Kinesis Releases its First Complete Gold and Silver Audit After More Than Two Years

Kinesis hasn't completed a full audit of their gold and silver holdings since October 2020. In this article we take a careful look at the latest audit.

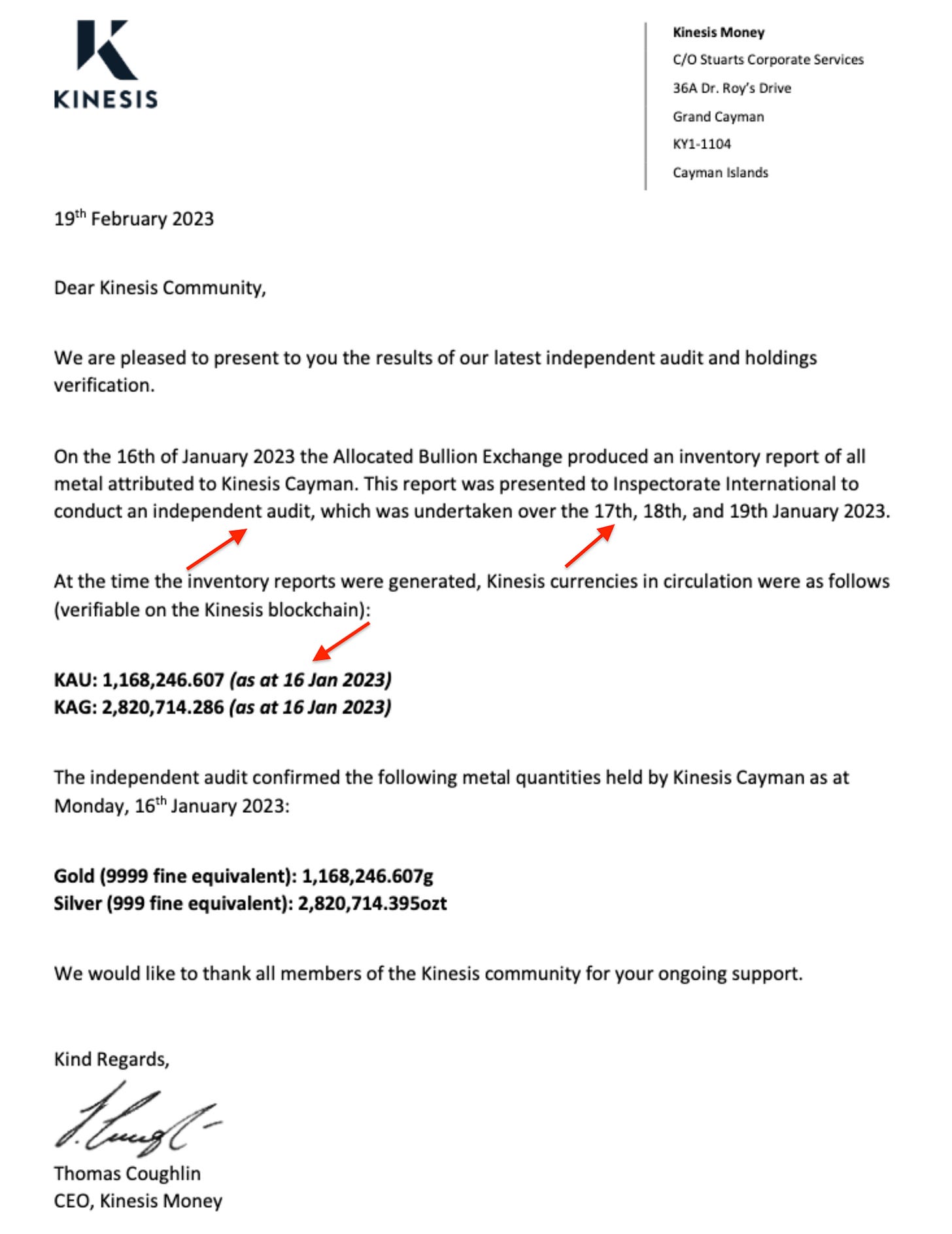

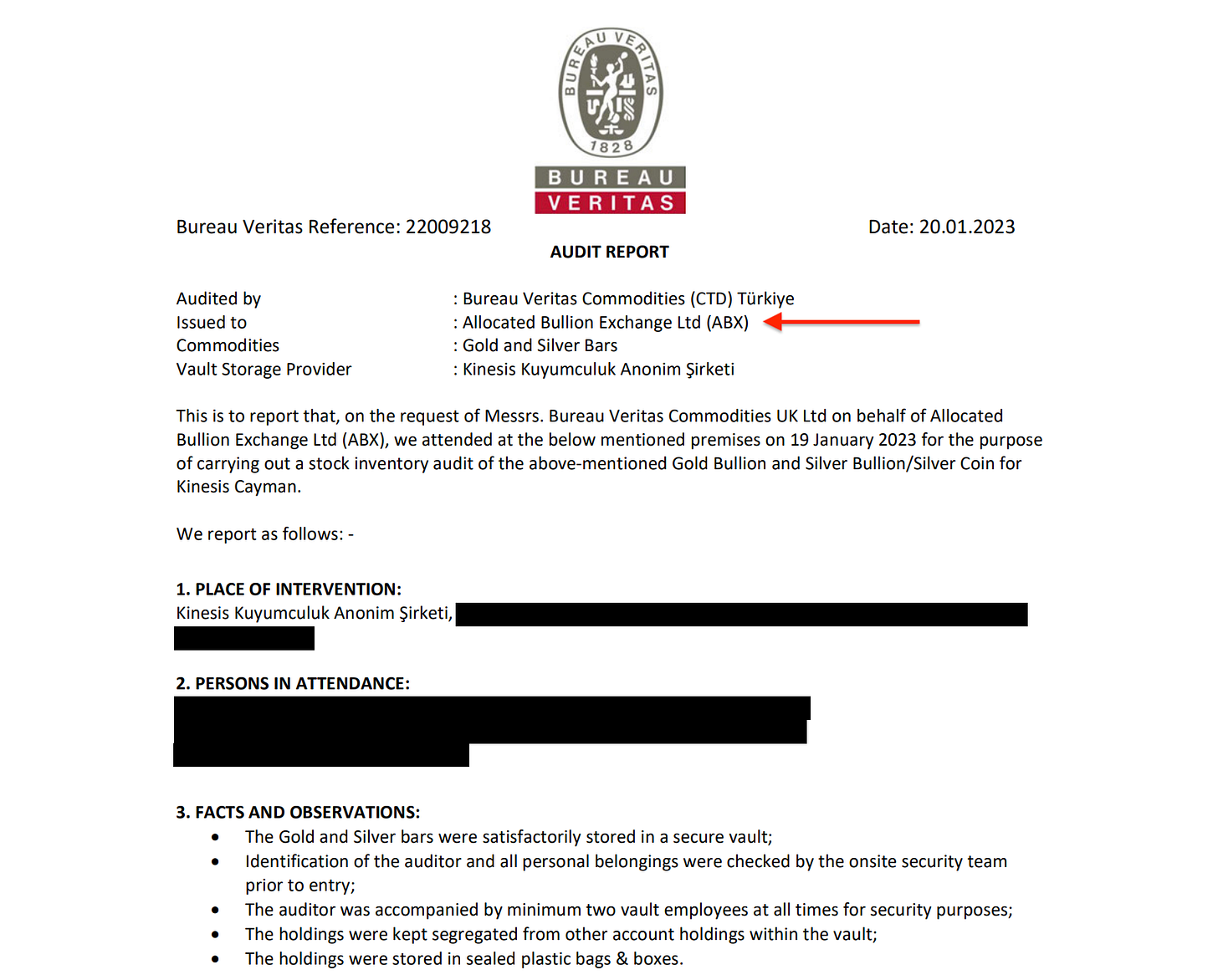

This latest audit does appear to be a complete audit of all of Kinesis’ gold and silver. Like previous audits, the auditors make no reference to token circulation, smart contracts, or blockchains. Also, as in previous audits, the token circulation date doesn’t match the audit dates. Allocated Bullion Exchange (ABX) still seems to be the vault account holder for all of Kinesis’ gold and silver.

In this latest audit, Kinesis provided the locations of the vaults, although two of them look a bit strange.

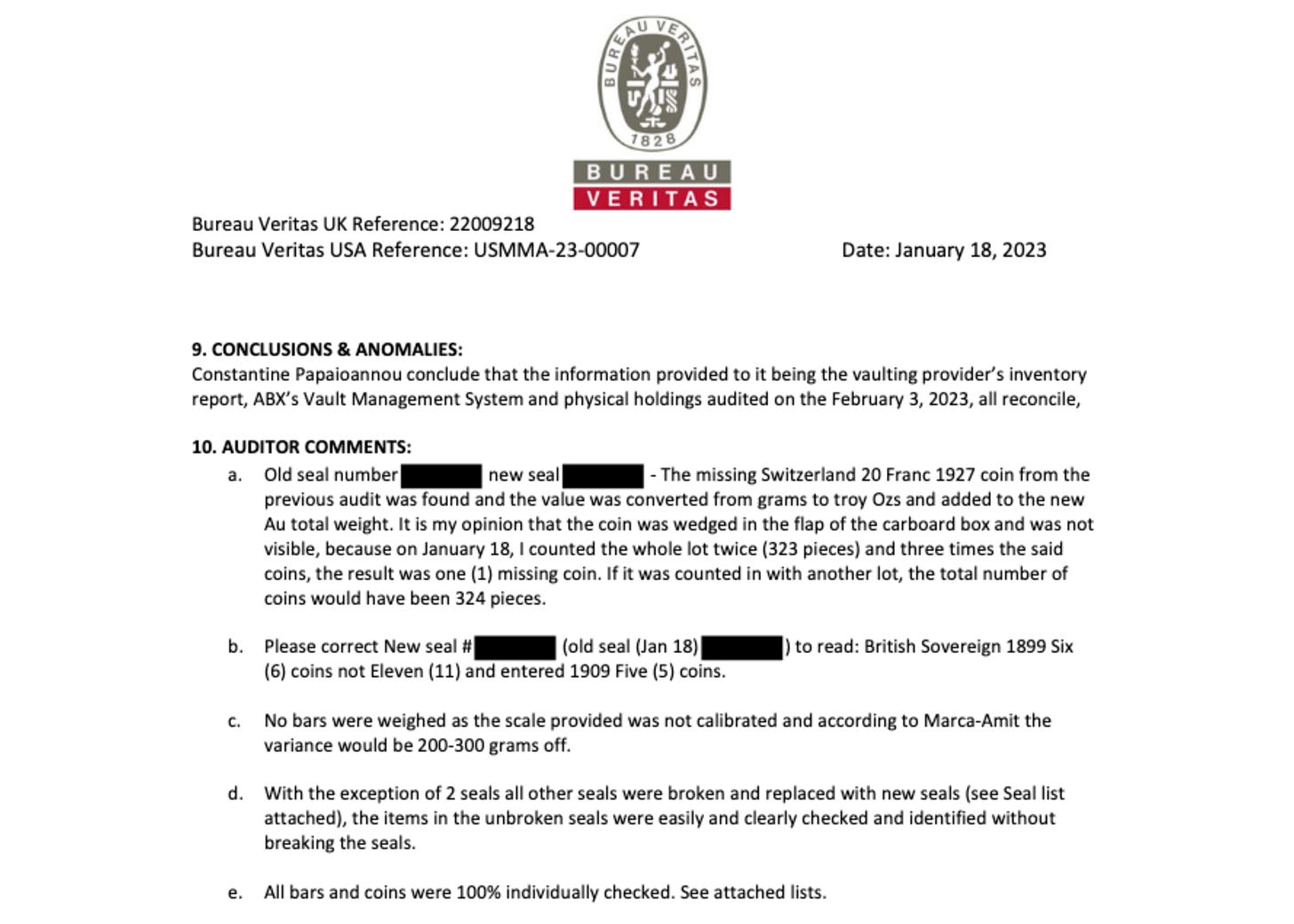

Two vaults didn’t have scales. These two vaults held 12% of the silver and 20% of the gold. One vault had a scale with a 200-300 gram variance ($12,000-$18,000 for gold).

This is what should be expected.

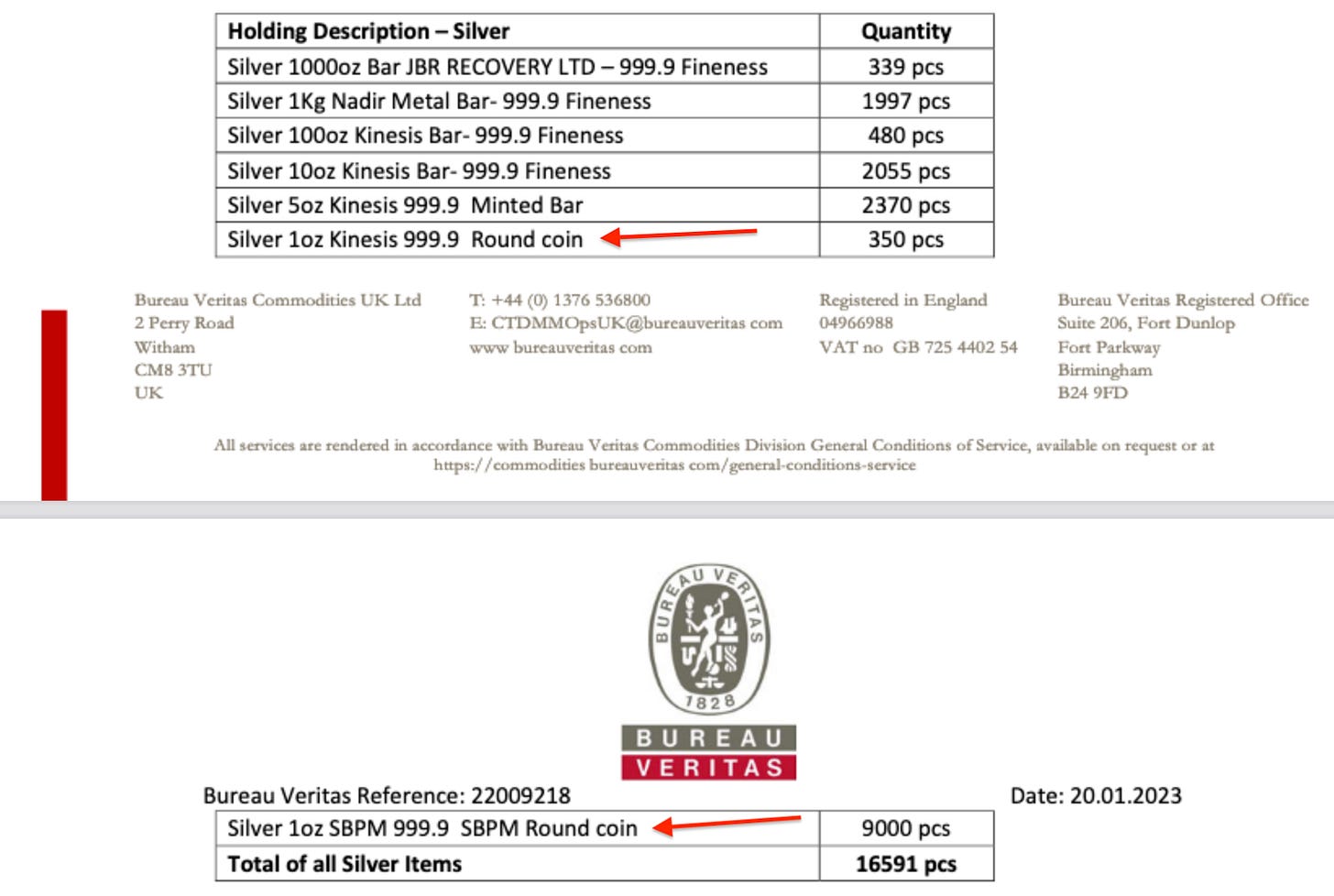

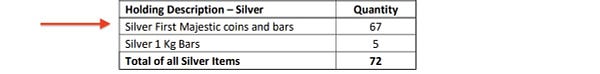

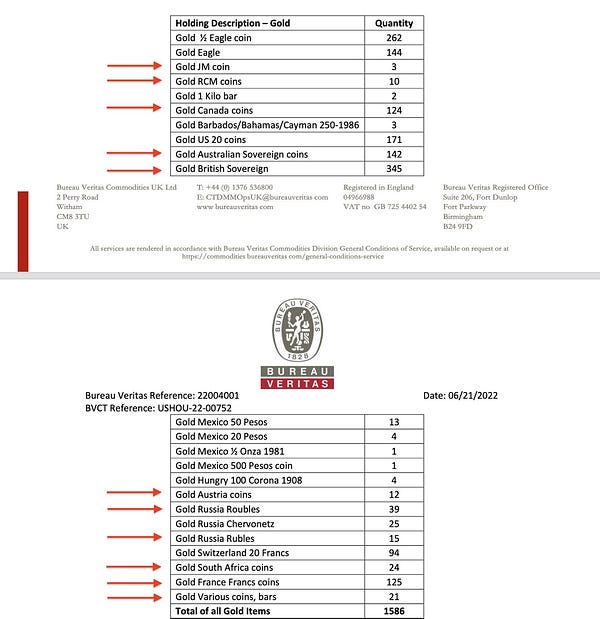

Why does Kinesis back KAG and KAU with high premium small bars and coins just to sell them at 0.6% over spot? If some uninformed user deposited these small bars and coins, why haven’t they been redeemed and replaced with low premium, large bars? There is no reason to keep 0.5 oz coins in the system because the minimum redeem order is 200 oz.

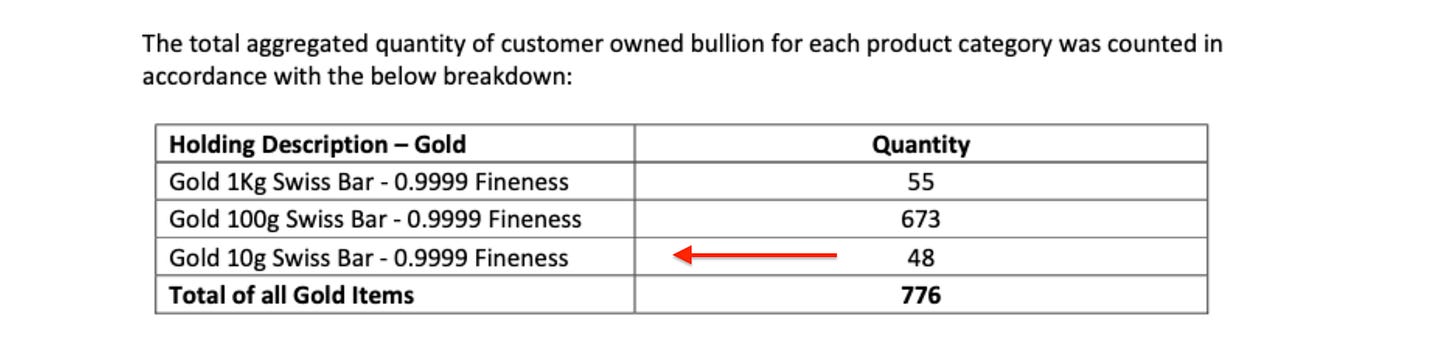

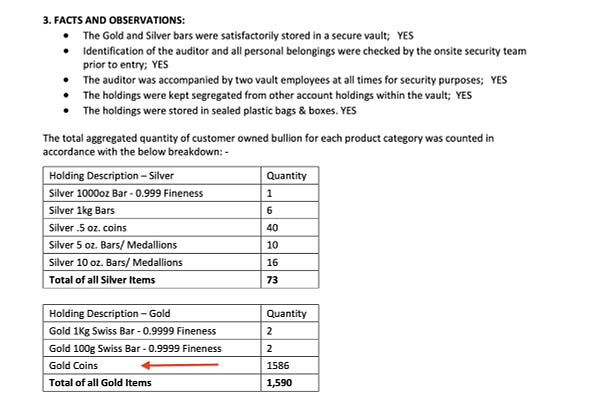

What kind of gold coins? Any details? Weight, fineness, mint? “Gold coins.”

Are some of these antique gold coins? A 20 Franc gold coin is only 6.4516g and 90% fine. Are all 1,586 of these “Gold Coins” only 5.8g coins? How should we account for these 1,586 “Gold Coins”?

This seems worthy of more than just a single line item on the audit report. Are some of the pages of this report missing? The “attached lists” referenced do not seem to be attached.

Now almost 68% of the total gold backing KAU is stored in Turkey as Kinesis 1kg bars. How did this happen? Did Kinesis melt down most of the LBMA bars that used to back KAU and recast them as Kinesis bars? Are they allowed to do that? Considering all the talk about how the gold and silver backing KAU and KAG are owned by the token holders and not Kinesis, Kinesis sure can do a lot of things with those assets. It can transfer them from a Liechtenstein entity to a Cayman Islands entity. It can give them to an Australian company for safekeeping. It can distribute them all over the world as it sees fit. It can even transfer them to vaults that don’t allow audits. Does a “Cargo Transport” company even qualify as a vault?

It would seem as though many of the vaulting locations are just for show, designed to make it appear like Kinesis is larger and has a greater global reach than it really does. Eight of the twelve vaults storing gold hold less than 2% of the gold. Five of the thirteen vaults storing silver hold less than 2% of the silver. Liechtenstein, which Kinesis CEO Thomas Coughlin often touts as the best country in the world for their business, holds 33% of the silver but none of the gold.

Perhaps the most interesting question is, “Why aren’t the summary figures on the first page of the report equal to the sum of the audit reports?”

There seems to be more than 116,000 extra ounces of silver. As for the gold, we don’t know how much the 1,586 “Gold Coins” weigh or what their fineness is. If we assume 1 oz coins with a fineness of 0.9999, there are nearly 15,000 extra grams of gold. If we assume each of those 1,586 gold coins are small coins like the 20 Franc coin, with just 5.8g pure gold content, gold is about 25,000 grams short.

Could it be possible that these audits are counting Kinesis’ or Allocated Bullion Exchange (ABX) gold that is not part of Kinesis’ KAU and KAG backing? Wouldn’t that explain the small bars and coins that make no sense to use as token backing and the inexact match with the summary figures on the first page of the audit?

Update 23-02-2023: Some more audit anomalies were pointed out.

How can an audit report dated January 18, 2023 contain a reference to an audit on February 3, 2023?

Why do Kinesis’ Bureau Veritas Singapore audits look so much different than the audits from other companies?

Upon careful inspection, it seems as though only the first two audits contain sufficient information to calculate the total fine weight of gold and silver stored. That doesn’t appear to conform to the audit policy described on Kinesis’ website.

Testing for fineness doesn’t seem to be part of Kinesis’ audit procedure at all, although Bureau Veritas does this for other clients.

Why does ABX appear to be the account holder at Kinesis’ own vault? Does this mean Kinesis gives ABX gold and silver backing KAU and KAG, which ABX then stores in Kinesis’ own vault, and then charges Kinesis to store in its own vault? What could be the purpose of that convoluted transaction other than to generate extra fees for ABX out of Kinesis’ coffers?

It seems like Kinesis still has some explaining to do. It will be interesting to see if Kinesis continues to refer to “once every 27 months” audits as “biannual audits.”