exceeded $1 million in fee revenue since May 2021.

37:03 “By the end of the year, all of our core foundations will be together, we’re fully launching our yield engine…”

KVT yields still aren’t being paid as of January 2023.

38:32 “We’re wrapping together a broader banking and payment ecosystem here.”

Is he claiming Kinesis is a bank?

39:02 “By the end of the year, full yield system rolled out.”

No, they’re still not paying KVT yields as of January 2023.

40:18 “We will be launching KVT on a number of other exchanges.”

Which exchanges does he think will allow trading of a security token? Security token exchanges are few and far between.

40:22 “We’re going through the process of listing KAU and KAG on about 7 or 8 other exchanges at the moment.”

That must’ve been a very long moment. After nearly two years, KAU and KAG are listed on only one other exchange and have very low trading volumes.

42:20 “10,000 transactions per second.”

Impressive. However, for their first 46 months of operation, KAU and KAG combined have required less than 4 transactions per hour to operate.

46:14 “We’re growing and we’re growing fast. Every month, seems to be, we’re looking at exponential growth.”

Yes, for one more month after this interview. By June 2021 an exponential collapse in revenues had begun. Most of this volume was likely artificial and created by “mint cycling.”

Awesome piece keep it up

FYI.

https://kinesis.money/blog/blockchain/understanding-the-kinesis-blockchain/