First Digital USD ($FDUSD) has continued to grow with little scrutiny or media attention and now boasts a market cap of almost $2.5 billion. Let’s have a look at the latest stats on FDUSD to see what’s changed over the past three months.

FDUSD has only 1,791 unique addresses and less than 12,000 onchain transactions.

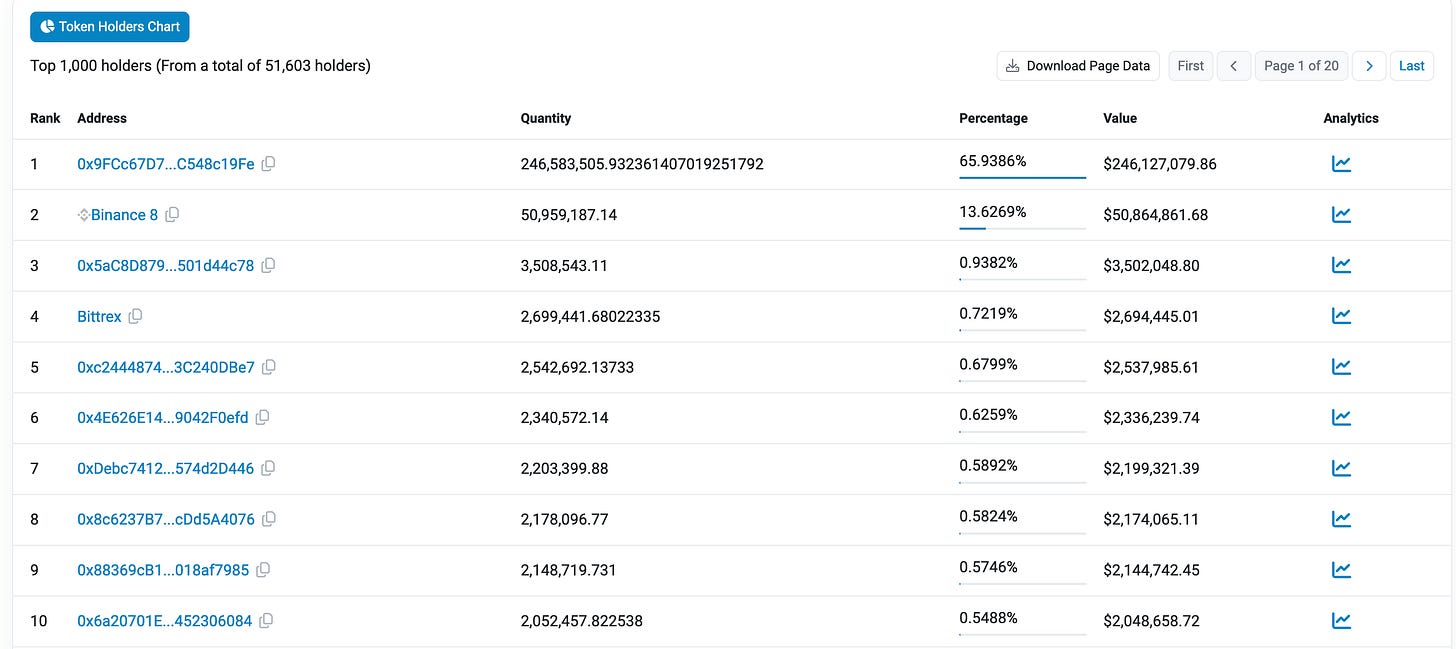

Compare this with TrueUSD ($TUSD), a stablecoin that until recently had a similar market cap but is now only about 15% ($373 million) the size of FDUSD. TUSD has 51,603 unique addresses and over 1.5 million onchain transactions.

The ownership of both tokens is laughably concentrated in the top 10 addresses. 84.8% of TUSD is held by the top 10 addresses, with 13.6% held by a known Binance address. 99.2% of FDUSD is held by the top 10 addresses, and all of those addresses are known Binance addresses, except the last one, which holds 0.25% of the total supply ($6.1 million). This means that over 99% of the total supply of FDUSD is held by just nine Binance wallets. What is the point of this token even existing onchain at all? It’s controlled entirely by Binance, and it’s virtually unused onchain.

How about volumes? Surely a token with so little adoption would have very low volumes.

Actually no, FDUSD routinely ranks in the top 5 crypto tokens for daily volume world wide.

FDUSD volume has even outranked USDC despite the fact that USDC is an order of magnitude larger and is listed on hundreds of exchanges.

USDC also has over 2 million unique addresses and nearly 90 million onchain transactions, indicating its adoption is multiple orders of magnitude larger than FDUSD.

USDC is significantly more decentralized than FDUSD, with only 18.6% of the total supply controlled by the top 10 addresses as compared to FDUSD at 99.2%. You can also see multiple exchanges represented in the top 10 holders of USDC.

Perhaps the most stunning fact about FDUSD is how much of Bitcoin’s total spot volume it is responsible for via a single pair on Binance.

Over the past 24 hours, FDUSD has been responsible for more than 12.5% of total Bitcoin spot volume, as tracked by Coin Market Cap. It’s nearly double the next highest volume pair, BTC/USDT, also on Binance, and it’s nearly five times more than the number 3 pair, BTC/USD on Coinbase.

How does this compare to the ETFs we’ve heard so much about?

Yes, you are reading that correctly. FDUSD, via a single pair on Binance, is doing over 135% of the daily volume of all Bitcoin ETFs combined. This is a token that is controlled nearly 100% by Binance. A single pair represents over 12.5% of total crypto exchange spot volume and more than 135% of the volumes of all Bitcoin ETFs combined.

Is this believable, or is this another fake volume, wash trading scam that the crypto industry is so famous for?

Is it not plausible that the new biggest scam in crypto is pumping up the price of Bitcoin with fake stablecoins on fake exchanges with fake volume and fake wash trades in order to cash out through ETFs for real US dollars? Make this make sense!

Also see Nobody Special’s reporting on on TUSD.

First Digital USD (FDUSD) is the stablecoin not enough people are talking about

First Digital USD is yet another stablecoin that appeared out of nowhere in May 2023. FDUSD is held by only 851 unique addresses, with a whopping 97.6% of the total supply controlled by just six known Binance addresses.