The Other Elephant in the Room at Kinesis: USD1

A $12 billion stablecoin with no proof of backing

Today, we turn our attention to the other elephant in the room: Kinesis USD1, the so-called "$12 billion stablecoin." Six months in, the on chain data tells a story of neglect, centralization, and potential deception that demands scrutiny.

The Numbers Don’t Lie

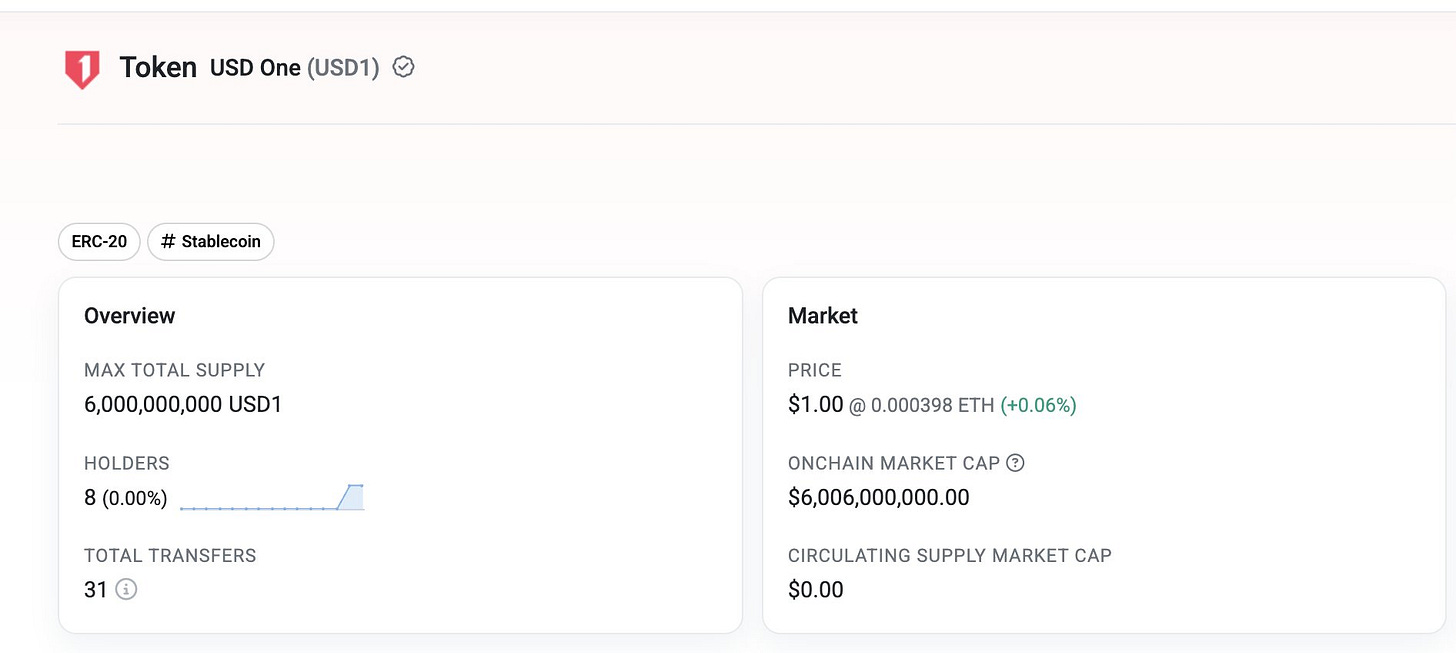

Let’s start with the facts. On the Ethereum blockchain, USD1 boasts a max supply of 6 billion tokens, yet it has only 8 holders and a mere 31 transactions. The top three addresses control over 99% of the supply, with two holding 3 billion each and a third holding 426,135. On the Stellar blockchain, the picture is no better, 27 holders and 470 transactions—but the total all-time volume is a laughable $92,690. Worse still, as of Friday June 13, 2025, USD1 was trading at $0.9525, off its 1:1 USD peg.

Compare this to real stablecoins like USDT and USDC, which have millions of holders and robust transaction volumes. USD1’s claim to be the "third largest stablecoin" is a circus act, not a financial instrument.

A Pattern of Red Flags

This isn’t the first time Kinesis has raised eyebrows. Back in February, we analyzed the laughable "attestation" letter from Herrscher Group, which promised $15 billion in reserves with no independent audit, transparency or custodian indicated. The latest letters, stamped with pixel-perfect signatures matching prior documents, only deepen the suspicion. The procedural irregularities suggest a house of cards rather than a stable foundation.

The concentration of USD1 in a few hands mirrors the centralization issues we uncovered with Kinesis Stellar fork. This isn’t decentralization—it’s a fully centralized sham masquerading as innovation.

The $12 Billion Question

Kinesis markets USD1 as a $12 billion asset, yet its real-world utility is nonexistent.

The implications are clear: USD1 is not a viable stablecoin. Its low adoption, peg instability, and extreme centralization make it one of the most obvious scams in the crypto industry. Stakeholders should immediately demand fully transparent third-party financial audits and verifiable reserve data; standards Kinesis has never meet for any of their products.