Kinesis Released a new "Audit" on May 31, 2023

This latest audit provides almost no meaningful details about the gold and silver Kinesis claims to hold

This latest "audit" has less detail than any other audit presented to date. The audit document has now been condensed to only 3 pages, down from 62 pages in January 2023, and no longer provides the breakdown between vault locations.

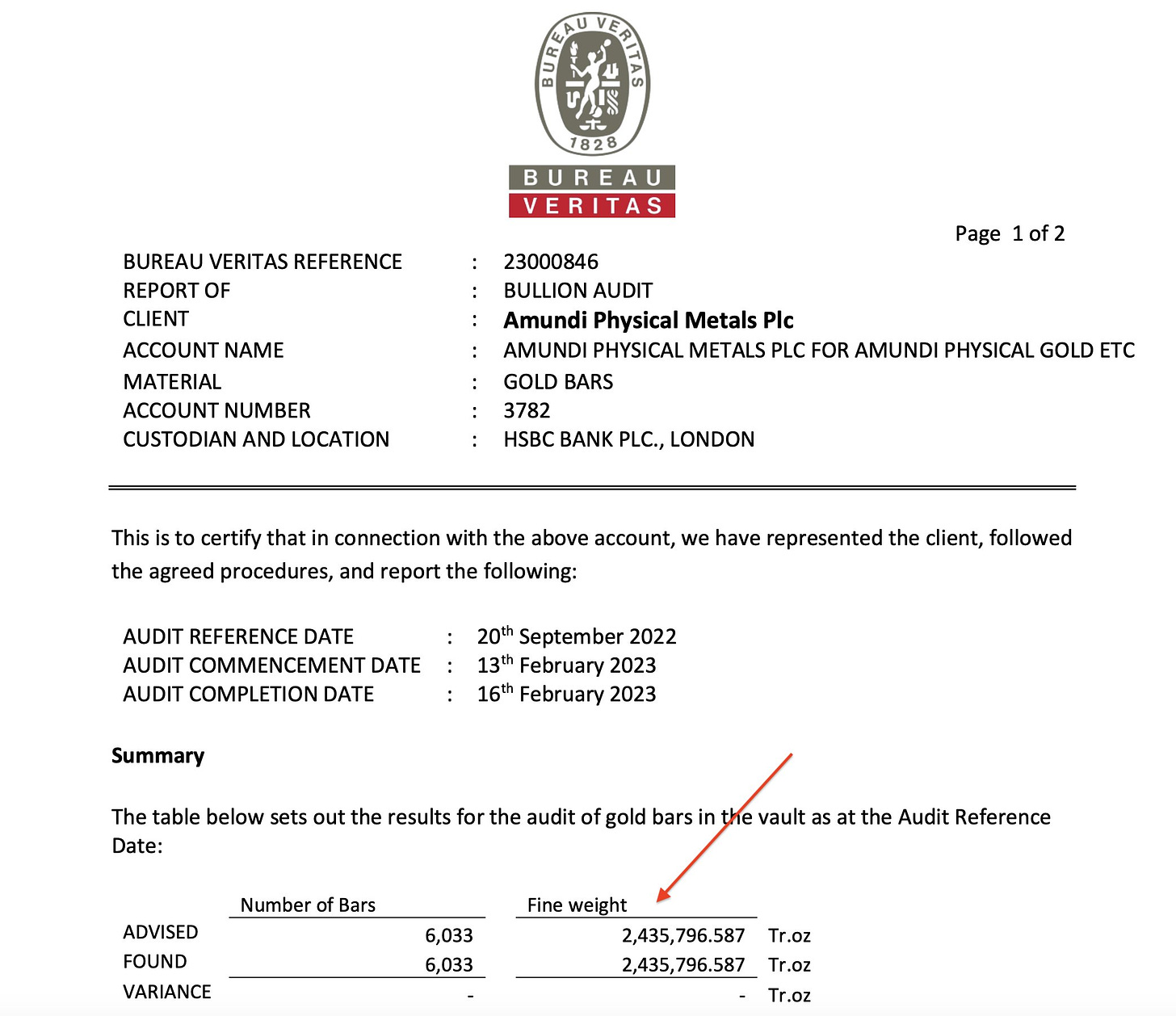

Obviously, a high page count doesn't necessarily make a good audit; there are ETFs that have one or two page audits covering billions of dollars of precious metals while at the same time clearly indicating the total fine weight of the metals held.

Despite the lack of detail, it took nearly six weeks from the audit date to publish the audit. Only the incomplete June 2022 audit took longer (50 days). The latest audit was completed on April 20 but was not published on Kinesis’ website until May 31, 2023, 41 days later.

Observations

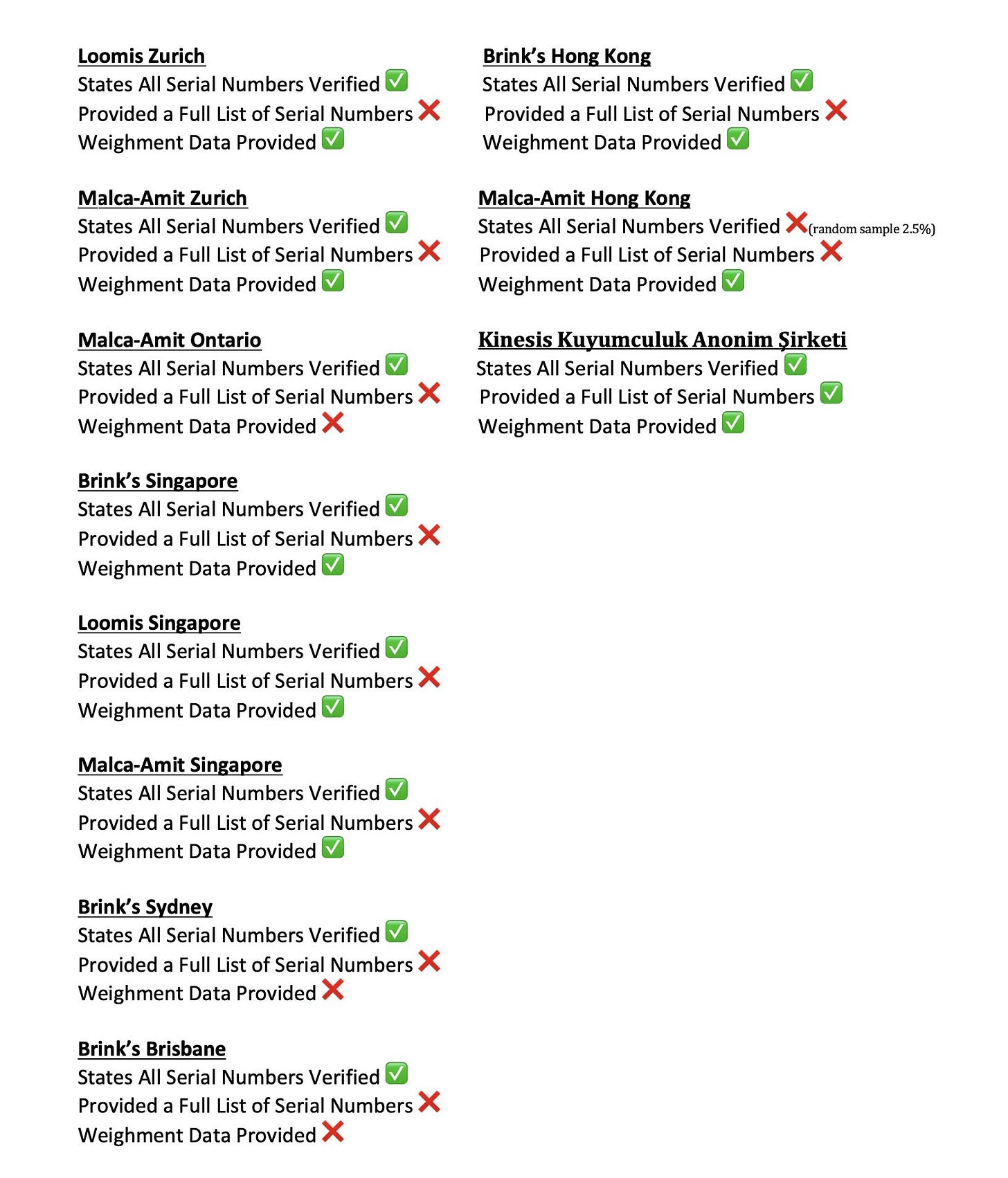

Kinesis is still exaggerating the number of locations and vaults that they store in. The audit shows vaults in Brisbane, Sydney, New York, Panama, Singapore, Zurich, Hong Kong, Istanbul, Toronto, and Vaduz, while the website claims metals are also stored in Batam, London, and Dubai, but these locations do not appear anywhere in the audit.

The audit makes no reference to tokens, token circulation, blockchains, or smart contracts.

The audit does not contain sufficient details to calculate the number of fine ounces of silver or fine grams of gold held. Kinesis’ cover letter falsely implies that the audit attests to not only the total fine weight of the gold and silver but to an accuracy of 0.001 gram for gold and 0.001 ounce for silver. This is simply not possible unless they failed to publish the entire audit.

The audit references "agreed procedures," but what exactly those agreed procedures were is not specified.

The audit was issued to ABX, not Kinesis.

Weighment data is no longer included in the audit.

Scale details are no longer included in the audit.

No bar serial numbers are included in the audit.

Testing data is not included in the audit (nor was it included in previous audits).

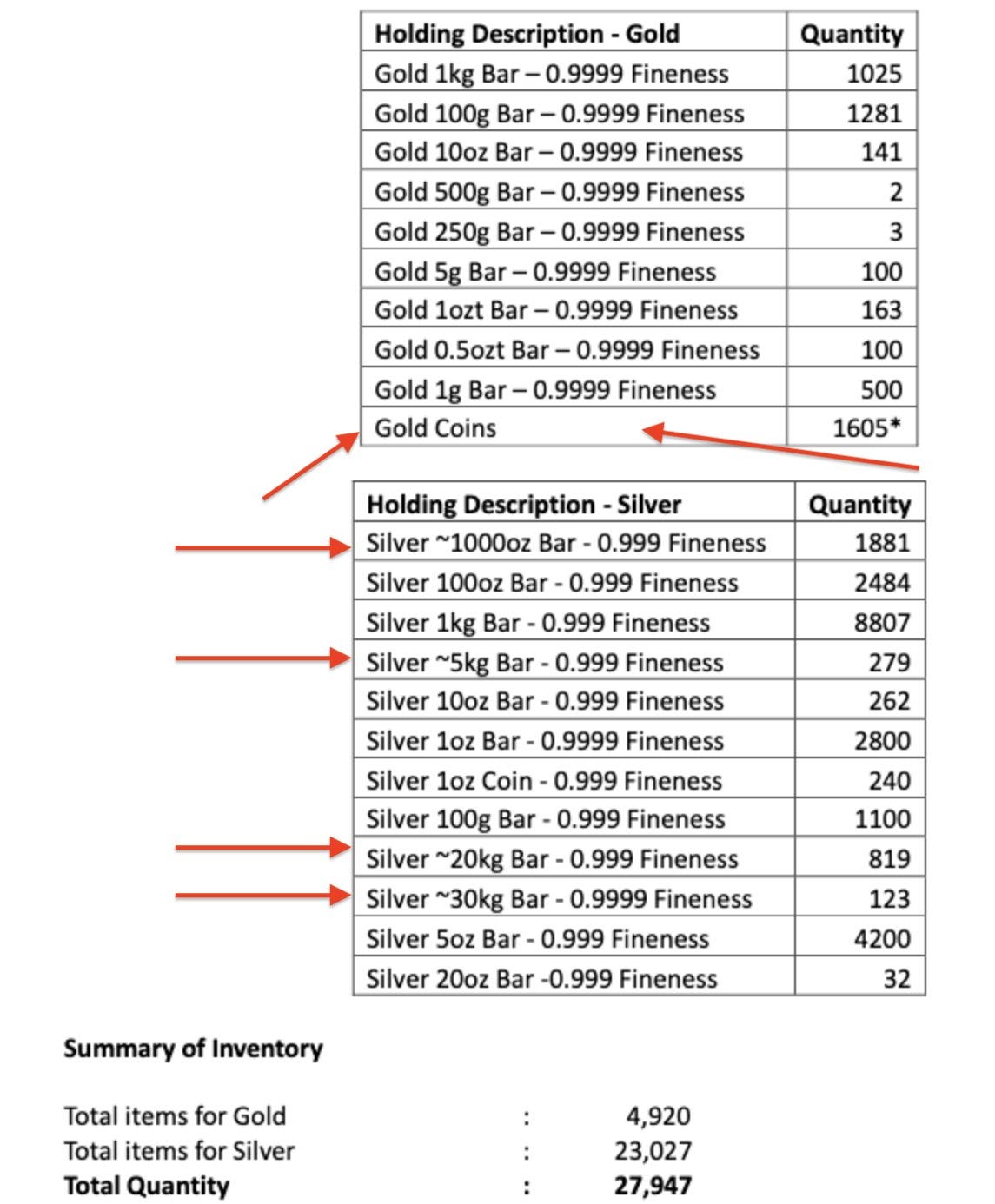

There are many small, high-premium items that do not make sense to use as backing for low-premium, fungible tokens.

This is not a financial audit and therefore provides no information about the ownership of the assets.

Each of the last three audits contains less detail than the prior audit. The June 2022 audit identified some but not all of the "gold coins" and provided their location. The January 2023 audit provided no specific details about any of the "gold coins" except their location. The April 2023 audit provides no details about any of the "gold coins".

It would appear that instead of addressing the numerous errors and omissions in the previous audits, Kinesis and ABX have decided to simply remove nearly all of the meaningful details from the audit entirely.

It’s an interesting exercise to compare Kinesis CEO Thomas Coughlin’s claims about audits with the actual content of the audits.

Previous audits also fell far short of these claims but none to date were as lacking in detail as the April 2023 audit.

It would seem that Kinesis has now fully migrated to the crypto industry’s favorite audit and attestation standard, the “Trust me bro” standard.